Pay For Delete Letter: Everything You Need to Know

Pay for delete letters entails contacting debt collectors and asking them to eliminate adverse entries from your credit reports as part of an agreement to settle your outstanding debts.

Recent surveys have revealed that a substantial number of Americans (14%) have missed payments, leading to negative items like unpaid bills on their credit reports. These derogatory items can significantly lower credit scores and affect creditworthiness. In such cases, a pay-for-delete letter can be a viable option to eliminate these negative items and improve credit scores. While you can wait for delinquencies to naturally expire in seven years, paying to delete may be the best solution for those who don't want to wait.

Let us get a comprehensive understanding of a pay for delete letter and how it works.

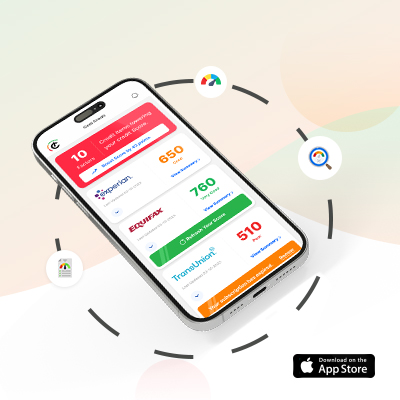

Transform Your Credit Score With AI Expertise

Elevate Your Financial Standing Today

What Is a Pay for Delete Letter?

Pay for delete is a negotiation tool utilized to remove negative information from a credit report. It also involves talking to a collection agency and asking them to remove a collection account from your credit report. When you send a letter or call to ask them to erase the debt you didn't pay, it's called a Pay-for-Delete letter.

Usually, a collection account sticks around on your credit report for about seven years, sometimes even longer. With a Pay-for-Delete letter, the aim is to convince the collection agency to erase the account from your credit report before it naturally falls off, according to the Fair Credit Reporting Act (FCRA).

Even if you use a letter of deletion from the creditor, its impact on your credit score will vary based on your overall profile. It is worth noting that, credit bureaus dissuade pay-for-delete because they rely on accurate reporting from debt collectors. Removing a legitimate collection account violates their agreement. That's why it's tough to convince collectors to agree. Though a pay-for-delete letter can help your credit score, it's not the greatest option and has some downsides.

How Does a Pay for Delete Letter Work

Start by contacting a collection agency either by phone or by writing them a letter. During your call, you can discuss this with the collection agency and request that they ask the credit bureaus to remove the negative item from your credit report. As a result, you'll need to either pay off the debt in full or reach a settlement with the agency.

However, if the debt collector agrees to your request, ask them to put it in writing. This keeps you safe if they forget to remove the account after you pay. The Fair Debt Collection Practices Act (FDCPA) stops debt collectors from making false claims, so you may need help getting the debt collection agency to agree.

Tips to Consider Before Writing a Pay for Delete Letter

✅ Make sure you're sending it to the correct debt collector. Also, you can confirm your debt by sending a debt validation letter. If the debt collector can't prove that you owe the debt, they can't make you pay. However, if they do provide evidence, they can again start debt collection activity.

✅ Only send the Pay for Delete letter if you can pay the full amount as soon as they agree to your offer. You might only have a limited amount of time to make the payment before they cancel the offer and start trying to collect the debt again.

✅ Mail the letter and your follow-up payment using certified mail. Through this, you'll have evidence that the letter and your payment were sent and received.

✅ Remember to save a copy of the letter for yourself. Moreover, keep track of things in case you want to use the same approach with another collector later on.

Here's What You Need to Include in Your Pay for Delete Letter

Ensure that the letter is written professionally and contains clear and precise details. Generally, your letter should contain the following:

- Your name and address

- The date

- Name and address of the creditor or collection agency

- Your account number

- Preferred payment method upon agreement

- Written and signed confirmation

- The due date for the creditor to reply

- Your signature

Stay Ahead With Smarter Credit Monitoring.

Protect Your Financial Future

What Happens If a Pay for Delete Letter Is Rejected?

Regrettably, there's no assurance that the Pay for Delete letter will be agreed upon. It's just a request and may or may not be accepted.

Despite this, if the creditor doesn't accept your proposal, you have these options:

- Having no balance at all is better than having an outstanding balance. In simple terms, indeed, it's a good idea to pay the full amount.

- You can wait until the account is handed over to another collector. Later, you can try making a new offer to Pay for Delete or settlement.

- Also, you can make an offer to settle and have it agreed upon by the creditor or collector. By doing so, you can resolve the account by paying less than the total amount owed.

- Lastly, you can choose to pay nothing and wait until the time limit for credit reporting expires. Eventually, the item will be removed from your credit report. Nevertheless, this is not the most recommended advice, as there's a chance you could be taken to court over the debt.

Alternatives to Pay for Delete

- Request a debt validation letter from the collection agency. Fortunately, if they are unable to provide this letter, you won't have to pay anything.

- Dispute the errors to all three credit bureaus, i.e., Equifax, TransUnion, and Experian. You can do this online or by sending a certified letter.

- Consider paying the bill instead of writing a Pay for Delete letter. It could make things simpler, especially if this is your only collection account.

Is Writing a Pay for Delete Letter Worth it?

Whether writing a Pay for Delete letter is worth it depends on your specific situation and goals. Removing the negative item can significantly improve your credit situation and if you're able to negotiate a favorable agreement, it is worth pursuing. However, weigh the potential benefits compared to the effort and any associated costs involved in the negotiation process. Contrarily, if you're unsure, you may seek assistance from a credit counseling agency or a financial advisor.

Conclusion

Having a better credit score means you can get loans with better terms and lower interest rates. Plus, it can lead to lower insurance rates, access to nicer credit cards, and more choices when renting homes or apartments.

What happens next after writing a Pay for Delete letter depends on your credit situation. If it goes well, it can make your credit score better. Nevertheless, you can choose other ways to fix your credit score. You can use CoolCredit, an AI credit repair app, which can help you out.

FAQs

Q: Does Pay for Delete Increase Credit Score?

A: Negotiating to remove a collection account from your credit report might not necessarily boost your credit score. However, arranging a Pay for Delete agreement to eliminate a collection account from your credit reports shouldn't harm your credit either.

Q: How Much Should I Offer for a Pay to Delete Letter?

A: Commonly, the debtor proposes to pay between 40% to 80% of what they owe. If the creditor agrees to this offer and the payment is made successfully, they'll take away the remaining debt from the credit reports.

Q: Is Pay for Delete Illegal?

A: While the FCRA doesn't explicitly forbid Pay for Delete, it's not the recommended approach for addressing incomplete or inaccurate entries on your credit report.

Q: How Common are Pay for Delete Letters?

A: Such agreements are rare. Additionally, persuading a debt collection agency to agree to a Pay for Delete request may not always work, but it won't harm your credit score either.

Q: Which Collection Agency Owns My Debt?

A: You can find out which collection agency you owe money to in two ways: First, contact the original debtor and ask who they transferred the debt to, or check your credit report.