What Is a Good Credit Score, and How to Get and Keep It?

What is a good credit score? Well! Let’s begin with this—a person with a good credit score enjoys more financial freedom, suitable borrowing opportunities, and more importantly purchasing power.

A credit score of 700 and above is considered good, and 800 and above is considered excellent for a range between 300 and 850. However, VantageScore’s 2021 data shows that the average credit score in the US is 698.

There are several benefits of having a good credit score. It improves your chances of getting better interest rates, leasing opportunities, and more. Having said that, you also need to remember that lenders will most likely have different criteria. Also, there are various ways to improve your credit score, including following good credit habits or using a DIY credit repair app like CoolCredit! Let’s dive right into the details without further ado.

AI Credit Repair, Simplified!

Let AI Fix Your Credit, Fast and Smart

What Is a Universally Good Credit Score?

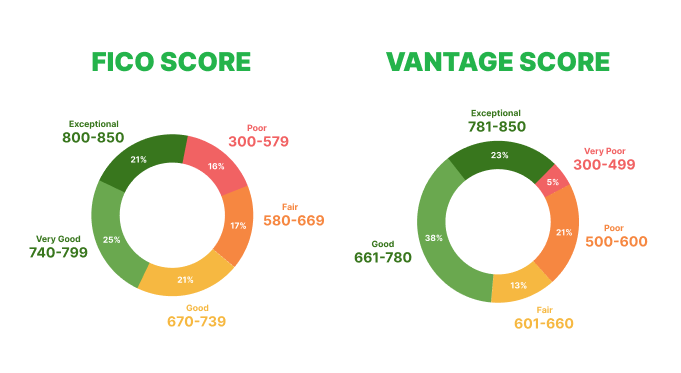

As a general standard, a 700 credit score is universally considered good. However, the credit ranges depending on the FICO and VantageScore scales usually differ.

According to FICO, a credit score above 670 is classified as “Good”, while a score above 740 is classified as “Very Good” and an 800+ credit score is classified as “Excellent”.

On the other hand, as per VantageScore, a credit score of 661 and above is considered “Good”. It categorizes your scores in the following way:

- Excellent: 781–850

- Good: 661–780

- Fair: 601–660

Higher scores can land you in a more favorable credit standing. So, in this blog, we’ll disclose everything from “why good credit scores matter” to actionable strategies and DIY tools to help you improve your credit.

How Does a Good Credit Score Help?

A good credit score helps you in many ways, largely because it tells the lenders that you can pay back the debt you owe in due time.

Rest assured a good credit score will help you access a wide range of financial services. For instance, loans with lower interest rates and flexible terms. Besides this, you also have to keep in mind, that the higher your scores, the more favorable your chances of getting approved for a particular financial service.

However, things get tricky when loan terms like low-interest rates are in question. In other words, even a good credit score will not guarantee approval. So, under these circumstances, irrespective of the factors considered by the lenders, you have to ensure your credit score is good. This may not ensure approval but will help increase your chances of getting a loan approved.

Here Are Some Things You Can Get With a Good Credit Score

▪ Applying for a Credit Card

When you are getting ready to apply for a credit card, your first thought might be, “What credit score do you need to get a credit card?”. To answer this question, a score of 660–720 or above will qualify you to get easily approved for most credit cards. But if your scores are below 660, it can be challenging to get approved even though your scores may be in the “Fair” category.

Best Score: 700 and above

▪ Getting a Mortgage to Buy a House

A minimum 620 credit score can help you qualify for a mortgage. However, you can also qualify for a mortgage, such as those backed by the government, like FHA (Federal Housing Administration), with lower credit scores. There are also other grants, such as VA (Veterans Affairs) loans for army members to get subsidized housing. But for buying your dream house, you may need higher scores.

