Why Did My Credit Score Drop? 13 Common Reasons & How to Recover

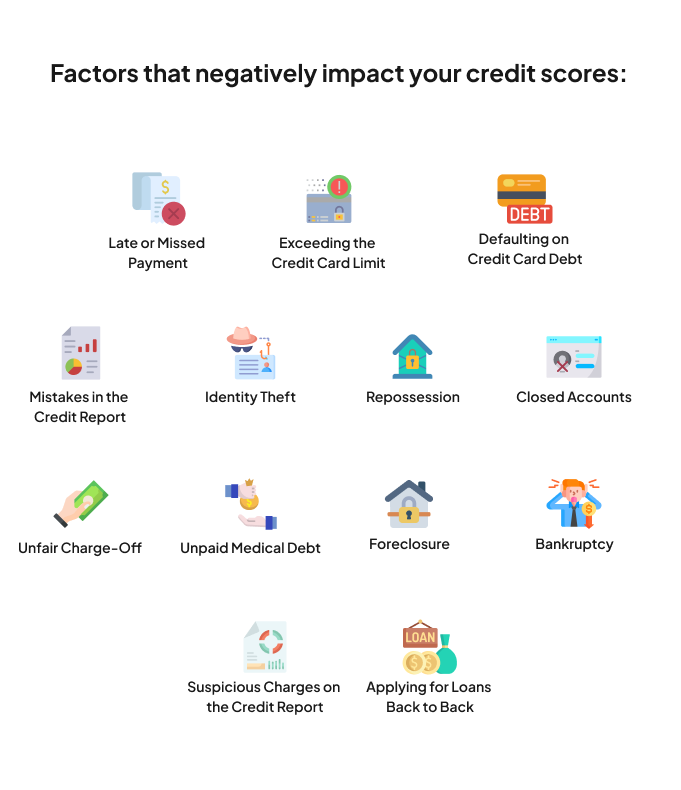

If your credit score drops out of nowhere, even by a few points, you may panic, which is the common reaction. A credit score drop can occur due to different factors, such as late or missed payments, defaulting on credit card bills, etc. However, sometimes it's due to mistakes in the credit report, unfair charges, or even identity theft, which is highly concerning.

So, if you notice any unusual dip in your scores, it's time to investigate. Let’s start by talking about which negative items impact your credit standing and what to do if your credit score is going down.

Experience Credit Freedom: Let AI Repair Your Score

Unlock Better CreditWhat Are The Negative Items on Your Credit Report?

Let's discuss how these impact your credit scores.

1. Late or Missed Payment

Sometimes it can happen when we miss a payment due date. But, if you fail to pay it off within 30 days past the deadline, you can lose 100 points in a blink. That’s not all, if you delay payment for longer, i.e., 90 or more days, you will lose an additional 50 points. So to minimize the impact of late or missed payments, it's crucial to pay within the first 30 days of defaulting, or it will go on your record if the creditor reports it.

How to Fix It?

One way to get a late/missed payment removed from your report is to contact the creditor and negotiate a "pay-for-delete" agreement.

Additional Tips on How to Avoid Late Payments:

- Communicate about the late payment with the creditor beforehand and get an extension on the due date if possible.

- Get a short-term loan or borrow money from a family member or friend to meet the payment deadline. Make sure to pay off the borrowed amount when you get paid.

- Negotiate with the creditor for a lower monthly installment if the current amount doesn’t easily fit your budget. Some lenders may allow flexible payment options upon request.

2. Exceeding the Credit Card Limit

If any unexpected major expenses arise and you put them on your credit card, maxing out its limit, it can increase your credit utilization. Hence, your credit scores may bear the brunt.

Solutions:

- If your credit scores are good, you can request a higher credit limit from the bank.

- Pay the exceeded amount using another credit account before using the card again.

- Maintain credit utilization between 20%–30% as a standard rule.

- Repay your credit card bill early to boost your credit score.

3. Defaulting on Credit Card Debt

Not paying your credit card debt can significantly impact your scores. Whether it's because you forgot or didn’t pay due to a low bank balance, your scores can take a hit by 40 points up to 200 points. Also, once it’s on your credit report, even if you pay it off, it can stay on your record for up to 7 years.

