Credit Score Basics: Complete Beginner’s Guide

Credit scores significantly impact various aspects of your life. In fact, sometimes, a few points can help you get a better offer on a new line of credit. Therefore, understanding credit score and maintaining good credit is crucial.

So, if you are in a sticky financial situation and aspire to achieve a better credit standing, this guide is for you. In this blog, you can learn how credit scoring works, the factors affecting your score, and what you can do.

| Key Takeaways: ▪ A credit score is a numerical reflection of your creditworthiness. ▪ There are five different credit score ranges: poor, fair, good, very good, and excellent. ▪ Higher credit scores help you qualify for lower interest rates and better credit terms. |

What Is a Credit Score?

A credit score is a numerical representation on a scale of 300 to 850. It suggests your credit behavior based on your credit history and many other factors.

Unlock the power of AI to boost yourcredit score quickly and efficiently

Learn HowCreditors and lenders typically demand a credit check to gauge your repayment ability. It helps them determine your credit risk when you apply for a loan or line of credit. Hence, if you have good credit, you may find it easier to secure a housing loan, insurance, and other essential services.

But, bad credit can bring forth various challenges. For example, you may face difficulty obtaining personal or home loans. Consequently, only a few points could mean the difference between approval and rejection.

What Is Considered a Good Credit Score?

Every credit bureau calculates credit scores based on different models.

For example, the two most widely used credit scoring models are FICO and VantageScore. Both use many of the same factors and core principles, including the same range of 300 to 850.

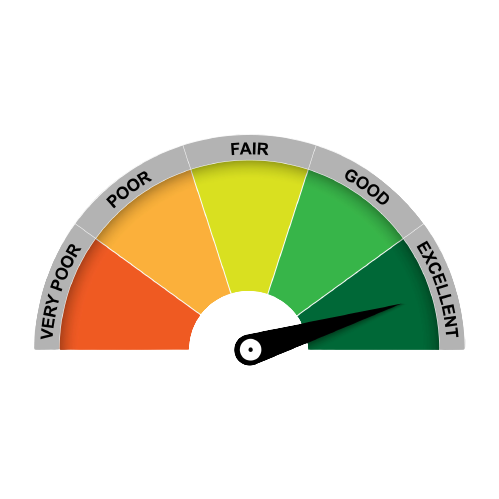

Usually, credit scores range from poor to excellent. Within that range, scores are divided into different categories depending on the scoring mode

Credit score ranges for FICO®

FICO breaks credit scores down into five different categories:

Credit score ranges for VantageScore 4.0

There are four categories:

Depending on the credit bureau, the credit score ranges for these categories may change.

| Generally, a score between the mid-600s and mid-700s is considered fair to good. |

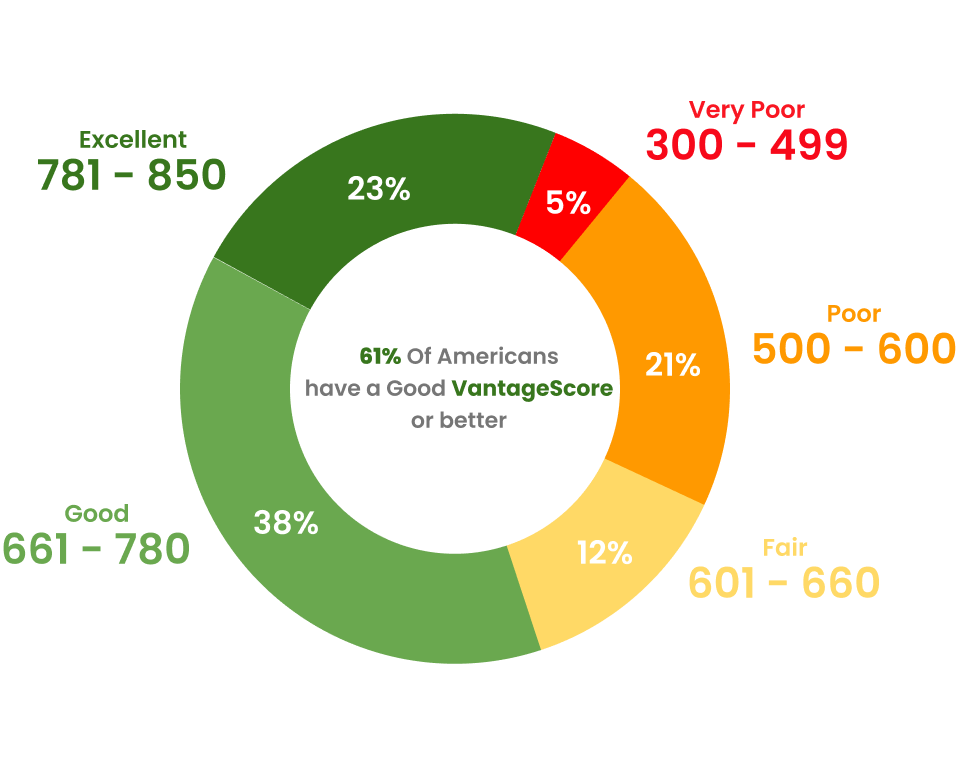

According to Experian, 61% of Americans fall into the fair to good credit score category. However, if you fall below 579, it is generally considered a poor credit score.

In this case, you can use a credit monitoring tool like Cool Credit to get a credit report and suggestions for DIY credit repair.

Why Does a Good Credit Score Matter?

A good credit score opens doors to a world of opportunities. Here’s why it matters:

- Better Loan Terms: Whether you're buying a home, a car, or simply making large purchases on credit, a good credit score means lower interest rates and better deals on acquiring new credit lines.

- Easier Approvals: When you apply for a loan, a rental property, or even insurance, lenders look at your credit score first. A good score makes it more likely that you'll get approved quickly.

- Build Trust: A strong credit history shows you're reliable with money. This can open doors to various financial benefits, which can help you save significantly on future purchases.

How Are Credit Scores Calculated?

Whether you want to buy a house, start a business, or get a personal loan, a credit check is always needed.

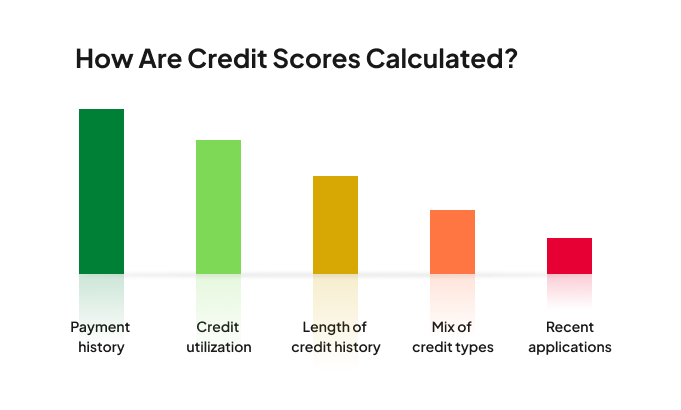

Here are the top factors that help calculate your score:

1. Payment History (35%)

Your payment history is the most influential factor when calculating your credit scores. It includes information like your active credit accounts, missed or late payments, and data related to debt collection. Hence, it helps creditors assess how likely you are to repay a loan on time.

2. Credit Utilization (30%)

The credit utilization rate is your debt-to-credit ratio. It means the amount of credit you owe is relative to your total credit limit. It is the second high-weightage factor that influences your credit score calculation.

Most lenders and creditors check your credit usage based on credit cards, mortgages, and other fixed loans you may have. So, the lower the ratio, the better it is.

| A credit utilization rate of 30% or lower is considered ideal. |

3. Credit History (15%)

Lenders also look at both your oldest and newest credit accounts. Thus, the length of your credit history may affect your score. It means a good credit standing over the years can help boost your chances of getting approval.

4. Credit Mix (10%)

Credit mix includes the types of credit accounts you have, such as mortgages, car loans, credit cards, etc. Hence, a diverse credit mix maintained well over a long period reflects positively on your credit.

5. New Credit Accounts (10%)

Your recent credit activity is another factor that helps determine your credit scores. Although it typically accounts for 10% of your credit score.

Whenever you apply for a new line of credit, it may necessitate a hard credit check, causing your score to drop a little. For example, if you apply for multiple loans, it can negatively affect your credit scores significantly.

How to Check Your Credit Scores?

You can access your credit report for free once a year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. It details your credit activity and helps lenders decide if you qualify for loans, credit cards, and other financial services.

Ways to Access Your Credit Report:

Here are the top four ways you can fetch your credit report and check your scores:

1. Apply with the Respective Credit Bureau Directly

All major credit bureaus, including FICO, Experian, and TransUnion, allow individuals to check their credit scores by applying directly from their official website.

2. Get a Free Annual Credit Report

You are entitled to request a free credit report once annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion using AnnualCreditReport.com. Simply follow the below steps:

▪ Head to AnnualCreditReport.com, the official website authorized by the U.S. government. It offers a quick and secure way to request your credit report.

▪ Follow the instructions and fill in the required personal information, including your full name and Social Security number (SSN).

▪ This service provides free credit reports, but your credit score might require an additional fee.

▪ You can choose to receive your report by email or mail.

▪ You'll typically receive your report within 15 days.

3. From Financial Service Providers

Banks, credit card issuers, and financial organizations also provide credit check services. Some financial institutions have credit check functionality available in their apps.

4. Credit Monitoring Apps

You can also use credit monitoring apps, which allows users to access their credit scores as part of their subscription plan. There are credit repair and monitoring apps, such as CoolCredit, which not only lets you retrieve your report and credit scores but also provides step-by-step instructions for DIY credit improvement.

Start your journey to better credit today With AI-driven credit repair approach

Get StartedWhat Are the Disadvantages of Poor Credit Scores?

- It will be difficult to get approved for credit cards and loans.

- You may get less favorable loan terms, such as high interest rates, annual fees, etc.

- Lower chances of getting approved when renting an apartment or applying for a mortgage.

What to Do If You Have a Poor Credit Score?

Many people already know the basics of credit scores. Unfortunately, they often neglect to maintain it. What’s more, they only start working on improving it when they need a credit card or any type of loan.

However, understanding credit scoring factors can help you pinpoint the cause of a low or declining score. As a result, it can help you find what to work on to improve your credit scores.

Improving Your Credit Scores

Strategies for Better Credit Health!

If you have a bad credit score, here are a few things you can do to improve it:

1. Maintain a Good Payment History

Missing even one payment due date can ruin your credit. Therefore, it is crucial to make bill payments on time or early, if possible. This helps build a positive credit history, which works in your favor during credit score evaluation.

2. Minimize Your Credit Usage

Maintaining a long credit history with lower credit utilization, i.e., <30%, is ideal for achieving higher credit scores. You can also consider applying for a higher credit limit to reduce the credit usage ratio.

3. Raise Disputes for Suspicious Charges

Any incorrect information on your credit report may cause issues that can impact your credit scores. For instance, incorrect loan balance, closed accounts reported as overdue, incorrect name, etc.

For this, you can also use tools like CoolCredit to monitor your credit report regularly. It’s an AI-assisted credit repair app that analyzes and provides actionable strategies to raise your credit scores for DIY credit improvement.

4. Look Out for Fraud and Identity Theft Threats

Any unfamiliar transaction can be a sign of identity theft or fraud. Hence, you should regularly monitor your credit report. This helps identify anomalies more quickly, so you can take action as needed before it's too late.

Additional Tips for Protecting Your Credit

Threats such as identity theft can be too damaging to your credit, so here are a few extra precautions you can take to safeguard your credit scores.

- Freezing your credit report

Freezing your credit report prevents unauthorized access to your credit report and credit scores. This means identity thieves won’t be able to access your credit information by creating an illegitimate account in your name.

- Enable two-factor authentication

Add another layer of security by enabling a two-factor authentication so you will receive an OTP on your trusted device. This can instantly let you know if someone tries to access your SSN account.

- Credit Lock

The major credit bureaus also offer the premium “credit lock” option for a specified fee. Once locked, you can get alerts if anyone tries to access your credit report. And you can get the credit lock removed when you want to apply for a new credit line.

| Pro Tip: Remember, locking your credit report at one bureau does not imply that it has been locked by all the credit bureaus automatically. So, make sure to apply for credit lock from all 3 credit bureaus individually to ensure optimum protection. |

- Regular Credit Monitoring

Despite taking the precautions, it is important to keep tabs on your credit report and monitor it without a miss. However, rather than going through the grueling process of applying for credit reports monthly from all 3 bureaus individually, it’s better to use platforms such as CoolCredit. It lets you check and monitor your credit report from all 3 bureaus instantly in one place.

Conclusion

In conclusion, it's best to stay updated with your credit report to keep track of your credit score status. As a result, you can immediately take action and maintain exceptional credit.

If you want to increase your creditworthiness, join CoolCredit to get started. It is an excellent tool for credit monitoring and identifying credit problems. In addition, you can use its insights and dispute letter templates for self-credit repair and management.

FAQ's

Q: What is the highest credit score?

A: 850 is the highest credit score that a person can get. However, if you fall into the credit score range of 781-850 then it is considered excellent, which is the highest score category.

Q: How to check credit score?

A: You can submit a request to one of the major credit bureaus, or you can use apps like CoolCredit. It lets you check your credit scores across the three credit bureaus with just a few taps on your phone. This way, you won’t need to wait for 15 days to get your credit scores from the credit bureau.

Q: What Is the Minimum Credit Score Needed to Get a Car Loan?

A: 600 is the lowest credit score you need for a car loan. However, a 650–730 credit score is the most preferred for auto loans. Also, with higher credit scores, you can get better interest rates and lower monthly payments.

Q: How to Boost Credit Scores for a Loan?

A: By displaying responsible credit behavior you can boost your credit scores. For instance, make bill payments on time, limit your credit utilization below 30%, never apply for loans back to back, maintain a balanced credit-to-debt ratio, check your credit report regularly, and raise disputes as needed for credit improvement.

Q: What to do if you have a poor credit score?

A: Many people know the basics of credit scores. Unfortunately, they often neglect to maintain it. What’s more, they only start working on improving it when they need a credit card or any type of loan. However, understanding credit scoring factors can help you pinpoint the cause of a low or declining score. As a result, it can help you find what to work on to improve your scores.

Q: How to raise credit score?

A: If you have a low credit score, here are some steps you can take to improve it:

- Always pay your credit card bill on time.

- Maintain a good payment history.

- Minimize your credit usage to maintain a lower credit utilization rate.

- Regularly check your credit report and raise disputes for suspicious charges.

Furthermore, you can also use tools like Cool Credit to regularly monitor your credit report. It also provides actionable strategies to raise your score.

Q: How Can CoolCredit Help Manage My Credit Scores?

A: CoolCredit is an AI-assisted platform that helps with the following:

- Access credit reports from all 3 major credit bureaus instantly

- Analyze negative items that are lowering your credit scores

- Provides actionable tips on how to fix each issue

- Offers an extensive library of resources to help improve your credit-related knowledge and tips on improving your credit scores the DIY way

- Let’s you raise a dispute for incorrect information on your credit report using ready-to-use letter templates

- You can also get personalized credit advice and assistance from a credit expert without needing to visit a credit repair agency.

Download CoolCredit today and see for yourself how it can help boost your credit scores!

Explore Similar Blogs

1. FICO Score vs Credit Score: What’s the Difference?

2. What Credit Score Do You Start With?

3. 770 Credit Score: Is It Good Enough and How To Improve It?

4. Credit Score 808: What It Means and How to Maximize Its Benefits