Understanding Credit Score: From Credit Invisibility to Building an Excellent Score

Numbers can reveal a lot about a person, just as a three-digit credit score tells everything about a person's financial situation. Especially, in situations, where a lender is evaluating a profile for a loan. This is to say that your credit score reflects your creditworthiness and plays a crucial role in determining whether or not you qualify for credit. Given that, it's reasonable for people to take credit seriously. However, that is not always the case.

| Surprisingly, according to the most recent data available by the Consumer Financial Protection Bureau, 26 Million U.S. adults have no credit history record. This means they are 'credit invisible' or simply have no credit scores. |

It is also worth noting that 16% of Americans have bad credit. And, one in five Americans aged 20-29 don't even know their credit scores.

This could be due to various reasons, including:

(a) Lack of financial education

(b) Ignorance of the credit system

(c) Unrecognized consequences

(d) Neglected future implications

| All things considered, understanding credit score and its implications is imperative. In this blog, we'll discuss: 🔹Credit Invisibility And Its Consequences 🔹Understanding Credit Score: What are the Credit Score Ranges 🔹Influencing Factors: Payment History, Credit Utilization, and More 🔹 Building An Excellent Credit Score: A Step-By-Step Guide 🔹CoolCredit: An IN(CREDIT)BLE Ally |

Credit Invisibility and Its Consequences: Why Being Credit Invisible Isn't Ideal

Credit invisibility refers to the lack of credit history reported to the leading bureaus: Equifax, Experian, and TransUnion. Now, what this means is that you don't have a credit score a.k.a. a way for lenders to assess your creditworthiness. There could be various reasons, including:

- Limited or no credit activity

- Newness to the financial system

- Limited use of traditional financial services

Now, even though credit invisibility in itself isn't problematic, there are potential setbacks associated with it, such as:

- Difficulty in obtaining loans or credit

- Limited financial and housing opportunities

- Higher interest rates on credit

- Challenges in setting up utilities

- Higher insurance premiums

Now that you know what credit invisibility means for your financial standing, let's get to understanding credit score, and go over various credit score ranges.

Revive your credit with CoolCredit's AI magic!

Get started todayUnderstanding Credit Score: What Is It and Why Should You Care?

To put it plainly, it's a reflection of your financial decisions and credit behavior lenders use to judge whether or not extending credit to you is their best bet. It is a three-digit number, typically ranging from 300 to 850, that exudes your borrowing power. An excellent or good credit score is likely to get you in the good books of lenders, making it easier for you to secure loans, and access better interest rates and favorable financial terms. In contrast, having no or low credit scores can result in limited credit access, high interest rates, restricted housing opportunities, and higher required security deposits for utilities.

That's right, your credit score may not be the only criteria lenders take into account, but it is quite a significant one.

What Are Credit Score Ranges?

There are various scoring models used to calculate credit scores, and as a result, credit scores may vary. However, more often than not, the credit score ranges typically from 300 to 850. The higher your score lies on the credit score ranges scale, the better credit opportunities you qualify for.

Let's take a quick look at the typical credit score ranges, and what they mean.

| Credit Score Range | Category | What It Means |

| 800-850 | Excellent | Exceptional credit; signifies low-risk borrowers with a proven track record; easily secures loans with highly favorable terms and lower interest rates. |

| 740-799 | Very Good | Demonstrates a consistently positive credit history and a strong financial track record that enhances the likelihood of approval for additional credit with favorable terms. |

| 670-739 | Good | Reflects responsible credit behavior; generally acceptable, though may encounter some challenges in securing larger credit amounts or face slightly elevated interest rates. |

| 580-669 | Fair | Considered "subprime" borrowers; viewed as having a moderate level of risk; and potential difficulties in obtaining new credit with terms that may not be as favorable. |

| 300-579 | Poor | Extremely low credit score; falls into the poor category; individuals in this range face significant challenges and must take essential steps to rebuild credit for new opportunities. |

Understanding credit score and knowing where your score falls within the credit score ranges is consequential. For someone with limited to no credit history, it's important to comprehend how to build your credit score from the ground up. And, the first step in doing so is gaining an insight into credit score influencing factors, such as credit utilization. So, let's get right to it.

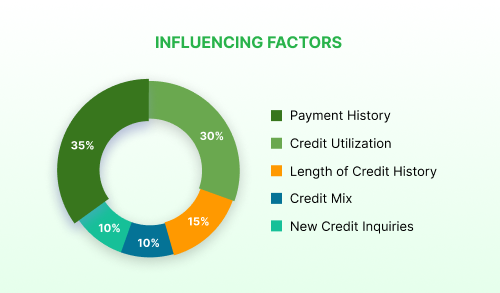

Influencing Factors: Payment History, Credit Utilization, and More

✅ Payment History (35%)

If there's one thing lenders care about, it's getting paid back timely. For that reason, payment history is one of the most influencing factors when calculating your credit score. And, delaying even a single payment for 30 or more days can be detrimental to credit score ranges. So, be sure to pay all of your bills timely. Consider setting up reminders or automatic payments to keep up with your bills.

✅ Credit Utilization (30%)

Remember, just because you have available credit does not mean you have to exhaust it. Maintaining a low credit utilization ratio is pivotal to acquiring a good credit score. This is because, to lenders, a high utilization rate may signal that you rely too much on credit, possibly revealing difficulty in managing your expenses and potential challenges in paying off installments. That said, it's advisable to pay down your credit card balances and aim to keep your credit utilization ratio below 30%.

✅ Length of Credit History (15%)

Consistency is crucial when it comes to credit, and that is primarily why having a prolonged credit history can benefit you. It demonstrates your constant ability to manage your finances and pay off debt. So, it's wise to keep older accounts open, even if you do not regularly use them, as they contribute to your average credit age.

