How To Get An Apartment With Bad Credit?

Landlords want reliable tenants. That’s why a good credit score can strengthen your chances. But if your scores are low, you must provide alternative proof. Here’s what you need: strong income proof, willingness to pay a substantial deposit, or a co-signer with good scores, and some extra effort.

So if your credit scores are unfavorable, read on to find out, how to get an apartment with bad credit. Also, learn what you can do to improve your credit scores.

Experience Hassle-Free Credit Repair with AI Precision

Get StartedWhat Credit Score Do You Need To Rent An Apartment?

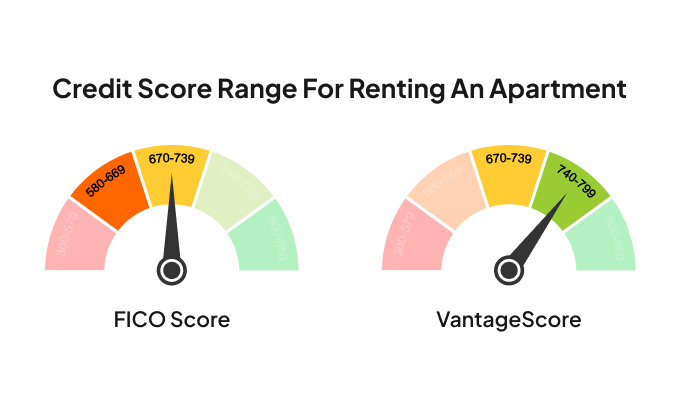

The most suitable credit score for renting an apartment is:

▪ FICO Score: 630–739

▪ VantageScore: 661–780

However, if your score is in the lower ranges:

▪ FICO Score: 300–579

▪ VantageScore: 300–660

It can be difficult to get approved, and you may need to take some extra measures when submitting your rental application

How Credit Impacts Getting Approved For An Apartment

A credit check is an important part of the rental application process. This is an essential step, as the landlords want to ensure your reliability and minimize the financial risk. So, they usually assume that if the renter has a high credit score, they are more trustworthy and highly likely to pay the bills on time. Though it’s not the only factor they assess your application on, it’s an important one. Therefore, high or low credit scores significantly impact your chances of getting an apartment.

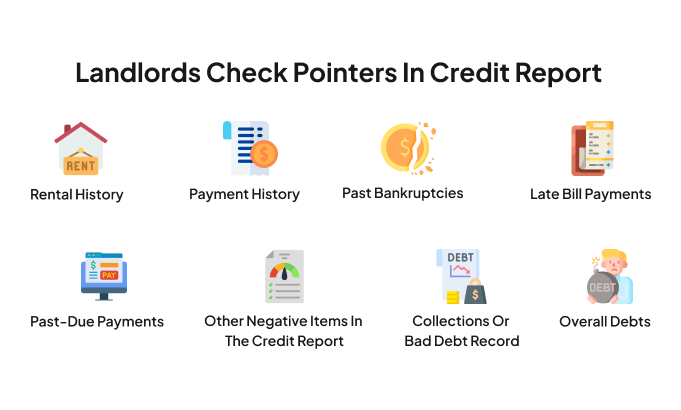

What Do Landlords Check On A Credit Report?

Landlords usually evaluate rental applications based on the following aspects:

So, if you have one or more of the above negative items on your credit report, you might be thinking, “Can I get an apartment with bad credit?”. Well, this requires an effective strategy.

How To Get An Apartment With Bad Credit?

Renting with bad credit requires some extra effort, so we have compiled a few ways it's possible:

1. Find A Private Landlord

But Beware of Scams!

A private landlord may consider renting with bad credit, but only if you can back it up financially. Thus, you may have a better chance of renting from an independent landlord. For this, you can look online for listings on Craigslist, Facebook groups, or recommendations from a friend.

2. Discuss Credit Check Issue Upfront

Transparency Builds Trust!

