Credit report

Many people check their credit score but never take the time to review the full credit report behind it. A credit report is not just…

Credit report

Many people check their credit score but never take the time to review the full credit report behind it. A credit report is not just…

Debt prevention

Not sure how to pay off credit card debt? This blog has the answers you’re looking for. Credit card debt often piles up quietly, and…

Credit report

Key TakeawayMidland Funding LLC is a major debt collection agency that indulges in debt buying from other providers. This entry can be removed from the…

Credit report

Quick AnswerChexSystems tracks your banking history of savings/checking accounts, ATM withdrawals, payment records, etc. It may not directly affect your credit score, but it flags…

Credit score

Checking your credit score often feels risky. There’s a quiet fear around it. A feeling that simply looking might make things worse. And that’s where…

Debt prevention

Becoming debt-free is not about one big decision. It usually starts with small, everyday choices. A balance that stays unpaid. A payment that keeps rolling…

Credit repair

Your credit is not just a number. It is a record of how you have handled the money over time. Every payment, every balance, every…

Credit report

Even after you’ve paid off a debt, seeing "Covington Credit" still sitting on your credit report is incredibly frustrating. That single line item can stick…

Credit

Quick Summary▪ Co-signer meaning: A co-signer is someone who co-signs a loan or debt jointly with a primary borrower and guarantees payment as a backup. ▪…

Credit

Your Credit History Is Your Financial ReputationHere Is How It Actually Works Your credit history is the backbone of your credit score. In most scoring…

Credit score

Short SummaryNSF fee meaning: It is a penalty fee charged by the bank on a transaction that is declined or returned due to insufficient balance…

Credit

When Maya started hunting for her first apartment, she thought the hardest part would be choosing between the one with the cozy brick walls and…

Credit report

Quick SummaryRadius Global Solutions is a debt collector company that also purchases debts from credit card companies and medical providers. If it shows up on…

Credit score

Credit score is just a number, right? And age is too. Well… not exactly.Believe it or not, the two are connected. While your age itself…

Credit score

Did you know your business has a credit score, just like you do?If you’re unsure what that means, it’s time to learn “how to check…

Credit score

Your credit score isn’t just a number. It’s a story of how you handle money. Between FICO Score 8 and FICO Score 9, every payment,…

Credit report

Short AnswerWFBNA is an abbreviation for Wells Fargo Bank N. A. (National Association). A WFBNA card on credit report signifies a hard inquiry related to…

Credit report

It’s a familiar scenario: you open your credit report and spot a name you don’t recognize—CREDCO. A wave of questions follows: “Why is CREDCO on…

Credit

If you’re reading this, chances are you either already have a credit card or are thinking about getting one. And if you’re like ‘nah’, you…

Not every home loan needs the same credit score. Your score decides how easy or hard it is to qualify, but it doesn’t have to…

Credit score

Building an excellent credit score usually takes years. However, raising your score by 10, 20, or even 100 points can sometimes happen faster than you…

Credit report

Seeing Harris & Harris listed on your credit report can feel unsettling, especially if you’re not familiar with the name. In most cases, this entry…

Credit report

Short Answer with Key Points:What is SYNCB/PPC: It refers to Synchrony Bank/PayPal credit, which is a line of credit/credit card offered through PayPal, issued via…

Credit score

Credit limits are crucial for your financial flexibility, but requesting a higher credit limit often brings questions. You might wonder, “Does requesting a credit increase…

Credit score

Quick AnswerWhat's a Good Credit Score to Buy a Car?A good credit score to buy a car is typically 661 or higher, since most approved…

Credit report

A Quick TakeWhen you are dealing with Wakefield & Associates collections, you can:▪ Ask for proof of debt legitimacy and request removal if the debt…

Credit score

Credit improvement apps make it easy to build or improve your credit without hiring an expert. Check those best apps below. In the U.S., having…

What is the average credit score, and why is it important? A question that strikes you mostly when you're trying to get a new line…

Credit report

Key Takeaway“JPMCB Card Services” on your credit report indicates Chase credit card activity, such as an application, account, or authorized user status. If the entry…

Credit report

Quick Answer: THD/CBNA stands for THD—The Home Depot / CBNA—Citibank North America. It is a “retail credit card” that you can apply for at Home…

