Free Credit Repair: Steps You Must Take to Fix Your Credit

Steps You Can Take to Improve Your Credit Score Yourself

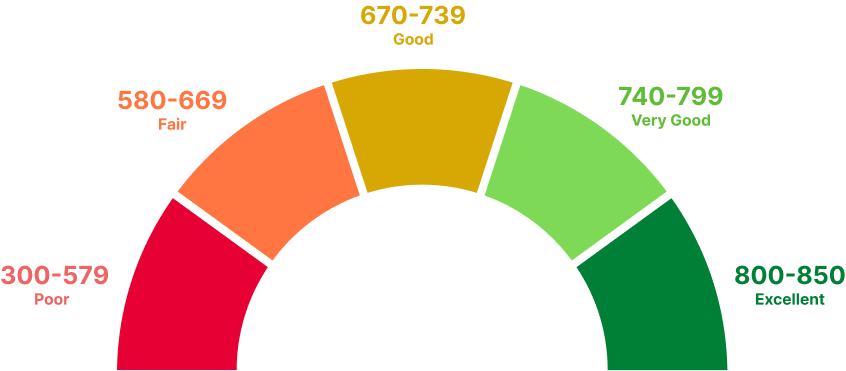

A credit score is a numerical representation of your financial health. A good score, typically above 660, indicates responsible financial behavior, while a low score can suggest otherwise. However, maintaining a good score is easier said than done. Often, factors beyond our control can negatively impact our score, leading to unexpected decreases. Fortunately, there are several steps you can take to improve your score and get started on your free credit repair journey.

Having a good credit score comes with numerous benefits, such as lower interest rates, better loan terms, and more favorable credit offers. Given these advantages, it's advisable to work proactively on repairing and improving your credit score. In this blog, we’ll explore practical, effective steps you can take to boost your credit score on your own. So, let’s get started!

How to Fix Your Credit for Free?

Check Your Credit Report

It Should Be on Point!

Your credit report is a comprehensive record of your credit history over the past 10 years. It includes detailed information about the number and types of your credit accounts, your payment history, and any negative information like collections or bankruptcies. A crucial first step of your free credit repair journey is to ensure that your credit report is accurate.

Start by obtaining a free copy of your credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion, with CoolCredit. You’re entitled to a free annual report from each bureau.

When reviewing your credit report, pay close attention to the following key areas to identify any inaccuracies or errors:

| Category | Details to Check |

| Personal Information | Name: Ensure your name is spelled correctly and matches your legal documents. Address: Verify all listed addresses where you have lived. Social Security Number (SSN): Check that your SSN is accurate. Date of Birth: Confirm your birthdate is correct. |

| Credit Accounts | Account Details: Review each account for accuracy, including the account type (credit card, loan, etc.), the date it was opened, and the account status. Balances: Ensure the reported balances are correct. Credit Limits: Check that the credit limits or loan amounts are accurate. Payment History: Verify that the payment history is correct and that any late or missed payments are accurately reported. |

| Negative Information | Collections Accounts: Confirm that any accounts sent to collections are reported accurately and check the amounts. Public Records: Ensure any public records such as bankruptcies, tax liens, or judgments are correct and up to date. Charge-Offs: Verify any charge-off accounts for accuracy |

| Credit Inquiries | Hard Inquiries: Review all hard inquiries (those made when you applied for credit) and ensure they are legitimate. Remember, too many hard inquiries in a short period can negatively affect your score. Soft Inquiries: Check soft inquiries (those made by you or by companies for promotional purposes) to ensure you recognize them. |

| Incorrect Accounts | Unknown Accounts: Look for any accounts that you do not recognize, as these could be signs of identity theft or errors. Duplicate Accounts: Ensure there are no duplicate accounts listed. |

Dispute Inaccuracies

| Did you know? 79% of credit reports contain inaccurate information or errors. Remarkably, around 15% of consumers witness an improvement in their credit scores after challenging these errors with the credit bureaus. |

This proves that having inaccuracies in your credit report can impact your credit score. So it is only worthwhile to dispute these errors.

Here’s a Free Credit Repair 101: You can raise a dispute with each bureau to correct the errors by yourself!

Start by identifying any discrepancies in your report as discussed above. Next, initiate a dispute with the relevant credit bureau, utilizing online, phone, or mail channels. Provide relevant documentation to support your claim. The credit bureau has 30 days to investigate your dispute and respond.

Here's how you can do it online:

- Experian

When disputing inaccuracies with Experian, you can visit their Dispute Center online. Start by selecting "Start a New Dispute" and choose the specific entry you wish to dispute. Provide a reason for each dispute and, if necessary, submit supporting documentation. Once you've reviewed and submitted the dispute, Experian will notify you when the results are available. Alternatively, you can also dispute by phone or mail.

- Equifax

Equifax offers an Online Dispute Portal where you can log in or create a myEquifax account to begin the dispute process. Ensure you have supporting documents, such as a valid driver's license, birth certificate, or utility bill, confirming your address, readily available for upload. Choose the item you wish to dispute, provide a clear reason, and include any relevant documents. Submit the dispute through the portal. Equifax will then update you on the status and outcome of your dispute.

