Does Breaking A Lease Hurt Your Credit?

Before renting out a property, the majority of landlords look up the renter's credit score. So, getting the kind of housing you want depends greatly on your credit. But if you decide to leave early, you might wonder, 'Does breaking a lease hurt your credit?'.

Indeed, breaking a lease can impact your chances of renting a house in the future. It may not directly impact your credit scores if you satisfy the terms of the rental contract. However, you may expect the consequences to affect your credit standing in some ways. So, read on to find out how breaking a lease could affect your credit and what you can do about it.

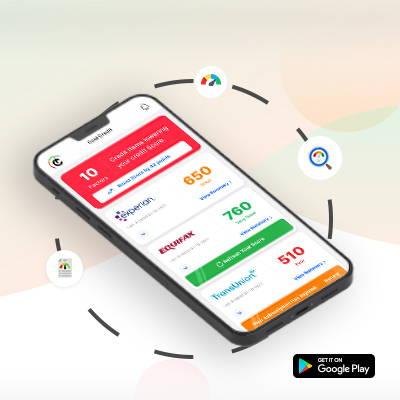

Unlock Your Credit Potential With

AI Credit Repair- CoolCredit

Does Breaking A Lease Hurt Your Credit: Impact Of Breaking A Lease

When you sign a lease you cannot vacate your rented apartment early. But if due to unforeseen circumstances, you must move out earlier than expected, it is critical to understand the impact on your credit.

It may not have a direct effect on your credit standing. However, it can impact your rental history if you breach the conditions of the rental agreement as the unpaid penalties appear on your credit report, lowering your score.

What Happens If a Lease is Broken Early?

The rental contract mentions the consequences in the event of a broken lease. For instance, you may face the following consequences:

- Impact on Future Rental Opportunities

Potential landlords may be wary of renting to you if you have a prior broken lease. Hence, it may lower your chances of getting the desired housing in the future.

- Financial Penalties

You may need to pay a penalty, such as an early termination fee, the rent in lieu of the notice period, or lose your security deposit, as specified in the agreement.

- Dealing With Collections

If the landlord sends you to collections as a bad debt and you do not pay the penalties and breach the terms of the lease, it can appear on your credit report. Thus, it can negatively impact your scores.

- Legal Action

You may also need to face long-term consequences if the landlord decides to take legal action. Hence, you should follow the procedure as needed to ensure a smooth shift.

When Can You Break a Lease Legally?

1. Flexible Lease Termination Terms

If the rental agreement includes provisions for early termination, you can mutually agree to end the lease. While there might be associated costs, this arrangement can be made without negatively impacting your rental history.

2. Lack of Livable Conditions

The property owner has an implied warranty of habitability. It means they must ensure the living conditions meet the specified standard. However, if the property is in poor condition but the landlord fails to resolve the issue, you may be able to move out temporarily or permanently.

3. Special Circumstances

In cases of harassment, stalking, domestic violence, or any life-threatening special conditions, the court can allow tenants to break the lease without any penalty. For this, you need to consult with a legal advisor.

4. Active Military Assignment

Military members assigned to relocate (temporarily or permanently) after signing a lease may be able to terminate it early. It can be applicable in the following cases:

- You were not aware of the assignment ahead of time

- You have been ordered to deploy for at least 90 days (or longer)

- If you are being permanently deployed to another location

Except for these, in any other instance, you must adhere to a specified procedure in the event of early rental lease termination.

How To Break Lease Without Hurting Your Credit Score?

If you have to breach the rental contract but want to protect your credit, here are the steps to follow:

✅ Give Proper Notice and Negotiate Terms

To avoid negative consequences, inform your landlord of your plans to move as soon as possible. By doing so, you might be able to negotiate the terms (i.e., notice period, the penalty, and associated costs) if you move out immediately.

✅ Help Find a New Tenant or Sublet

If it is feasible, you can help look for a new tenant who would be willing to assume your lease for the rest of the period or sign a new one.

✅ Get Legal Help

It's a good idea to discuss your legal options in special circumstances. For instance, if you are a victim of domestic violence or the living conditions are unsafe due to any other reasons, you may have the legal grounds to move out.

✅ Keep a Proper Record

Rent payments usually do not appear on your credit report. But when you terminate the lease early, the failure to pay the penalties can show up on your report. So, it's crucial to monitor your credit report.

Additionally, you should keep proper records to ensure you have the evidence if you need to raise a dispute. For this, you can use tools like the AI credit repair app- CoolCredit.

How Does CoolCredit Help?

The CoolCredit app is an excellent tool to monitor your credit score. It analyzes the negative items on your credit report and provides AI-assisted insights to resolve them. It has a range of tools to help you improve your credit rating. Its ready-to-use dispute letter templates can help you quickly file for a correction.

Conclusion

Breaking a lease early can impact your rental history and result in penalties. As a result, it is critical to monitor your credit. And, you can do this by using platforms like CoolCredit to instantly access your credit report from Equifax, TransUnion, and Experian.

If you notice any negative impact, it can help you raise a dispute with evidence-based, ready-to-use letter templates. Simply download the CoolCredit app for free and experience the benefits firsthand.

FAQs

Q: Does a Lease Termination Go on Your Record?

A: It won’t appear on your rental records or credit report, as long as you follow the correct procedure. However, when renters fail to pay the termination fee or other costs as a penalty for breaking the contract, then the property owner can send the account to collections for recovery. It generally appears in your credit report and becomes part of your rental data.

Q: How Long Does a Broken Lease Remain on Your Record?

A: It stays on your record for up to seven years if it is sent to the collections. Even when you pay off the outstanding rent or penalty charges, it can appear on your credit report. However, it may not weigh heavily on your report. Additionally, it is recommended to work on improving your credit score with the AI-assisted CoolCredit app.

Q: How Does Breaking a Lease Affect Your Credit?

A: Renters who breach a lease must pay the termination fee, unpaid rent for previous months or the remaining lease period, any damages, property cleaning charges, and so on. If left unpaid, the property owner may use a rent reporting service or hire a collection agency, which may report it to credit bureaus. As a result, you may notice a drop in your credit score. In fact, your credit score can drop as much as 110 points as a result.

Q: Does Being Late on Rent Affect Rental History?

A: If the late payments are reported to the credit bureau, it can affect your credit and rental history. As every property owner usually runs a credit check before renting, it can appear on your credit report and impact your chances of renting a property in the future.

Q: What Can You Do to Maintain Your Credit?

A: If you are breaking your lease, your credit score can be at risk. Thus, it’s important to check your credit report and monitor it regularly to check for any negative impact. If your score goes down, it's crucial to take action immediately to maintain your credit standing.

For this, using the CoolCredit app can come in handy. You can use CoolCredit to access your credit report and monitor your scores. Additionally, this DIY credit repair tool helps you easily identify the problem items as well as gives recommendations on how to remedy them.