670 Credit Score: What It Means and How to Improve It

Your credit score plays a major role in your financial life. A 670 credit score might leave you wondering if you’re on solid ground or if you have work to do. Let’s break down what a 670 credit score means, how it affects your financial opportunities, and what you can do to improve your credit score.

Take Control of Your Credit with AI Your AI-powered Credit Repair App Monitor, Detect, & Resolve Issues

Get StartedWhat Does a 670 Credit Score Mean?

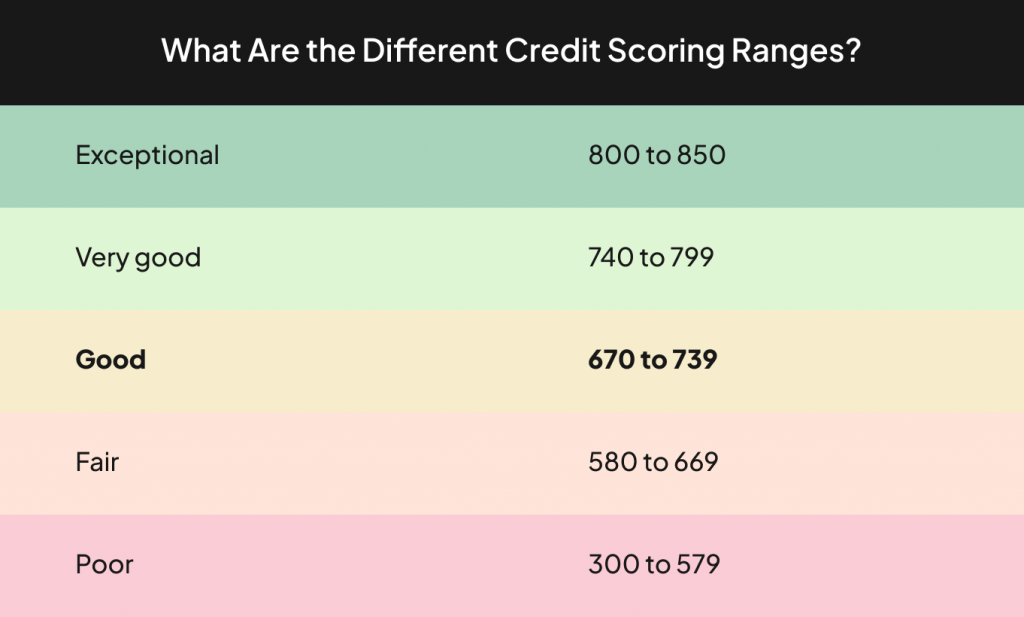

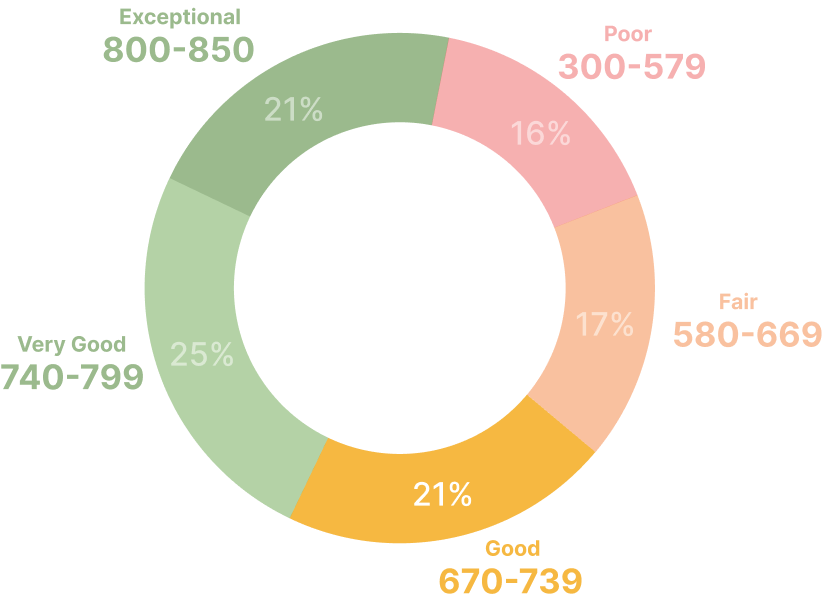

Credit scores generally range from 300 to 850. A score of 670 is considered “Good” by FICO and often “Fair” by VantageScore. This places you in the 670 to 739 credit score range, which is viewed as acceptable by many lenders. While it’s not at the top of the scale, it’s a respectable score that shows you have a decent track record with credit.

Here’s what a 670 credit score means for you:

- Lenders View You as a Moderate Risk

You’re not considered a high-risk borrower, but you may not qualify for the lowest interest rates available. - You Can Still Get Approved

Most lenders will approve you for credit cards, car loans, personal loans, and an auto loan, though your rates and terms may not be as favorable as those offered to people with scores above 740.

If you’re new to the concept of a 670 credit score, check out our guide on what a credit score is.

Factors That Affect Your 670 Credit Score

Several elements influence where your 670 credit score stands:

- Payment History: This is the most important factor. Late or missed payments can pull your 670 credit score down significantly. Paying your bills on time is critical.

- Credit Utilization: Using a large portion of your available credit limit can negatively impact your 670 credit score. Experts recommend keeping utilization below 30%.

- Length of Credit History: A longer credit history tends to help your 670 credit score since it shows consistent and responsible use of credit over time.

- Credit Mix: A combination of types of credit, such as credit cards, auto loans, and mortgages, can positively influence your 670 credit score.

- New Credit Inquiries: Too many hard credit checks (such as applying for multiple credit cards or loans) can slightly lower your 670 credit score.

- Credit Bureaus and Credit Scoring Models: Your score is calculated by credit bureaus using credit scoring models. Slight variations may occur between bureaus.

How to Improve a 670 Credit Score

The good news? You can boost your 670 credit score with simple, consistent efforts. Here’s how:

1. Pay Your Bills on Time

Avoid late payments at all costs. Even one missed payment can affect your credit score.

2. Lower Your Credit Card Balances

Pay down your debts and aim to keep your credit utilization under 30% to protect your 670 credit score.

3. Be Cautious With New Credit

Only apply for credit when absolutely necessary to avoid multiple hard inquiries that can affect your credit score.

4. Review Your Credit Report

Check your credit score and reports for errors or inaccuracies and dispute anything that seems incorrect to safeguard your 670 credit score.

5. Keep Older Accounts Open

Closing old accounts can reduce your average credit score age and negatively affect your 670 credit score.

For those starting their credit journey, learn how to build credit from scratch and strengthen your 670 credit score over time.

Why Improving Your Score Matters

Moving your 670 credit score from 670 to 700 or higher can bring big financial benefits:

- Lower interest rates on loans and credit cards.

- Easier approval for mortgages, car loans, auto loans, and personal loans.

- Access to premium credit cards with better rewards and perks.

Stay on top of your 670 credit score by using one of these best credit monitoring apps.

Ready for a Higher Credit Score? Our AI-powered platform helps you dispute inaccuracies

Get StartedConclusion

A 670 credit score marks a good starting point on your credit journey. It puts you in a position where you have access to most credit products, though improving it can open even more doors. With mindful steps like paying your bills on time, maintaining a low credit utilization ratio, and monitoring your credit report, you can steadily boost your credit profile. Consistency is key. Small actions today will lead to stronger financial opportunities tomorrow.

FAQs

Q: Is 670 a good credit score?

A: Yes, a 670 credit score is considered a good credit score. It places you within the 670 to 739 credit score range recognized by lenders.

Q: What credit score range does 670 fall into?

A: A 670 credit score falls into the 670 to 739 range, which is generally categorized as good or fair depending on the credit scoring models.

Q: Can I get an auto loan with a 670 credit score?

A: Yes, most lenders will approve car loans or an auto loan for borrowers with a 670 credit score, though interest rates may vary.

Q: Will paying your bills on time improve a 670 credit score?

A: Absolutely. Timely payments are one of the most important factors to improve your credit score.

Q: How do credit bureaus calculate my 670 credit score?

A: Your 670 credit score is calculated by credit bureaus using credit scoring models that consider your payment history, credit utilization, length of credit history, types of credit, and recent inquiries.