How Many Hard Inquiries Is Too Many and How to Remove Them?

When you apply for a line of credit, be it a credit card, loan, or mortgage, you trigger what is known as a "hard inquiry" or a "hard pull." This process involves lenders scrutinizing your credit report. They do this to assess your creditworthiness and determine the risk associated with lending money.

Your credit report serves as a financial dossier that showcases your credit history, payment habits, and overall fiscal responsibility. It's the document that potential lenders use to make informed decisions about whether to approve or deny your credit application.

Now, here's the catch! Multiple credit inquiries within 30 days can significantly harm your credit score.

In this blog post, we help you decode the complex world of credit, demystify hard inquiries, and equip you with the knowledge to safeguard your credit score.

Credit Repair Simplified -

CoolCredit AI, Your Path to Financial Success!

Understanding Credit Inquiries

A credit inquiry is a request by a lender to look at your credit file. There are two types of inquiries.

Let's say you want a loan or a credit card; the lender will want to see how good you've been with borrowing money in the past. You can consider this process a lens through which lenders gauge your financial reliability.

For instance, recurring missed bill payments might signal to lenders that there's a likelihood of future payment lapses. And that might mean they say "no" to your loan or charge you more interest. For this, the lender must initiate an account review inquiry to get the required information. It is known as a hard inquiry and will appear on your credit report.

In contrast, soft inquiry, also known as a soft pull, happens when you or someone else checks your credit report for non-credit-related purposes. Unlike hard inquiries, soft inquiries have no impact on your credit score. They remain visible only to you and leave no trace for lenders to see on your credit report.

Here are some instances where you can trigger a hard and a soft inquiry:

| HARD INQUIRY | SOFT INQUIRY |

| Submitting applications for credit cards | Personal credit checks initiated by the individual for self-assessment |

| Applying for loans such as mortgages, auto loans, student loans, or personal loans | Credit inquiries associated with insurance applications |

| Seeking approval for apartment rentals, where credit checks are typically involved | Employment applications that include a credit check as part of the hiring process. |

| Applying for lines of credit from financial institutions | Receiving pre-approved credit offers from financial institutions |

| Collection agency skip tracing to locate individuals for debt collection | Routine account reviews conducted by current creditors |

How Much Do Hard Inquiries Affect Your Credit Score?

When it comes to your credit score, hard inquiries have a relatively modest impact compared to other factors. For instance, your payment history carries substantial weight, accounting for approximately 35% of your overall credit score. On the other hand, credit inquiries contribute only 10%.

Once a hard inquiry is made, it remains documented on your credit report for two years. However, credit bureaus only consider inquiries made within the last 12 months when calculating your credit score.

For example, when you apply for a credit card or a loan, there may be an initial, slight reduction in your credit score. Nevertheless, as time progresses and you demonstrate responsible credit behavior, this impact gradually diminishes. It thus allows you to recover from the dip relatively swiftly.

While account review inquiries are an inevitable aspect of your credit history, it's imperative to approach them with prudence.

Ideally, these inquiries should be limited and strategically timed. It is especially true when you're engaged in the process of comparing rates on various financial products. You can minimize the impact of hard inquiries and maintain a healthy credit score over time by adopting a thoughtful approach to credit applications.

| Did you know that credit bureaus like Equifax, TransUnion, and Experian must provide you with one free credit report each year? Analyze your reports with CoolCredit! |

How Many Hard Inquiries Are Bad?

Determining how many hard inquiries are "too many" can be challenging because it varies from person to person.

Generally, having one or two hard inquiries within a short time frame may not impact your credit score significantly. However, as the number increases, so does the potential negative effect.

| According to FICO, “Statistically, people with six inquiries or more on their credit reports are more likely to declare bankruptcy than people with no inquiries on their reports.” |

Lenders may view multiple credit inquiries within 30 days as a sign that you are actively seeking credit. It could be interpreted as a financial risk. It's essential to strike a balance between managing your credit needs and avoiding unnecessary applications.