Short Answer: ▪ 1 to 3 credit cards are ideal, especially for credit building. You can start with 1 credit card, and as you build a…

Debt prevention

Planning a vacation, home makeover, birthday bash, or grabbing those concert tickets? Instead of panicking later, start a sinking fund now! It’s simply money you…

Credit score

Quick SummaryHigh credit scores mean favorable terms when borrowing money, renting property, and much more. To improve your credit scores, you should:1. Check your credit…

Credit repair

Credit scores have a way of creeping into every major moment in life. Whether you’re applying for a car loan, getting your first apartment, or…

Credit report

Key Takeaway Caine & Weiner Inc. is a debt collection agency. The top ways to deal with Caine & Weiner Collections include reviewing the credit report,…

Can I use ITIN to build credit? Yes, and it starts with understanding how. If you don’t have a Social Security Number, building credit may…

Credit

TL;DR: Student loan collections are back, and dealing with them the right way is imperative. Late payments, defaults, and collections can wreck your score fast.…

Credit

Credit repair! It sounds overwhelming if you’ve never had the right help. You may have heard about credit experts who can guide you, but how…

Credit

Can You Really Have Both a 'Good' and 'Excellent' Credit Score at the Same Time? Surprisingly, yes! It's entirely possible to have a 'good' credit…

Credit

There are different ways to borrow money. Each one shapes your credit story in its own way. When you understand the types of credit, you…

Credit report

LVNV Funding LLC is a debt buyer company that usually purchases overdue accounts from lenders, including financial institutions, credit card companies, and personal loan providers.…

Credit score

If you’ve found a collections notice from CBE Group Inc on your credit report, you’re not alone, and it’s okay to feel a little stressed…

Credit score

Did you know you don’t have just one credit score? That’s right — your score can actually vary depending on which scoring model is used…

Credit report

Capio Partners LLC is a debt collection company specializing in managing medical debt collections and purchasing healthcare debt. Many people have reported damage to their…

Loan

Paying for college isn’t easy, and loans are part of the journey for many students. Federal student loans come in two primary forms: subsidized and…

Credit report

Vantage 3.0 is a credit scoring model that gives lenders a clearer, more up-to-date picture of your credit—nothing outdated, just what matters. As of March…

Credit score

When you are looking for a new car and want to take on a car loan, you need a good credit score to buy a…

Credit report

Filing for bankruptcy is a tough financial decision that can change your life. It brings relief from overwhelming debts, but the impact on your credit…

Poor

570 Credit Score: What It Means and How to Improve It A 570 credit score can feel like a heavy burden, especially when you’re trying…

Credit monitoring

Credit monitoring services act as a crucial early warning system, protecting individuals from the ever-growing threat of identity theft. Over the past two decades, the…

Very good

740 Credit Score: What It Means and Why It Matters A credit score of 740 places you in the Very Good category according to most…

Fair

600 Credit Score: What It Means and How to Improve It A 600 credit score falls into the fair range. Even with a 600 credit…

Good

670 Credit Score: What It Means and How to Improve It Your credit score plays a major role in your financial life. A 670 credit…

Exceptional

850 Credit Score: What It Really Means and What You Can Get An 850 credit score is more than just a number—it’s the highest possible…

Credit score

850 is the highest credit score—and yes, it is achievable. Keep reading to learn how to reach this maximum score and why it matters. Picture…

Credit monitoring

Your credit score significantly impacts your financial well-being. Whether you're applying for a loan, getting a credit card, or even renting an apartment, lenders and…

Credit

Your credit score can open many doors to better loan options or close them when it’s not high enough. But what if your report isn’t…

Credit

Whether you are considering taking a loan or diving into investing, you may have come across terms like “APR” and “APY”. While these terms may…

Credit repair

Credit boost is more important than you think—it’s your ticket to financial freedom. And, DIY credit boost apps are your way to achieve it! Your…

Credit report

Freezing your credit helps protect against identity theft and blocks any unauthorized access to your credit. When you plan to apply for a new credit…

Credit

The annual percentage rate or APR indicates the true cost of borrowing money. It is a determinant in credit cards or other forms of credit…