Best Score: 660–700 or better (for best loan terms and lower interest)

▪ For Rental Lease Approval

When you are looking to rent an apartment, you need at least a minimum 670–739 score. In fact, in mainstream locations with competitive markets like New York, Boston, or California, landlords actively prioritize applicants with 700+ credit scores.

Best Score: 700 and higher

▪ Financing for a Car Loan

661–684 is the required credit score for auto loans, in case you are wondering, “What is a good credit score to buy a car?”. Higher credit scores mean better interest rates. So, people with credit scores of 700 or higher usually get more favorable loan terms. However, if your credit score is below 700, it’s best to work on improving it before applying for a car loan.

Best Score: 684–700 or better

However, a good credit score does not guarantee approval since there are various other factors that lenders consider. So, under these circumstances, it helps to work on improving your credit score for better chances of getting approved.

How to Improve Credit Score?

Improving your credit score involves opening accounts that report to credit bureaus, maintaining low balances, paying bills on time, and limiting the frequency of new account applications.

Here Are a Few Other Things to Try:

- At least make a minimum payment and always make all debt payments on time. Even one payment late by 30 days or more can negatively impact your score and stay on your credit report for almost 7 years. If you are late making a payment, reach out to your creditor and try working things out with them.

- Try keeping your credit card balances low. Having a low credit utilization rate can help your credit score. The ones with excellent credit scores have an overall utilization rate in the single digits.

- Open accounts that will get reported to the credit bureaus. If you have a few credit accounts, ensure the ones you open are added to your credit report.

- Apply for credit when you need it. Opening a new credit account can lead to hard inquiry, which is bad for your credit score.

- With regular credit monitoring, you can keep track of the changes to your score and avoid risking your credit health. You can instantly dispute an error using a DIY credit repair app like CoolCredit that offers pre-made dispute letter templates.

Don't Wait! Start Improving Your Credit Score Now!

Proven StrategiesWhat Factors Affect Your Credit Score?

FICO and VantageScore have different approaches to explain the relative importance of the categories. However, they both consider the following 5 factors:

- Payment History (35%)

This involves whether you have responsible financial habits, i.e., on-time payments, late payments, missing payments, bankruptcy records (if any), collection accounts (if any), etc.

- Amount You Owe (30%)

How many of your accounts are open, their balances, how much you still owe, and how much of the credit limit you are using—they all come into play here.

- Length of Credit History (15%)

Length of credit history involves the average age of all your credit accounts, i.e., the length of how long you’ve had debt, including the old and new.

- Credit Mix (10%)

This considers whether you can manage different types of accounts (installment accounts like a car or personal loan and revolving accounts like credit cards or other types of credit lines). It helps your credit score.

- New Credit Lines (10%)

This considers your recent activity, i.e., whether you recently applied for or opened new accounts.

The percentage of each factor is how much they influence your credit. This means your payment history and the amount owed are the two most influential factors on your credit report.

What Are Credit Score Ranges?

There are different scores. Below you will find a complete breakdown of credit score ranges:

What Makes a Good FICO Score?

The score range starts from 300 to 850, and a good FICO credit score is 670 and 739. FICO makes different types of credit scores. There are base scores for lenders in multiple industries, credit issuers, and auto lenders.

FICO’s industry-specific credit score range is from 250 to 900.

What Makes a Good VantageScore?

Its first two scoring models ranged between 501 and 990, but the two newest scores run between 300 and 850. As per the latest models, VantageScore defines credit scores between 661 and 780 as good.

What Is a Good Credit Score to Purchase a House?

You should always aim to have and maintain a good credit score to qualify for a lower-rate mortgage. And that good FICO score is 670 and above.

The minimum credit score is 500-700 to purchase a house, but it will depend on the lender and the type of mortgage you apply for. Several lenders require a minimum credit score of 620, while others may have different requirements.

- FHA loans require a minimum credit score of 500 when you put 10% down and 580 when you put 3.5% down.

- USDA loans don’t have a specific credit score requirement, but lenders want a minimum score of 580.

- VA loans don’t have a specific credit score requirement either, but lenders want a minimum score of 620 and above.

Note that your credit score plays a significant role in determining the payment terms and interest rate. Lenders decide the interest based on how risky they think you are. Although it’s not entirely impossible to get a mortgage with bad credit, the terms may not be that great.

What Is a Good Credit Score to Purchase a Car?

There’s no specific minimum credit score requirement to purchase a car, but you should aim for a score of 670 and above. It puts you in the good credit range.

The same rule applies here. The higher your credit score, the better auto loan terms you get. If your FICO score is below 670, try building your credit before buying a car. You can use a trusted self-credit repair app like CoolCredit to get started.

Compare, Choose, Build – Find the Best Credit App for You!

Read the blogWhat Information Credit Scores Do Not Consider?

Credit scores don't consider the following factors:

- Personal Characteristics/Details: As per U.S. Laws, your race, color, religion, ethnicity, residency status (i.e., national or international origin), sex, and marital status do not affect your credit scores.

- Your Age: FICO and VantageScore don’t directly consider age as a factor for credit score assessment. However, it is a factor that lenders and credit card companies usually consider. For instance, when a minor applies for a credit card, they often require a cosigner parent or guardian, as the younger individuals may not have a well-established credit history.

- Employment History: Whether you are a salaried employee, unemployed, self-employed, belong to any particular occupation, your job title, and other details of your employment history do not affect the credit score assessment. But, these are important factors that the lenders usually consider when making the approval decision.

- Your Geographic Location: Where you live does not impact the credit score estimation.

- Credit Monitoring: When a company or you check your own credit scores with soft inquiries, it does not impact your credit assessment.

- Debit Card Payments: While your credit card activity is a significant factor in determining your credit score, any payments made by your debit card are not considered a liability.

- Child Support and Alimony Payments: These are usually not considered as these payments are not made to a lender or credit institute.

Conclusion

There’s no single definitive answer to suggest what’s a good credit score but we’ve given you a framework to work with. Try staying in the good FICO and VantageScore zone to live a financially free and fulfilling life.

Use the ai credit repair- CoolCredit to get credit reports from all 3 bureaus and get expert help whenever and wherever you get stuck. Educate yourself by accessing a vast library of credit resources and navigate the world of credit more easily.

FAQs

Q: How Do I Get a Good Credit Score?

A: To build a good credit score, make payments on time. Ensure that you keep your credit card balance low. Only apply for credit if you need it, and open accounts that will be added to the credit bureaus.

Q: How Long Does It Take to Get a Good Credit Score?

A: It takes about six months to get a good credit score. However, the chances are that it will most likely take you longer to get your credit score from good to excellent. In other words, the better the credit score, the higher the chances of getting your score improved, and vice versa.

Q: How Do I Find Out What My Credit Scores Are?

A: You can apply for a free credit report once a year from the 3 major credit bureaus—Experian, Equifax, and TransUnion. Or, you can also use the CoolCredit app for credit monitoring. It will instantly fetch your scores from all three bureau(s) as well as provide a range of credit resources for education, tools for credit repair, and much more.

Q: What Is a Good Credit Score Range?

A: 670-739 is considered a good credit score range.

Q: Is 664 a Good Credit Score?

A: 664 is considered a fairly good credit score. However, the range of credit scores may vary depending on the scoring model, generally adopted by creditors or other financial entities. Rest assured, a good credit score ranges from 670 to 739. On the other hand, any score above 799 is considered excellent.

Q: What’s a Good Credit Score for Buying a Home?

A: 620 is considered a good credit score for renting or buying a home. However, 740 is the ideal score if you want a lower downpayment and better mortgage terms.

Q: What Is a Good Credit Score to Buy a Car?

A: A 650 credit score is considered good for buying a car but if your credit scores are above 720 you can get the best deals, especially when getting a car loan.