- TransUnion

To dispute inaccuracies with TransUnion, visit their Dispute Center online and sign up or log in to your account. Select the entry you want to dispute and provide a reason for the dispute, attaching any necessary supporting documents. You have the option to request multiple updates within the same dispute request. Once you've compiled all necessary items, submit your dispute. TransUnion will keep you informed about the progress and resolution of your dispute. Alternatively, you can choose to submit disputes via phone or mail for added flexibility.

| Do It With CoolCredit Your Trusted Credit Repair Ally  Access Your Free Credit Reports The most important step of your free credit repair journey is to get your hands on your credit reports. With CoolCredit, you can easily obtain yours from the three major credit bureaus: Experian, Equifax, and TransUnion. Regularly reviewing your credit reports is crucial for identifying inaccuracies and understanding your financial standing. AI-Assisted Dispute Letters CoolCredit offers a unique feature that allows you to generate AI-assisted dispute letters. This tool helps you craft effective, personalized dispute letters to address any inaccuracies found in your credit reports. Expert Assistance When you sign up with CoolCredit you have the option to seek expert assistance throughout the dispute process. Our experts can help you navigate the complexities of credit repair, ensuring your dispute letters are sent to the right bureaus. With CoolCredit- your ai credit repair, get the tools and support to help you achieve a better credit score. |

Pay Down Debt

An increasing number of Americans are struggling to keep up with their monthly credit card payments amid rising inflation and interest rates, according to the New York Federal Reserve.

This underscores the importance of paying down debt as a crucial step in improving your credit score. High levels of debt, especially credit card debt, can significantly impact your credit utilization ratio—the percentage of your available credit that you're using—which is a major factor in your credit score. It is advisable to keep this ratio under 30%. Lowering this ratio by paying down your balances can lead to a healthier credit score and improved financial stability.

Focus on paying off high-interest debt first, as this will save you the most money in interest payments over time. Alternatively, you can use the debt snowball method by paying off smaller balances first to gain momentum and stay motivated.

It is important to note that paying off debt may temporarily reduce your credit score, but the long-term benefits of financial stability and a higher credit score far outweigh this short-term impact.

Avoid New Credit Inquiries

Avoiding new credit inquiries is important because each application for credit results in a hard inquiry on your credit report, which can temporarily lower your score. To minimize this impact, only apply for new credit when absolutely necessary. If you're shopping for rates on a major purchase, such as a mortgage or auto loan, do so within a short period (14-45 days) to ensure multiple inquiries are treated as a single inquiry by scoring models. By being strategic about when you apply for credit, you can protect your score from unnecessary dips.

Free AI Credit Repair:Smart Solutions for Your Credit Challenges!

Boost My CreditUse Old Credit Cards Wisely

Using old credit cards wisely can positively impact your credit score by contributing to the length of your credit history, which is a significant scoring factor. Keep your oldest credit card accounts open, even if you don't use them frequently. Make occasional small purchases with these cards and pay off the balance immediately to keep the accounts active without accruing debt. This approach helps maintain a long and healthy credit history, which can boost your credit score over time.

Create a Budget and Payment Plan

Creating a budget and a payment plan is essential for managing your finances and improving your credit score. Start by listing all your income sources and monthly expenses, ensuring you can at least cover the minimum payments on all your debts. Incorporate strategies to reduce unnecessary spending and allocate more funds toward debt repayment. Setting up automatic payments or reminders can help you stay consistent with on-time payments, which are crucial for maintaining and improving your credit score. By adhering to a well-planned budget, you can avoid missed payments and gradually reduce your overall debt burden.

Consider a Secured Credit Card

If you have poor credit or no credit history, consider using a secured credit card to build or rebuild your credit. A secured credit card requires a cash deposit that serves as your credit limit, reducing the risk for the issuer. Use the card responsibly by making small purchases and paying off the balance in full each month. Over time, responsible use of a secured credit card can demonstrate your creditworthiness, helping to improve your credit score and potentially qualify you for an unsecured card in the future.

Monitor Your Progress

Monitoring your progress is vital for staying on top of your credit health and catching any errors or issues early. Regularly check your credit score and follow the above-mentioned free credit repair steps to keep your financial health on track. By keeping a close eye on your credit report and score, you can track the impact of your efforts, identify and dispute any inaccuracies promptly, and make informed decisions to further improve your credit.

Conclusion

You Are in for the Long Haul!

Repairing your credit takes time, patience, and discipline. By following these steps and staying committed to responsible credit habits, you can improve your credit score and achieve greater financial stability.

Remember, it’s a marathon, not a sprint. Start today, and your future self will thank you.

And for the rest, CoolCredit- credit repair app is here to help!

FAQs

Q: How to Fix My Credit for Free?

A: You can fix your credit for free by reviewing your credit report for errors, disputing inaccuracies, paying down debt, and maintaining consistent, on-time payments.

Q: What Is AI Credit Repair?

A: AI Credit Repair uses artificial intelligence to analyze your credit report, identify errors, and generate dispute letters to help you correct inaccuracies and improve your credit score.

Q: How Long Does It Take to Improve a Credit Score?

A: Improving a credit score can take a few months to several years, depending on your starting point and the steps you take to address any issues.

Q: What Factors Affect My Credit Score the Most?

A: The most important factors affecting your credit score are payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries.