770 Credit Score: Is It Good Enough and How To Improve It?

The average FICO credit score in the US is 717, according to the latest FICO data. And the average VantageScore is 701 as of January 2024.

If you’re wondering ‘Is 770 a good credit score?’, you should be glad to know that it is. Moreover, not only is it well above the national average, it’s just as close to an excellent score. So, the question is, why not build one?

Before we get to the details of how to improve a 770 credit score, let’s understand whether building one is worth it or not.

Transform Your Credit with AI: Elevate Your Score, Seamlessly with Our AI Credit Repair Solution!

Learn HowWhy Aim Higher Than A 770 Credit Score?

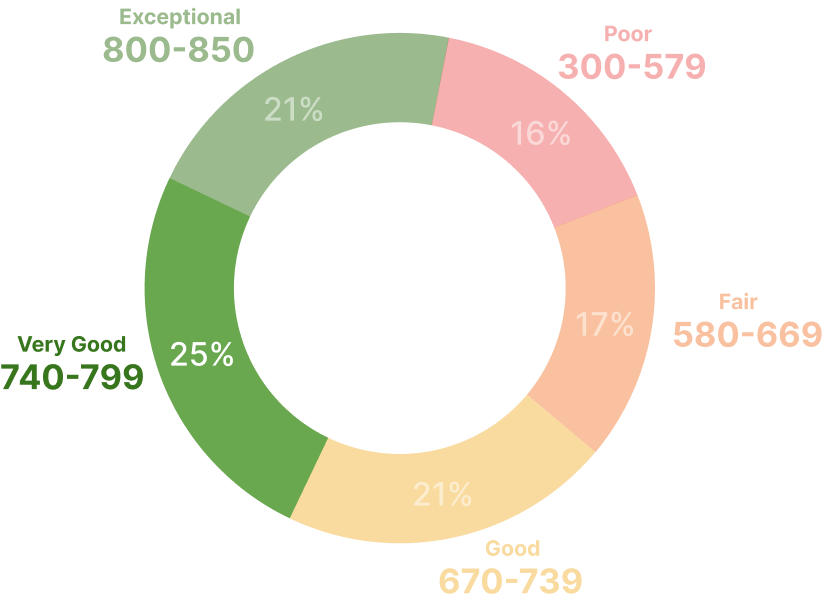

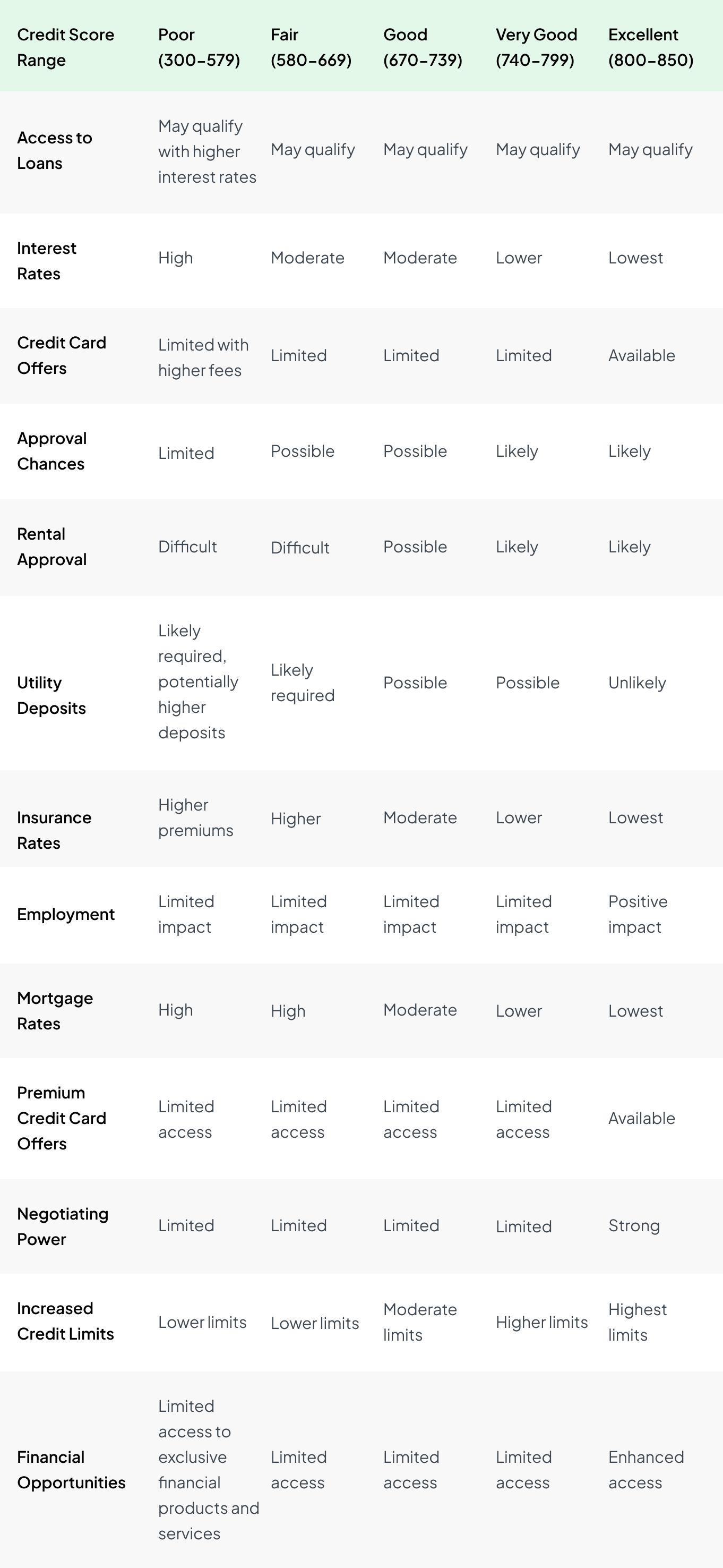

Besides the bragging rights, improving your 770 credit score to fall in the range of an excellent score will entitle you to exceptional benefits. Let's go over the benefits each credit score range entails to give you a more nuanced perspective.

different credit score range & benefits

How To Improve A 770 Credit Score?

◾ Keep Tabs On Your Credit Report Regularly

A 770 credit score is way too close to an excellent credit score to not aim for. And the first step is to keep tabs on your credit report to identify gray areas and the scope for improvement. This will make it all the more easy for you to improve your 770 credit score to one that falls in the excellent category.

◾ Do Away With Inaccuracies On Your Report

Sometimes, the only thing between you and an excellent score are a few inaccuracies or errors. And disputing them can be the easy answer to 'how to improve 770 credit score'. These can include:

- Account Errors

- Duplicate Accounts

- Inaccurate Or Outdated Personal Information

- Illegitimate Entries

You can easily generate impactful, evidence-based letters and dispute such inaccuracies using ai credit repair like CoolCredit.

◾ Take Due Payments Seriously

The last thing you should do while trying to improve a 770 credit score is to be lenient with your due payments. Missing or even delaying payment by a few days will not only keep you from achieving a higher score but can also set you back by a few points. So, set up auto payments or reminders if need be, but do not miss a due payment.

◾ Don't Use Up All Your Available Credit

Just because you have a high credit limit does not mean you should use it all. In fact, it's wise to keep your credit utilization ratio below 30%. So, if your credit utilization ratio is higher than that and you want to improve your 770 credit score, you should aim to lower the ratio. To do so, focus on paying down balances, increasing credit limits, and avoiding maxing out cards.

◾ Set Aside Rainy Day Money

Maintaining a 770 credit score is just as much of a task as improving it. To do so, it is imperative to ensure you don't miss payments or need to take on additional credit due to unprecedented emergencies. And one of the most effective ways to prevent this is to save up a rainy day fund to rely on instead of using credit.

◾ Stay In Your Budgetary Limits

Expanding on the preceding point, it is important to find ways to set a little money aside to reduce your dependence on credit in times of emergencies. And that requires budgeting. So, try to create one and stick to it. Over time, this will not only allow you to improve your 770 credit score but also strengthen your overall financial standing.

◾ Settle Any Outstanding Accounts Under Your Name

The last you want in your name if you're aiming to improve your 770 credit score is an overdue or collection account. So, prioritize paying off any such accounts as soon as possible. Not only do they not look good on your credit report, but can also keep your score from improving.

◾ Don't Go Overboard With Your Credit Applications

Resort to applying for credit only when you really need it, especially within a short span of time. This keeps your credit health at its best. Again, since you're aiming for an excellent score, there is no room for missteps. Moreover, too many applications increase the possibility of rejections, which can hinder your progress.

◾ Give It Time

Improving your 770 credit score to one that falls in the excellent category is no easy feat. And it definitely cannot be achieved overnight. So, take all the steps and let time take its course. However, be sure to track your progress on an app like CoolCredit. This will reassure you of your gradual improvement.

◾ Brush Up On Your Credit Education

Making informed decisions is crucial when improving your 770 credit score. And understanding how credit works is the first step to realizing how to improve a 770 credit score. There are innumerable resources available on CoolCredit for you to refer to including comprehensive guides, walkthrough videos, and much more to aid your journey.

Elevate Your Financial Status Today: Improve Your Credit Score with Our Expert

Get StartedWhy Is It Important To Safeguard Your Credit Against Identity Theft And Fraud?

When your identity is compromised, it can lead to unauthorized accounts and debt that can severely damage your credit score. This can create long-lasting effects, making it harder for you to secure loans, mortgages, or even favorable interest rates.

This can be a problem in more than one way:

- The Obvious Impact On Credit Score: Fraudulent accounts can lower your credit score, impacting your ability to borrow money.

- Unwarranted Financial Stress: Resolving identity theft issues can be time-consuming and stressful, leading to anxiety about your financial future.

- Higher Interest Rates: A damaged credit score often means you’ll face higher interest rates on loans and credit cards, which is just more money out of your pocket.

- Obtaining Credit Can Become A Real Challenge: A poor credit profile can lead to lenders saying "no," or at least offering you less-than-stellar terms.

- The Recovery Process Can Take Forever: Fixing the mess from identity theft isn’t a quick fix; it can take ages and throw your financial plans out of whack.

Conclusion

While a 770 score already falls within the 'Good' category, it is also just as close to the 'Excellent' one. So, here are some final words on how to improve a 770 credit score. Well, it's no easy feat, but by taking the right steps - like maintaining your credit profile, addressing inaccuracies, prioritizing timely payments, and tracking your progress on an credit repair app like CoolCredit - you can achieve it over time.

FAQs

Q: Is A 770 Credit Score Good?

A: Yes, a 770 credit score falls in the good category, which usually ranges from 670 to 739.

Q: What Factors Contribute To A 770 Credit Score?

A: A history of timely payments, low credit utilization, a diverse mix of credit accounts, and a limited number of credit inquiries are a few factors that can contribute to a 770 credit score.

Q: What Are The Benefits Of Having A 770 Credit Score?

A: Having a credit score of 770 offers a multitude of advantages, including eligibility for better interest rates on loans and credit cards, greater access to credit cards with attractive rewards, and improved standing with landlords and utility companies.

Q: How Can I Achieve A 770 Credit Score?

A: Achieving a 770 credit score requires you to take the right steps over time: regularly monitor your credit reports on CoolCredit, focus on making timely payments, keep the credit utilization ratio low, maintain a diverse credit portfolio, and avoid excessive credit inquiries or new accounts.