✅ Credit Mix (10%)

While keeping your credit utilization ratio below 30% is important, it is also beneficial to manage a diverse mix of credit types. This means that having a mixture of installment debts and revolving accounts will positively impact your credit score. So, try to mix things up if circumstances allow.

✅ New Credit Inquiries (10%)

Applying for new credit often raises the brows of lenders, as it may cast doubt on your ability to manage your financial affairs and make timely debt payments. Try to limit the number of new credit applications in a short period. So, apply only if and when you really need credit.

Factors That Can Further Influence Credit Score Ranges

✅ Public Records and Negative Information

Try to keep your public records clean. Bankruptcies, foreclosures, and liens can prove detrimental to your credit score. Similarly, collection accounts and any such similar negative information or derogatory marks can harm your credit.

✅ Inaccuracies in Credit Report

A study revealed that 34% of participants identified at least one error in their credit reports. Depending on their nature, these inaccuracies can potentially harm your score. Therefore, it's critical to review your reports constantly to ensure they are accurate. In case you detect inaccuracies, you can leverage the CoolCredit App to generate impactful dispute letters and send them to respective bureaus.

Building an Excellent Credit Score: A Step-By-Step Guide

Did you know only 1.3% of Americans have a perfect credit score of 850?

According to Experian's latest analysis, they have three things in common:

- They're typically older

- Have more credit carts but lower balances

- Have less debt in general

That said, your goal doesn't necessarily have to be a perfect score, but aiming for a near-perfect or an "excellent" one certainly should be. But how? Let's get into the nitty-gritty of it.

Don't settle for one—try multiple credit-building apps to find the best fit for your financial journey.

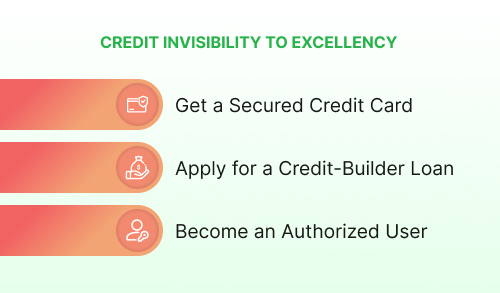

Learn MoreCredit Invisibility to Excellency: Building Credit From Square One

If you're building your credit score from scratch, there are a few steps you can take to establish your credit profile. Let's look at a few:

1) Get a Secured Credit Card

Beginning your credit-building journey on the right note is fundamental. And getting a secured credit card is a safe bet. You can simply make a deposit that serves as your credit limit. Responsibly using this card over time allows you to build a credit history. And this translates into a good credit score.

2) Apply for a Credit-Builder Loan

As the name so blatantly suggests, a credit-builder loan helps you do just that - build credit. When it comes to credit-builder loans, instead of receiving the loan upfront, the borrower makes monthly payments into a savings account or CD held by the lenders. Making these on-time payments positively impacts your credit score as they are reported to credit bureaus. Once the repayment term ends, you receive the total amount. These loans help you build your score and possibly qualify for credit in the future.

3) Become an Authorized User

Another way to build your credit score is by simply asking your family member or friend to add you as an authorized user on their credit card amount. Authorized users have access to an existing credit card amount and you might even get your own card. This allows you to piggyback on their positive credit history and add to your credit history.

These are only an initial part of the prolonged process of building an excellent credit score. Yes, and it requires time, consistency, and above all, discipline.

Steps You Must Follow to Build an Excellent Credit Score

- Never miss a bill - pay every last bill on time.

- Keep your credit utilization ratio below 30% - don't go overboard.

- Apply for credit in intervals - avoid too many hard inquiries in a short period.

- Prolong the length of your credit history - keep older accounts open.

- Review your credit score and report from all three bureaus regularly through the CoolCredit App.

- Look out for and dispute any inaccuracies in your credit report.

- Make responsible financial decisions and minimize your reliance on credit.

- Build an emergency fund - avoid applying for an overwhelming amount of credit in times of financial distress.

- Track your credit-building journey using an AI-assisted, DIY Credit Repair App, such as CoolCredit.

CoolCredit: An IN(CREDIT)BLE Ally

Building an excellent credit score is no child's play. And using an AI-assisted credit repair app to navigate your journey can prove to be wise. And, this is where CoolCredit comes in with all the information, resources, and assistance you need to build your score on your own.

- Retrieve and review credit reports from all three leading bureaus.

- Easily identify inaccuracies in credit reports.

- Generate evidence-based dispute letters to dispute inaccuracies efficiently and promptly.

- Track the progress of your credit repair journey in real-time.

That's not it. If you find yourself in a complex credit-related situation, you can resort to the choice of expert assistance, and get personalized advice and support.

Why CoolCredit Over Traditional Credit Agencies?

| Traditional Agencies | CoolCredit App |

| Higher fees over time | Cost-effective |

| Limited transparency | User-friendly and transparent |

| Variable education | Includes resources for improving credit knowledge |

| Variable responsiveness | Offers support and in-app resources |

| Limited control over the process | Users have control over disputes and actions |

Conclusion

Understanding credit score and building an excellent one is crucial for your financial well-being. Even so, credit invisibility and poor credit scores remain a concern. However, by taking the right steps, and demonstrating responsible financial behavior, consistency, and discipline, you can build your credit from the ground up to the excellent credit score range.

Explore Similar Blogs

1. FICO Score vs Credit Score: What’s the Difference?

2. What Credit Score Do You Start With?

3. 720 Credit Score: Is It Good Enough and How To Improve It?

4. From 808 Credit Score to 850: Achieving The Perfect Score