It is best to be upfront about your poor credit score and the reasons behind it. Also, let them know what you are doing to improve your credit. This shows you in a trustworthy manner.

3. Look For A Sublet Apartment

Minimal Hassle, Smoother Move!

Another effective way is to find a renter who wants to sublet their apartment. In that case, they will be the original renter on the lease, so your bad credit may not be a problem. The original renter will be responsible until the lease expires. However, you still have to undergo a credit check and provide sufficient financial proof to get approved.

4. Short-Term Lease Apartment

Build Trust Before Signing Long-Term Lease

It may be easier to rent an apartment on a month-to-month or three-month lease basis. This way, you can prove to the landlord that you are a reliable renter by paying the rent on time. If the landlord is satisfied, you can discuss signing a long-term lease or simply renewing the lease every few months.

5. Housing Programs

For Low-Income Individuals

You can also explore the rental housing programs by the United States government. The government and non-profit housing assistance programs may be ideal for low-income individuals, such as:

- Non-Profit Housing Programs: Individuals can also explore the HUD-approved programs and those provided by the Housing Assistance Council (HAC). These are nonprofits that support affordable housing efforts nationwide.

- Housing Choice Voucher (Section 8): For families with low incomes, seniors, and people with disabilities

- Subsidized Rental Housing: To help low-income adults explore local affordable housing options

- Public Housing: U.S. citizens and eligible immigrants may also look for public housing properties for rental.

- Rental Assistance For Specific Groups: These are special rental programs for specific groups, such as veterans and individuals with special needs or disabilities.

6. Browse Apartments In Suburbs

Credit Check Requirements Vary In Different Locations

For instance, looking for an apartment in the main city can be more challenging, especially with bad credit. So, you should consider looking for apartments in the suburbs. Depending on the neighborhood, location, and type of apartment, you may be able to get an apartment without a stringent credit check.

7. Ensure Finances For A Substantial Deposit

Planning Ahead Is The Key!

Renters with bad credit often need to pay a hefty amount as security. So, you should be financially prepared to at least submit an extra month’s rent as a deposit. So it’s best to set aside some money regularly to pay rent upfront and save for future rent.

8. Lease With a Roommate or Co-Signer

Greater Reassurance For Landlords

An easy way to rent an apartment without a credit check is to sign the lease with a co-signer, i.e., a roommate, family member, friend, etc., who has good credit scores. This way, the landlord can rest assured that they can recover the rent even if you miss a payment.

Word of caution: The co-signer will be responsible for paying the rent when you cannot cover it yourself. So, defaulting may not impact your credit score, but it can hurt the credit score of the co-signer. Therefore, discuss the matter wisely before taking this step.

9. Alternative Income Proof & Supporting Documents

Demonstrate Your Financial Stability

When your credit score is poor, it’s crucial to provide adequate income proof and demonstrate financial stability to assure landlords that you can cover the rent. The following are the relevant documents you should submit:

- Pay stubs

- Income-tax returns

- Latest bank statements (to show you have adequate funding)

- Reference letters from the previous landlord

- Letter of recommendation from your employer (preferably the current one) as a professional reference can help strengthen your chances.

- Utility bills (record of timely payments)

10. Work On Improving Your Credit Score

Repair Credit to Enhance Future Prospects

It’s a good strategy to work on rebuilding your credit scores in the meantime while looking for an apartment. For this, you don’t necessarily need to go to a credit repair agency. You can do it yourself by analyzing your credit report and the factors that are affecting your scores poorly.

How To Improve Your Credit Scores Before Getting an Apartment?

Follow the below steps:

◾ Monitor Your Credit Report

The first step is to monitor your credit report and improve your financial habits accordingly. You need to identify the negative items on your credit report to know what next steps to take.

◾ Dispute Errors

If you see any wrong/inaccurate information on your credit report, this can be cause for concern. In this case, you need to take immediate steps and raise a dispute, along with sending the relevant proof.

