A Beginner’s Guide on How to Dispute Credit Report Inaccuracies

Ever met someone who likes inaccurate information reflected on their credit reports? Probably not, and that’s why you need to dispute credit report inaccuracies to eliminate mistakes and outdated information from your credit history.

A survey from the Society for Human Resource Management found that 60% of employers use credit reports to screen job applicants for some positions. |

Inaccurate credit information can hinder job opportunities, loans, and housing prospects. Hence, to rectify errors and safeguard your credit score, it is essential to dispute credit reports.

This blog discusses the steps to dispute errors on your credit report and tips for a success-worthy dispute letter.

What is a credit dispute letter?

Understanding what a credit dispute letter or a 609 letter is, is important. It is a written communication to a credit bureau (Experian, Equifax, and TransUnion). This method ensures your credit report accurately reflects your financial details.

Errors may arise in one report or across all three credit bureaus. Therefore, regularly checking your credit report is crucial for accuracy. It helps you catch and correct any errors that may impact your creditworthiness.

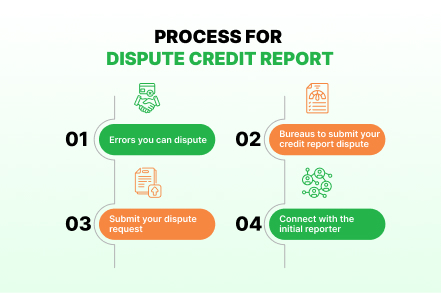

Process for dispute credit report

When disputing a credit report, ensure you submit all required documents. You need to provide thorough details in your disputes to facilitate credit bureaus' investigation.

1. Errors you can dispute

- Information of errors that can be disputed: Consider, for instance, your credit report indicating a late payment, despite your timely payment. This information can be disputed.

- Error in balance information: After recently paying off a loan or another balance, it's vital to check that the correct information is reflected. Otherwise, you can report this error.

- Information about ex-spouse credit card: Removing this information can help you avoid unnecessary expenses made by your ex-spouse.

- Wrong account numbers: If the details of your closed accounts still show on your credit report, then you can dispute them.

2. Bureaus to submit your credit report dispute

There are three credit bureaus in the U.S., i.e. Equifax, Experian, and TransUnion. Each bureau has a different credit score evaluation process. You need to dispute the credit report with the bureau that has shown inaccurate information in your report.

3. Submit your dispute request

Once you know where to dispute your credit report, mention this information:

- Full name

- Residential address

- Account information

- Details of dispute

- Highlighted sections of the credit report showing disputed information

Be very specific when you dispute credit report inaccuracies. Explaining why you believe there's a mistake is equally important. The credit bureau can investigate more easily with more information.

4. Connect with the initial reporter

You can submit accurate credit reports to businesses that report your errors. Once done, the business will conduct its investigation. After that, you can notify credit bureaus to correct the errors.

Reshape Your Financial Canvas:

Elevate Your Credit, with Credit Score Revival

What things should be ensured that the credit dispute letter doesn't get rejected?

To begin the credit dispute process, download an accessible form. Also, include your personal and dispute-related information in it.

✔ Personal details

- Name in full

- Birth date

- Present residence

- Driver's license ID

- Social Security number (if desired)

✔ Discrepancy details

- Account number for the disputed tradeline

- Corresponding account number (matching personal information).

- Dates and nature of the contested data.

- A thorough explanation of the inaccuracies on your credit report.

✔ Enclosures

You need to send a copy of your original documents to the credit bureaus. The enclosures comprise the inaccuracies in your credit report.

Where to mail your credit report dispute letters

◾ Equifax

You can dispute errors on Equifax through letter, phone, or online. If you choose to send your dispute by mail, you can use this address:

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374-0256

For phone disputes, you can call 1-888-378-4329.

◾ Experian

You can dispute errors on Experian through letter, phone, or online. If you prefer mailing your dispute, send it to this address:

Experian

P.O. Box 4500

Allen, TX 75013

For phone disputes, you can call 1-888-397-3742.

◾ TransUnion

You can dispute errors on TransUnion through letter, phone, or online. If you prefer mailing your disputes, you can use this address:

TransUnion LLC Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

The phone number to call for disputes is 1-800-916-8800.

What happens after you submit your dispute?

When you've completed the required steps to dispute credit report errors, the credit bureau informs the providing business within five business days. Simultaneously, it shares your dispute details with the information furnisher.

After sending a credit dispute letter, you can expect results within 30-45 days. The furnisher will review and investigate the dispute, reporting the results to the credit bureau. If changes are made, the furnisher must notify all three credit bureaus.

If there's no mistake, the disputed details will remain on your credit reports. Nonetheless, credit bureaus must provide written details of dispute outcomes.

Possible results of credit report dispute

The result may vary depending on the nature of the dispute and the information credit bureaus find.

Disputes over personal details may lead to the addition, updation, or deletion of information. Similarly, information regarding payment history and balances can be modified or removed.

If you're unsatisfied with the result, consider:

- Reaching out to the company to verify information for any errors in their records.

- Initiating a new dispute with additional evidence for a stronger appeal.

- Include a credit report statement to communicate disagreement with particular details.

Conclusion

Your credit report may carry inaccurate information that can negatively impact your score and overall credit profile. Knowing how to dispute credit report errors could help remove such items and improve your score. It eventually increases your chances of securing loans, lines of credit, and more at favorable rates.

So why wait? Simplify your credit dispute process with an credit repair app like CoolCredit. It guides you through the credit report dispute process and gives you control over everything. The user-friendly app additionally reviews your report and identifies the areas of improvement. It facilitates error reporting using ready-to-use dispute letter templates to save time and effort.

Additionally, it works to improve and repair your credit score while keeping you updated on every change, every day.

Don’t keep thinking. Take your financial future in your hands today!

FAQ's

Q: How to fix credit report mistakes?

A: Check your credit report and identify the credit bureau from where the report was generated. If you find errors, download the dispute form, fill it out, and send it to the credit bureau with supporting documents. They have 30-45 days to verify and report results within five days. Get a copy of the investigation when it's done.

Q: How to remove addresses from a credit report

A: To remove old addresses, contact the credit agency to identify the reporting creditor. Send a letter to the creditor, confirm receipt, and prove your disassociation with the old address for a swift update. You can also fill out a credit dispute letter.

Q: Can disputing hurt your credit?

A: Disputing something on your credit report won't directly affect your credit score. However, if the information you dispute gets updated, your score might change. Whether it goes up, down, or stays the same. It depends on what you're disputing and its possible results.

Q: How do I dispute all three credit bureaus?

A: If you find errors on your credit report, let the credit bureaus know. You'll need to contact each bureau with the mistake. Write down why you think it's wrong, use their dispute form if they have one, include copies of documents supporting your case, and keep track of everything you send.