4. Closed Accounts

If you have recently paid off a debt, i.e., closed off a credit account, then you may see a slight dip in your credit score. This happens because it changes the credit mix ratio. As a result, some may experience a score drop of up to 100 points if it's a big account. So, even if your credit behavior hasn’t changed, your credit scores drop.

5. Mistakes in the Credit Report

As per a survey conducted in 2024 by USA Today, 44% of participants found one or more errors in their credit reports. So, it's more common than you might think. Any errors in your credit report data can lead to lower scores. That’s why it's crucial to keep a close watch on your credit report to identify any mistakes early on.

Here are the common errors to look for:

- Incorrect personal data (i.e., wrong name, SSN, phone number or address)

- Unfamiliar accounts in the credit report (this may indicate foul play, such as identity theft)

- Credit accounts that belong to someone else with the same name

- Wrong payment information

- Wrongly reported late payments for closed accounts

- A closed account with an incorrect balance or false open status

How to Fix It?

When there’s a mistake in your credit report, you need to draft a dispute letter and raise a dispute immediately. You will also need to provide relevant proof to support your claim. You can raise the dispute online with the respective credit bureau. Once the complaint is submitted, you may need to wait 2-4 or more weeks for the erroneous information to be removed.

| Pro Tip: You can use the FREE DIY credit repair platform like the CoolCredit Credit Repair App which provides ready-to-use dispute letter templates. All you need to do is fill in the required information, print the letter, and forward it to the relevant authorities for correction. Or you can submit the request through CoolCredit for convenience. |

6. Identity Theft

If you notice any unexplained expenses on your credit report, especially for large purchases, or in locations far from where you live, it most likely signifies that you’ve been a victim of identity theft.

Here’s What to Do:

Visit www.identitytheft.gov/ which is a website by the Federal Trade Commission, and report the situation, get a recovery plan, and put it into action.

Additional tip: Make sure to monitor your credit report every 30 days to ensure there’s no more unauthorized activity in your credit report.

7. Suspicious Charges on the Credit Report

Unknown expenses related to unauthorized credit card use may appear on your credit report. So, if you discover credit card activity that was not initiated by you, take action immediately, as this could lead to potential credit score issues.

Here’s What to Do:

- Suspicious credit activity can be a sign of fraud or identity theft. So, you should file a report as soon as you identify this.

- To safeguard against such a situation, it’s best not to share the credit card details with others.

- Make sure that your credit card is not saved on multiple shared devices.

- Regularly check your credit report.

8. Applying for Loans Back to Back

If you apply for new credit lines one after another, such as for a car loan, mortgage, or any other reason, it will require a hard credit inquiry. Generally, with each hard inquiry, you can lose 5-10 points. However, back-to-back hard inquiries within a short window impact your credit scores more.

Solution:

Make sure to keep a reasonable distance, i.e., 6-12 months, before applying for a new loan. In addition, you may want to work on displaying responsible credit behavior by making timely payments to strengthen your credit in the meantime.

9. Unfair Charge-Off

A charge-off appears on your credit report when you have an unfulfilled financial commitment that the lender has written off as a loss and closed the account. It can cause your credit score to drop by 50 to 150 points.

Getting a Charge-Off Removed From Your Credit Report:

- If it’s an illegitimate charge-off you can contest it and get it removed. Simply file a dispute with the credit bureau or the creditor.

- You can also take legal action against an unfair charge-off.

- Getting a legit charge-off removed can be way more challenging. But you can try to negotiate a “pay-for-delete” agreement with the creditor if possible.

10. Unpaid Medical Debt

Unpaid medical bills won’t affect credit scores as long as the debt is not handed over to a collection agency. But, if your debt is over $500 and stays unpaid for 12 months in collections, it can hurt your scores.

Here’s What You Should Do:

- It is recommended to pay off the debt within 3 months before it goes to collections to prevent your credit scores from getting hurt.

- If you cannot pay the bill at once, negotiate a monthly plan with the healthcare provider that fits your budget.