Credit score

Every time you or someone reviews your credit for a job, a loan, or a promotional offer it leaves an inquiry in your report. These…

Credit

Credit, credit scores, and credit reports are interconnected pillars of your financial journey. Whether securing a credit card or purchasing your dream home, having a…

Credit

Wondering how to increase your score in 30 days? Monitoring your report, identifying and disputing errors on your report, and reducing debt and reducing debt…

Credit

Surprisingly, 80% of Americans are actively working to improve their credit. It's a staggering statistic, and it's one you definitely don't want to associate with.…

Credit repair

Repossession is a derogatory mark that can stay on your credit record for a minimum of seven years. It strongly impacts credit ratings, causing a…

Credit

Medical bills can be troublemakers when you don't know how much to pay each month to avoid collections. That’s why understanding what is the minimum…

Credit

Credit Lock vs FreezeCredit freezes are legally free and need a PIN or password to unfreeze, whereas credit locks are typically paid and unlockable via…

Credit

Knowing how to freeze your credit is an essential step to protect your financial information from unauthorized access. A credit freeze limits access to your…

Credit repair

4 in 5 Americans are trying to improve their credit scores. If you are one of them, AI credit repair will definitely help you. AI…

Credit score

Experian reports that 91% of consumers have FICO® Scores higher than 555. A 555 credit score puts you in the "poor" range (300 to 579),…

Credit report

A collection account can stay on your credit report for as long as seven years from the date of the first missed payment. Concerning, yes.…

Credit

Planning to build credit is a choice that can strengthen your financial status in many ways. However, the possibility of getting loans or credit cards…

Loan

What Is a Guarantor?A guarantor is an individual who provides himself or herself as surety in a contract for meeting financial obligations. It is usually…

Car and credit

Car leasing with bad credit history can be tough because it usually means higher interest rates, resulting in pricier monthly payments. Although a poor credit…

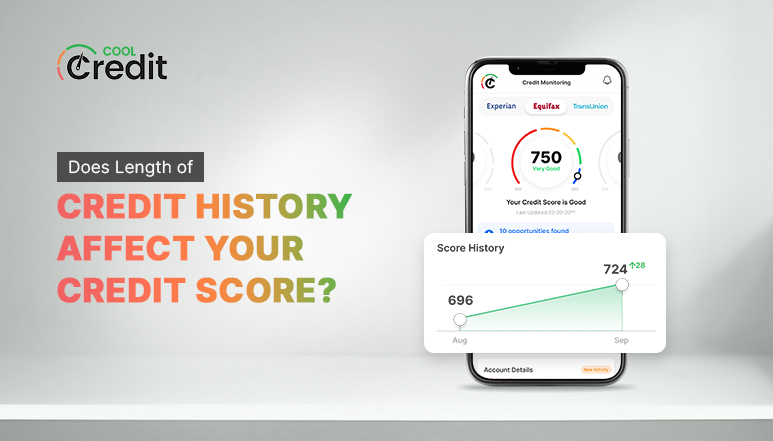

Credit

Credit history makes up 15% of your credit score calculation, needless to say, it significantly impacts your scores. The length of the credit history is…

Credit

Can you apply for credit under age 18? If not, how can you build credit before 18? Well, although you need to be at least…

Credit score

A utility bill covers the cost of the services that keep your home comfortable—like water, gas, and electricity. But you might wonder, does paying these…

Credit report

A credit score is a delicate and unique blend of credit mix, credit history, payment history, and more. Slight changes in these pieces of credit…

Credit

Paying off your loan early can wipe out the excessive burden of recurring debt payments. Once your loan amount is paid off, you can move…

Credit

Secured credit cards are a smart way to build or rebuild your credit, especially if traditional credit options aren’t available. With a secured card, you’ll…