◾ Pay On Time To Improve Payment History

Timely rent payment is a crucial requirement for landlords. Therefore, it can benefit you to build a good payment history by paying your bills on time, such as credit card bills, and utility bills. This will help rebuild your credit little by little.

◾ Reduce Credit Utilization

A high credit utilization ratio can quickly make your credit score drop. Hence, it's recommended to reduce your credit utilization to below 30% and timely pay credit card bills for better scores.

◾ Try DIY Credit Repair

You can also use a DIY credit repair app like CoolCredit to improve your scores. It helps you improve your credit standing without involving any third-party credit repair agencies.

The AI-powered app fetches your credit report in an instant. It analyzes your report and provides a list of negative items. Additionally, it suggests actionable strategies on how to fix each issue with step-by-step guidance.

Maximize Your Credit Potential with Our Expert Credit Repair App

Try It FreeConclusion

It can be a nightmare when you are apartment hunting with bad credit. The renting options can be limited, especially when you want a no-credit-check apartment or housing. But by taking the right steps, you can get an apartment with bad credit. Planning your finances in advance, accumulating funding, and signing a lease with a co-signer or roommate who has good scores are a few strategies that work. Additionally, you should also work to improve your credit score with CoolCredit—the DIY way to repair your credit with AI assistance.

FAQs

Q: Do All Apartments Check Credit Scores?

A: A credit check is often part of the rental application process. This can make apartment hunting challenging for those with poor credit scores. However, it is possible to find one without the credit check requirement.

Q: How Does Credit Standing Impacts Getting Approved For An Apartment?

A: Good credit indicates satisfactory financial credibility, so the higher your credit score (i.e., 670+), the better your chances of successful approval. A low credit score translates to fewer chances of approval and more chances of your application process getting dragged for too long.

Q: What Do Landlords Look For On Your Credit Report?

A: Landlords may use the credit report to verify your identity and past credit behavior. They look for any payment gaps in your credit history. They also use the credit report to check for public records, such as prior bankruptcy, tax liens, and official judgments (if any).

Q: Can I Get An Apartment With Poor Credit?

A: Yes, you can. Though it may be challenging, strong determination, willingness to pay a larger security deposit, and extra efforts to improve your credit scores can help show the landlord your sincerity. This may make them more willing to evaluate your application.

Q: Can I Get an Apartment With a 500 Credit Score?

A: Yes, you can. Though 500 is considered a poor credit score, you can probably get approved if you can—provide strong income proof, lease with a roommate/co-signer, pay a large deposit, or sign a short-term lease.

Q: How Do I Avoid a Credit Check When Renting?

A: There are a few ways, you can sign the lease with a roommate/co-signer, pay a large deposit upfront for an immediate move-in apartment, or find an apartment rented by a private landlord.

Q: What Is The Lowest Credit Score For Renting An Apartment?

A: There’s no specified minimum limit. However, any rental application with a credit score below 600 is usually rejected. A 670 score is generally considered good for renting or buying an apartment.

Q: Can I Reapply for an Apartment After I Get Denied Due To Bad Credit?

A: Yes, you can. A rental denial usually doesn’t appear on your credit report, so it’s possible. However, the approval chances depend on the reason for denial. If the reason was low credit scores and you have worked to improve them, then you can apply after you reach the ideal FICO range, i.e., 630 and above. However, if the reason is a previous bankruptcy or criminal record then you may not be able to reapply.

Q: Can CoolCredit Really Help Raise My Credit Scores For Free?

A: Yes. It is an AI-assisted app equipped with the following capabilities:

- Credit monitoring

- AI-powered credit report analysis

- DIY tips to deal with the negative items on your credit report

- Step-by-step instructions on raising a dispute (if/as needed)

- Ready-to-use dispute letter templates

- Expert assistance from a credit expert (if/as needed)

Hence, you can start working on improving your scores from today itself for better chances of getting an apartment, even if your credit score may not be excellent right now.