11. Foreclosure

Having a foreclosure on your credit report not only impacts your scores but also restricts your credit-obtaining abilities. A foreclosure can cause your scores to drop a whopping 100 to 160 points in one go. And, it can take you 3 to 7 years to recover your credit scores.

12. Bankruptcy

It's the most influential factor that can significantly impact your credit scores. Hence, on average, people can lose anywhere from 130–150 points to 200–240 points. Additionally, a bankruptcy can stay on your credit report for up to 10 years.

| How Long Does It Take to Rebuild Credit After Bankruptcy? It may generally take 12-18 months to recover your credit scores if you take the right steps. |

13. Repossession

Repossession is an event that affects the payment history, which is a crucial factor when evaluating credit scores. It can lower your scores by 50–150 points or more. How much the score drops depends on how much was paid off before the repossession.

Here’s What to Do:

- If the repossession is unfair, you can raise a dispute, and the lender will be required to prove whether the repossession is accurate and fair. However, the window for raising a dispute is short, so it’s crucial to act quickly.

- But, if the repossession is due to legitimate reasons, you should try to negotiate a different pay-off approach with the lender directly.

Revive Your Credit: Expert Assistance Awaits!

Get Expert HelpHow to Know Why Your Credit Score Dropped?

The easiest way to identify the reason your credit score dropped is by using the CoolCredit app. It’s an AI credit repair tool that helps you analyze the credit report in an instant. CoolCredit comes with a range of functionalities, including AI-powered credit report analysis, ready-made dispute letter templates, and expert assistance on-demand.

How Does CoolCredit Help?

- The AI will highlight the list of negative items that are lowering your credit score.

- When you click on a negative item, it provides step-by-step instructions related to how to fix each issue.

- You can click on the “Raise a Dispute” option to instantly create a dispute letter using its ready-to-use templates.

- Mail the dispute letter to the respective credit bureau, or submit it through CoolCredit.

Hence, it’s way more convenient than manually checking your credit report to find the problem.

Conclusion

A declining credit score is a grave concern that should not be ignored. It's crucial to analyze your credit report and find the cause to fix it as soon as possible before it declines your credit standing and starts affecting other aspects of your life.

So, if you are worried about your credit score dropping for no reason, sign up for CoolCredit and start taking steps in the right direction towards credit prosperity.

FAQs

Q: Why Did My Credit Score Drop?

A: Credit scores can decrease due to various reasons, such as missed payments, late payments, hard inquiries, high credit utilization, or even fraud, identity theft, or mistakes in the credit report.

Q: How Much Does a Derogatory Mark Affect Your Credit?

A: It depends on the type of derogatory mark. For instance, late payment can cause your scores to drop 100–150 points. Defaulting on credit card debt can cause the scores to drop 100–200 points.

Q: How Much Does One Late Payment Affect Your Credit Scores?

A: A late payment that is 30 days past due can lower your scores by 100 points.

Q: Does Your Credit Score Drop When You Check It Frequently?

A: No. It is considered a ‘soft inquiry’ as you haven’t applied for any new credit line. So, it wouldn’t impact your scores to check them by yourself. Only hard inquiries requested by third-party lenders impact scores.

Q: How Do I Identify Why My Credit Score Dropped by 30 Points?

A: The easiest way to find out why your scores dropped is to analyze your report with the AI-assisted CoolCredit app. It can highlight the problem items to make it easier to identify the cause. You may also consult with a professional credit expert if needed.

Q: Why Is My Experian Score So Much Lower?

A: Every credit bureau uses a different credit scoring model, i.e., FICO 8, VantageScore 3.0, etc. Therefore, your credit score is usually not the same across different bureaus.

Q: What to Do if Your Credit Score Drops?

A: In that case, depending on the cause of the drop, you can take the relevant actions. For instance, if the score drops due to late payments, make sure to pay future installments on time without any delays. If it is because of an error in the report, then raise a dispute using a dispute letter template.

If you need assistance with DIY credit repair, simply download the CoolCredit app and let the AI assistant help you analyze and improve your scores.