As a rule of thumb, try to space out your credit applications and avoid making numerous inquiries within a short time frame. It can help mitigate the impact on your credit score and present a more stable financial profile to potential lenders.

Have You Tried Rate Shopping?

Rate shopping is a practice that allows consumers to compare interest rates and terms from different lenders before committing to a loan or credit agreement. Recognizing that consumers may want to explore their options, credit scoring models typically consider multiple account review inquiries for the same type of credit within a specific time frame as a single inquiry.

For instance, when shopping for a mortgage or an auto loan, credit scoring models often treat all inquiries made within a time frame as a single inquiry. It recognizes that consumers may be trying to find the best deal and prevents multiple inquiries from unduly impacting their credit scores. Think of it as a grace period for smart shopping!

It's crucial to note that this rate shopping window may vary depending on the credit scoring model used. So, it's advisable to check with the specific credit bureau or lender to understand their policies. For FICO, this window is 45 days; for VantageScore, it is 14 days. By consolidating your loan or credit applications within this timeframe, you can minimize the potential negative impact on your credit score.

| It pays to check out a few options! According to a study by Freddie Mac, borrowers who obtain just an additional mortgage rate quote can expect to save an average of $1,500 over their loan term. But here's the kicker – if you shop around a bit more and get five different quotes, you might end up saving $3,000. |

How to Remove Hard Inquiries?

You can't expedite the removal of legitimate hard inquiries before the two-year mark.

Having said that, errors can still creep into your credit report. For instance, reporting errors, identity theft, or two hard inquiries from the same company.

However, there are steps you can take to ensure the accuracy of your credit report and address any errors or unauthorized inquiries.

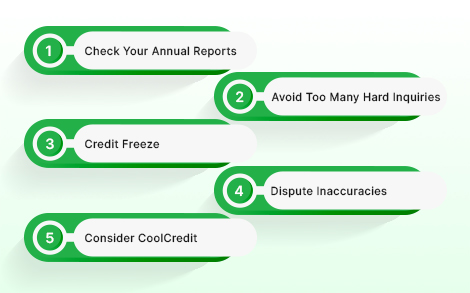

✅ Check Your Annual Reports

Regularly review your credit reports from all three major credit bureaus — Equifax, Experian, and TransUnion. Scrutinize the inquiries section to ensure that all listed inquiries are legitimate.

✅ Avoid Too Many Hard Inquiries

As stated above, hard inquiries have a temporary impact on your credit score. It is advisable to wait at least six months between new credit applications to minimize their effect. Lenders often view multiple recent inquiries as a sign of financial instability, so spacing out your applications can help maintain a positive credit profile.

✅ Credit Freeze

A credit freeze restricts access to your credit report, making it more difficult for unauthorized parties to initiate inquiries. You can lift the freeze temporarily when you need to apply for new credit.

✅ Dispute Inaccuracies

If you identify any unauthorized or inaccurate hard inquiries on your credit report, initiate a dispute with the credit bureau. Provide clear documentation supporting your claim, such as evidence that you did not initiate the inquiry or that it resulted from an error. The credit bureau will investigate the dispute and make corrections if necessary.

✅ Consider CoolCredit

Explore credit monitoring services like CoolCredit - ai credit repair app that utilize artificial intelligence to identify opportunities for improvement in your credit report. CoolCredit's AI can help you generate dispute letters to the credit bureaus and guide you through the dispute process. This service provides a convenient and proactive way to manage and improve your credit health.

Conclusion

Account review inquiries play a role in lenders' assessments of your creditworthiness. Although hard inquiries have a relatively modest impact on your credit score, it's crucial to approach them with prudence and strategic timing.

As the impact varies from person to person, it will be hard to generalize how many hard inquiries are too many for you. In this case, knowledge becomes your strongest ally.

Stay informed, adopt responsible credit habits, and take proactive steps to address any discrepancies. It helps safeguard your credit health and pave the way for a more secure financial future. Your credit score is a valuable asset, and managing it wisely opens doors to favorable financial opportunities.