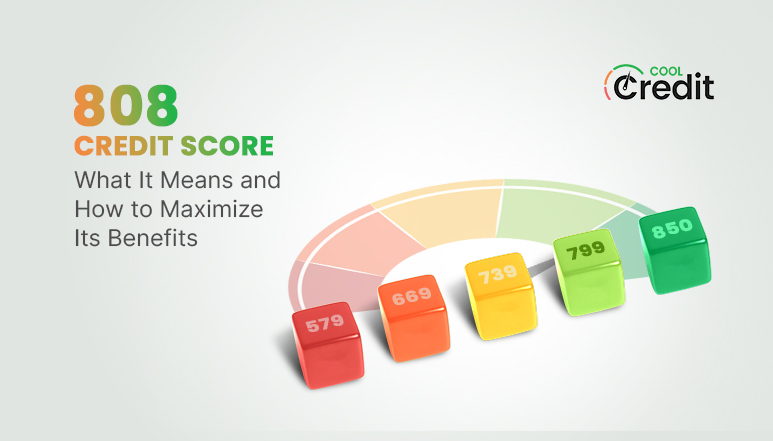

Credit score

808 credit score is considered Exceptional. Falling within the 800-850 range, an exceptional score means you're in a prime position to secure the best interest…

Credit score

A 650 credit score falls under the fair category. It is considered ‘fairly okay,’ however, this score does not fall in the good range. The…

Credit score

If you've got multiple active high-interest credit cards or loan accounts, you might have considered a balance transfer. But before you decide on it, a…

Debt

A document or a notice that a debt collector gives informing you about the debt owed by you: the information in the debt validation letter…

Credit score

Only a quarter (22%) of Americans have a FICO Score of 800 or higher, so if your credit score is 808, you're already doing an…

Credit

Forget the struggle of building credit! A credit builder app offers a powerful solution to unlock a healthy financial future. These innovative apps empower you…

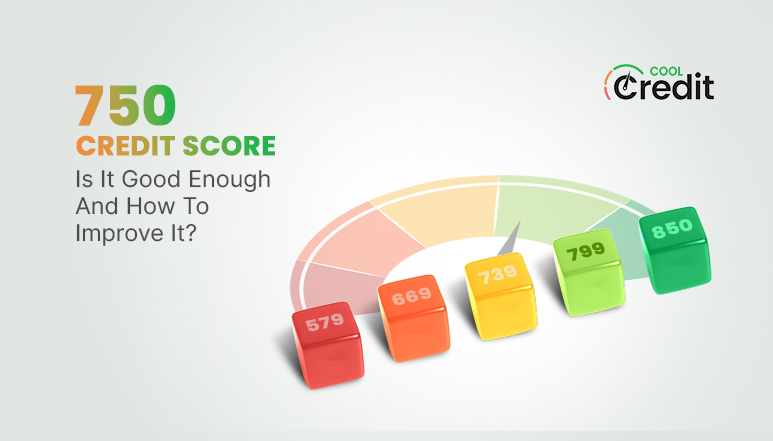

Credit score

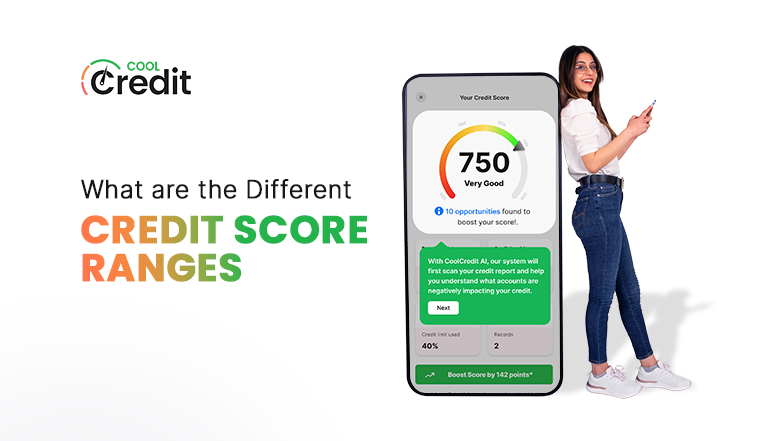

According to FICO, 47% of Americans have a 750 credit score. Is 750 a good credit score? Absolutely yes! Moreover, FICO and VantageScore agree that 750…

Credit

Paying rent can help you build credit. And while an on-time payment can boost your credit score, a late rent payment can affect it negatively.…

Credit score

Landlords want reliable tenants. That’s why a good credit score can strengthen your chances. But if your scores are low, you must provide alternative proof.…

