FICO Score vs Credit Score: What’s the Difference?

Your credit score is a number between 300 to 850 that tells lenders your creditworthiness, i.e., how you handle your credit and manage debt. Whereas, FICO is a credit scoring model that helps calculate your credit score.

While they both may seem like the same thing, it's crucial to distinguish that credit scores assess your credit standing, i.e., your reliability to pay back loans, your credit history, etc. Credit bureaus use different models for calculating credit scores, such as the FICO model, VantageScore, or other models. However, FICO is the most popular credit scoring model, used by 90% of leading lenders.

Read on to learn more about FICO score vs credit score and tips to improve your score for better credit standing.

Improve Your Credit Score Today:

Try Out Our AI Powered Credit Repair Tool

Understanding Credit Score

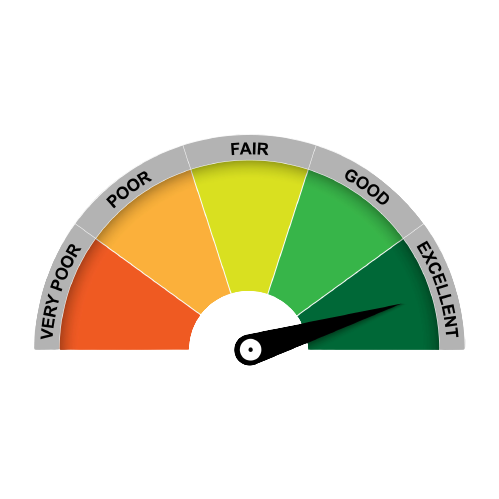

As you might already be familiar with, a credit score is a number between 300 and 850, showing your creditworthiness. It predicts your credit risk to lenders, i.e., whether you repay loans promptly or not. Credit bureaus use various methods to calculate your credit score.

Higher scores mean responsible borrowing, whereas lower scores signal poor financial standing. Hence, a good credit score gives you a better chance of getting approved when applying for loans. So, it is best to keep an eye on your credit scores by regularly monitoring them by submitting a request on AnnualCreditReport.com or licensed apps like CoolCredit.

Understanding FICO Score

Developed by Fair Isaac Corporation (FICO), this model is used by the three major credit bureaus—Experian, TransUnion, and Equifax—to create your credit report, and factors in this report help determine your FICO scores.

It uses a credit score range of 300–850 divided into five categories. Good FICO scores are highly useful when you want to apply for loans or new lines of credit.

| FICO | Rating | What the Score Mean |

| <580 | Poor | Well below average Demonstrates to lenders that you're a risky borrowers |

| 580-669 | Fair | Below average Many lenders will approve loans |

| 670-739 | Good | Near or slightly above average Most lender consider this a good score |

| 740-779 | Very Good | Above average Demonstrates to leaders you're a very dependable borrower |

| 800+ | Exceptional | Well above average Demonstrates to lenders you're an expectational borrower |

There are also various credit scoring models other than FICO, like VantageScore and Experian’s National Equivalency Score (ENES). So, it may lead to differences in credit scores from different sources.

The Difference Between FICO Score and Credit Score

| Criteria | Credit Scores | FICO Scores |

| What is it? | A numerical measure of your credit and debt | A type of credit scoring model |

| Score Calculation | Estimated using various credit-scoring models, i.e., FICO, VantageScore, ENES | FICO has various algorithms to calculate scores, i.e., FICO 8, FICO 9, FICO 10 |

| Score Range | May vary depending on the scoring model and bureau | Ranges between 300 to 850 |

Notably, FICO scores and credit scores calculated by other models are both based on the same five factors:

- Payment history

- Credit utilization

- Credit history

- Types of credit (credit mix)

- Recently acquired new credit lines

But the key difference lies in how they are calculated and categorized. This can lead to different results.

Take Control of Your Credit with AI Credit Repair

Learn MoreConclusion

Credit scores and FICO scores do not necessarily mean the same thing. Credit scores are a broader term, and every credit bureau uses credit scoring models such as FICO and other models to determine credit scores. The higher the scores, the better credit standing you can enjoy.

Thus, it is best to monitor and improve your credit rating using credit repair ai tool like CoolCredit. This way, you can access your credit report and check your scores instantly. Its dispute letter templates make it simpler to report inaccuracies, which might lower your scores.

FAQs

Q: Is a FICO score the same as a credit score?

A: The answer is: not really. The credit score is a numerical score between 300 and 850, which is a widely accepted measure of your creditworthiness. FICO is one of the scoring models that credit bureaus use to evaluate your credit score. There are also various other recognized scoring models, like the VantageScore, Equifax National Equivalency Score (ENES), etc.

Q: Why do credit scores differ between credit bureaus?

A: The FICO 8 scoring model is more sensitive to credit utilization rate, meaning fluctuations can impact your score. VantageScore 3.0 considers historical rates but may not impact scores as much. With VantageScore 4.0, utilization does impact scores.

Q: Why do my FICO scores differ among themselves?

A: Different FICO models, like FICO 10, 9, and 8, are used by various lenders. As a result, scores across these models may not align.

Q: What is considered an overall good credit score?

A: Scores above 700 are typically seen as good to excellent. However, around 40% of Americans have FICO scores below 700.

Q: How to Maintain a Good Credit Score?

A: Here are a few tips:

- Check your credit report and dispute errors: It may seem difficult to many, but it becomes much easier with apps like CoolCredit. It is a licensed AI-assisted DIY credit repair app. Its ready-to-use dispute letter templates make it easy to dispute any inaccurate information without much hassle.

- Reduce credit utilization: A lower credit utilization rate contributes toward a higher credit score. So, you should reduce credit card spending or apply for a higher credit utilization limit.

- Pay bills on time: Payment history is a crucial factor that can influence your credit scores. Thus, it’s recommended to never miss a deadline and pay bills, especially the credit card bill, on time. Timely payments reflect positively on your credit report, boosting your scores. (For more tips, check out the free knowledge resources available in the CoolCredit app)

Explore Similar Blogs

1. Understanding Credit Score: Complete Beginner’s Guide

2. What Is a Good Credit Score, and How to Get and Keep It?