Can You Get An Apartment With Bad Credit?

Searching for an apartment often raises a question for people with unfavorable credit: 'Can you get an apartment with bad credit' or 'Are there any no credit check apartment rental options nearby?' Though this query seems simple, it needs a lot of brainwork to navigate the credit world and rental applications.

But Why Do Credit Scores Matter for Apartment Rentals?

Ready to unlock better credit?

Start repairing today!

If you’re wondering why, here’s the fact.

Many landlords consider credit scores before offering a rental home to potential tenants. So if you need an apartment rental with bad credit, your chances of securing it automatically become low. However, there are pathways and strategies that can lead to successful apartment hunting, even with a less-than-perfect credit history.

A low score might seem like a roadblock, but some pathways and strategies can lead to successful apartment hunting, even with a less-than-perfect credit history.

How Credit Score Impact Rental Apartment Approval?

| Did you know? A Credit Karma survey revealed that over 40% of landlords consider credit scores a factor in tenant selection. |

A high credit score typically signifies financial responsibility, increasing the likelihood of timely rent payments. On the other hand, a lower score might flag potential risks for landlords, affecting your rental prospects.

So, if you’re struggling to get an apartment rental due to a low credit score, this blog is particularly relevant for you. Let’s dive into what credit score is needed to rent an apartment, how you can rent an apartment with bad credit, and tips to improve your chances.

Credit Score Requirements for Renting

While landlords often seek a credit score of 620 or above for renting out apartments, this number is not absolute. Market demands can influence this figure; for instance, more competitive areas might require scores above 700, while others may accommodate scores in the lower 500s.

Typical Credit Score Ranges for Apartment Renting:

| Credit Score | Rental Likelihood |

| 300-549 | Low |

| 550-619 | Moderate |

| 620-699 | High |

| 700+ | Very High |

Renting an Apartment with a Bad Credit Score

Securing an apartment with a poor credit score is undoubtedly challenging, but it's not impossible. It often involves exploring additional measures, such as seeking no credit check apartments near your desired location, negotiating higher deposits, or having candid discussions with potential landlords about your financial situation.

If you’re planning to rent an apartment soon, consider using the time to analyze and improve your credit profile. This proactive approach can reduce potential embarrassment and denials later.

Finding No Credit Check Apartments

No credit check apartments offer a valuable opportunity for those focusing on rebuilding credit. These rentals tend to prioritize rental history and current income over credit scores, thereby offering a pathway for financial redemption. Such listings can be found through dedicated online searches or local housing forums.

Landlords’ Perspective on Credit Reports

Landlords don’t just consider credit scores; they also scrutinize entire credit reports. They look for patterns of financial behavior, such as consistent late payments or significant debt, which might indicate a higher risk.

Demonstrating improvements in financial habits, even with a lower score, can positively influence their decision-making process.

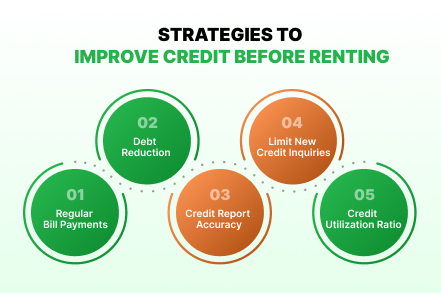

Strategies to Improve Credit Before Renting

Enhancing your credit score can be a decisive factor in the rental market. Begin by ensuring your credit report is accurate and addressing any errors without delay. Timely bill payments, reducing overall debt, and limiting new credit inquiries can collectively improve your credit score over time.

Consider the following steps for assured improvement:

1. Regular Bill Payments

Ensure all your bills are paid on time. Late payments can significantly impact your credit score and further bring down your chances of bagging an apartment.

2. Debt Reduction

No landlord wants to offer their apartment to an individual with the lowest credit and hefty debt. So work on paying down existing debts, especially high-interest credit card debts.

3. Credit Report Accuracy

Regularly check your credit report for errors. Dispute any inaccuracies you find immediately to rectify the items and improve your credit score.

4. Limit New Credit Inquiries

Every new credit application can lower your score. Apply for new credit sparingly.

5. Credit Utilization Ratio

Aim to keep your credit utilization below 30%. It shows you're not overly reliant on credit.

| Did You Know? According to Experian, reducing your credit card balances can increase your score within a few months. |

Find A Guarantor For Apartment

A guarantor can significantly increase your chances of securing an apartment, especially if you have bad credit. When choosing a guarantor:

- Consider Close Relatives or Trusted Friends: Typically, guarantors are family members or close friends who understand your situation and are willing to help.

Example: Consider the story of John, who successfully rented an apartment with the help of his sister as a guarantor. Despite his low credit score, his sister’s excellent credit and willingness to co-sign helped him secure his lease.

- Ensure They Have a Strong Credit History: Your guarantor should have a good to excellent credit score to be seen as credible by landlords.

- Discuss Financial Implications: Your guarantor needs to understand they are responsible for the rent if you're unable to pay.

- Legal Agreements: Consider having a legal agreement outlining the terms of the guarantor arrangement to protect both parties.

Conclusion

Bad credit can complicate the process of renting an apartment, but it's not impossible to achieve. If you understand landlords' expectations and follow the suggested strategies to improve your credit score, you can do it. For the rest, no credit check apartments are there to pave your way to a successful rental experience.

Other than manual credit improvement, DIY-assisted credit repair app like CoolCredit can take the burden off your shoulders while giving you control over your credit. It offers insights into credit score improvement and dispute resolution. Even better, you can choose from ready-to-use dispute letters to send to the bureaus. For any added help, they have specialists to guide you through the dispute process and increase your chances of winning.

All in all, manual, AI, or expert assisted credit improvement- by addressing your credit challenges head-on, you open doors to apartment rental opportunities and a stronger financial future.

So don’t watch your dream apartment rent out while you struggle with embarrassing refusals. Take charge of your credit today.

FAQs

Q: Can you rent an apartment with a credit score of 500?

A: It's tough but doable, especially with options like no credit check apartments or having a guarantor.

Q: How can I find apartments without credit checks?

A: Search online for listings or ask local property management companies about “no credit check” apartment options in your desired location.

Q: What's considered a low credit score for apartment rentals?

A: Scores below 620 are often seen as challenging but various factors like location and landlord discretion play a role.

Q: Does paying rent on time improve my credit score?

A: Yes, consistent and timely rent payments can positively influence your credit score.

Q: What alternatives exist if I can’t find a co-signer?

A: Offering a larger security deposit or seeking landlords who prioritize rental history over credit scores can be possible alternatives.