Credit score

Key Takeaways:▪ Having a score of 720 is considered good.▪ A 720 credit score equates to access to more opportunities like personal loans, auto loans,…

Car and credit

Leasing out a car is a convenient and cost-effective way to own a new set of wheels every few years. However, when the lease term…

Credit report

Ever paid off a loan but your report reflects otherwise? Such closed accounts on credit report can be consequential, and in some cases, even cost…

Credit

Thinking of using a credit building app but not sure which one? We've got you. A good credit score helps you in making big moves…

Credit repair

Steps You Can Take to Improve Your Credit Score Yourself A credit score is a numerical representation of your financial health. A good score, typically…

Credit score

We often come across terms like a 609 dispute letter, especially when credit score improvement is in question. However, before you decide to opt for…

Credit score

◾ Afterpay and other buy now pay later (BNPL) options offer a convenient solution for handling immediate expenses, but understanding its impact on credit and…

Credit report

To remove a valid charge-off from your credit reports you can attempt to negotiate with your lender or debt collector. If your account is still…

Credit score

Financial literacy and building credit at 18 go hand in hand and are an important aspect of turning 18. It’s all about learning how to…

Credit score

The average FICO credit score in the US is 717, according to the latest FICO data. And the average VantageScore is 701 as of January…

Credit score

If your credit score drops out of nowhere, even by a few points, you may panic, which is the common reaction. A credit score drop…

Credit repair

16% of Americans have bad credit, and another 18% have fair credit, according to Experian data. That’s not ‘good’. But does your credit score really…

Credit score

The world of credit may sometimes feel like deciphering a complex puzzle. Among the many questions that arise, one often overlooked yet crucial one is…

Credit score

◾ Refinancing will hurt your credit score, but temporarily. As a matter of fact, there are several long-term advantages to refinancing, regardless of whether you…

Credit score

The first step to building good credit is to know where you stand, i.e., know how to check credit score, and credit report. Astonishingly, one…

Credit score

Numbers can reveal a lot about a person, just as a three-digit credit score tells everything about a person's financial situation. Especially, in situations, where…

Credit repair

Pay for delete letters entails contacting debt collectors and asking them to eliminate adverse entries from your credit reports as part of an agreement to…

Credit report

When you apply for a line of credit, be it a credit card, loan, or mortgage, you trigger what is known as a "hard inquiry"…

Credit

A Credit Privacy Number (CPN) is a nine-digit illegal alternative to a Social Security Number (SSN). It is usually claimed to be a substitute for…

Credit report

Eviction does not only impact your life but can also affect your credit score. In this blog, we'll discuss how eviction is reflected in your…

Credit repair

Why rebuild credit? How to rebuild credit? What are the best credit repair tips? These are the most asked questions by individuals looking to rebuild…

Credit

Mixing business with personal life is rarely a good idea, especially when it comes to finances. Even so, 46% of small business owners use personal…

Credit score

Before renting out a property, the majority of landlords look up the renter's credit score. So, getting the kind of housing you want depends greatly…

Credit score

Key Takeaways▪ Whether you have a credit history or haven’t built one yet, your credit score does not start at 0. ▪ Your beginning score will…

Credit score

What is a good credit score? Well! Let’s begin with this—a person with a good credit score enjoys more financial freedom, suitable borrowing opportunities, and…

Credit report

Did you know? A derogatory mark on your credit report can drop your credit score by up to 200 points. Baffling, isn't it? That's not…

Credit score

Quick SummaryRenting an apartment with bad credit, such as a 500 or lower credit score, is possible. It's challenging, but you can take proactive steps:…

Credit report

Ever met someone who likes inaccurate information reflected on their credit reports? Probably not, and that’s why you need to dispute credit report inaccuracies to eliminate…

Credit score

Your credit score is a number between 300 to 850 that tells lenders your creditworthiness, i.e., how you handle your credit and manage debt. Whereas,…

Credit score

Quick AnswerCredit score range starts at 300, with five categories: 300–579 is “Poor”, 580–669 is “Fair, 670–739 is “Good”, 740–799 is “Very Good”, and 800–850…

Credit score

Credit scores significantly impact various aspects of your life. In fact, sometimes, a few points can help you get a better offer on a new…