740 Credit Score: What It Means and Why It Matters

A credit score of 740 places you in the Very Good category according to most scoring models like FICO and VantageScore. These models consider a variety of factors—from payment history and debt levels to credit age and types of credit in use. Scoring above 700 already reflects strong credit behavior, and 740 indicates that you're managing your credit very well.

Lenders use your credit score to assess your reliability. A 740 score signals that you're a low-risk borrower—someone who’s likely to repay loans on time. As a result, financial institutions tend to approve applications from borrowers in this range more quickly, with better terms and fewer hurdles. Whether you’re applying for a mortgage, a car loan, or a credit card, your chances of approval are high with this score.

Why Guess? Elevate Your Score, Let AI Tell You What’s Hurting Your Credit.

Learn HowIs a 740 Credit Score Considered “Very Good” or “Excellent”?

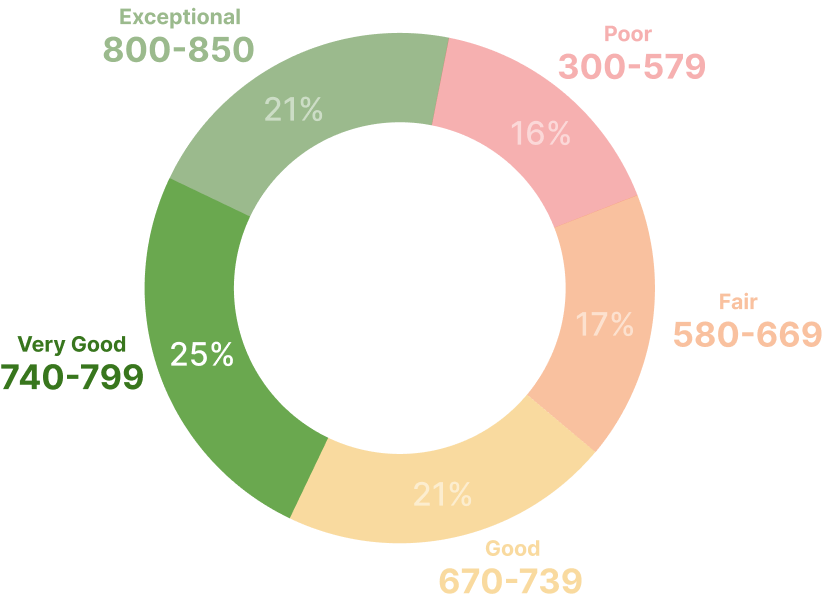

While a 740 score isn’t quite “excellent,” it’s very close. Here's how FICO breaks down score categories:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Exceptional

So at 740, you're just one point into the Very Good category. While you’re not yet in the elite 800+ bracket, most lenders still treat a 740 score with high regard. The interest rates, loan limits, and financial opportunities available to you will be nearly as good as those offered to someone with an 800 score—especially if other aspects of your application (like income and employment) are strong.

Key Benefits of Having a 740 Credit Score Across Loans and Credit

A 740 credit score unlocks financial advantages that go beyond simple loan approvals. Here are some of the most important benefits:

▪ Lower Interest Rates

You'll typically qualify for the lender’s best advertised interest rates. Whether it’s a car loan or mortgage, even a 0.5% reduction in your APR can mean thousands saved over time.

▪ Higher Credit Limits

Credit card issuers and lenders are more willing to offer you higher credit limits and larger loan amounts, which improves your credit utilization ratio and helps your score stay healthy.

▪ Easier Mortgage Approval

You can get approved for conventional mortgages without needing to rely on FHA loans. You may also get better offers on refinancing your current mortgage.

▪ Flexible Auto Financing

With a 740 score, you’re likely to get access to promotional auto loan rates with 0% APR for the first year or low fixed rates throughout the loan term.

▪ Stronger Rental and Insurance Profiles

Landlords and property managers often perform credit checks before approving tenants. A 740 score shows financial responsibility, increasing your chances of getting the rental you want. In some states, a higher credit score may also reduce your insurance premiums.

What Can You Qualify for with a 740 Credit Score?

| Financial Product | Approval Likelihood | Typical Benefits |

| Credit Cards | High | Rewards, cash back, balance transfer offers |

| Auto Loans | High | 4–6% interest rates, flexible terms |

| Personal Loans | High | Low APRs, larger loan amounts |

| Mortgages | High | Competitive rates, fast approvals |

| Rental Applications | High | Faster approvals, fewer deposits |

With a 740 score, lenders see you as a dependable borrower. This translates to faster approvals, less paperwork, and stronger negotiating power.

Smart Ways to Maintain or Improve Your 740 Credit Score

If you’re already at 740, you’ve clearly built a solid credit foundation. But you’ll need consistent habits to maintain it—or even improve it. Here are key practices to follow:

▪ Pay on Time, Every Time

Your payment history makes up the largest part of your credit score. One missed payment can drop your score by 50–100 points. Automate payments or set up reminders.

▪ Watch Your Credit Utilization

Try to use less than 30% of your available credit. For even better results, keep it under 10%. For example, if your total credit limit is $10,000, aim to keep balances below $1,000.

▪ Don’t Close Old Accounts

The longer your credit history, the better. Even if you’re not using an old credit card, keeping it open helps your average account age.

▪ Limit Hard Inquiries

Each credit application causes a small, temporary dip in your score. Avoid opening multiple new accounts in a short period.

▪ Check Your Credit Reports Regularly

Mistakes or fraudulent activity can hurt your score. You can check your credit score with CoolCredit and dispute errors promptly.

From 740 to 800: What It Takes to Reach an Excellent Credit Score

Getting from a 740 to an 800+ score is absolutely possible—and often, it doesn’t require major changes, just consistency and time.

Here’s how you can climb that final stretch:

- Maintain Stellar Payment History: This one’s non-negotiable. Keep making every payment on time.

- Let Your Credit Age: Avoid closing old accounts and refrain from opening too many new ones.

- Diversify Credit Types: A mix of revolving credit (like credit cards) and installment loans (like a car loan or mortgage) can help.

- Use Less Credit: Keeping your balances low relative to your limits makes you look financially responsible.

- Avoid Over-Borrowing: Stay conservative with your credit usage and only apply for new credit when necessary.

Most people with 800+ credit scores didn’t necessarily do anything extreme—they simply stayed consistent for a long period.

Tap. Track. Repair. Your Credit, Rebuilt by AI.

Get StartedWhy Your 740 Score Still Matters—Even If You’re Not Borrowing Right Now

You might not be applying for a loan or credit card today—but your credit score still matters.

- Landlords Check It: Good credit can help you land your dream apartment.

- Employers May Check It: Some companies review credit during the hiring process, especially for finance-related roles.

- Insurance Companies Consider It: In many states, a good score lowers your premiums.

- Emergency Borrowing: When life happens, you’ll be glad your score lets you access fast funding.

Your credit score influences more aspects of your life than you may realize. Keeping it high is always a smart move.

Conclusion

A 740 credit score places you in a great financial position. You’ve earned the trust of lenders, and you have the opportunity to access some of the best borrowing terms available. Whether you're eyeing a new home, a major purchase, or just want peace of mind, your credit score is a valuable asset. It’s a process, but with a bit of effort—like keeping your credit clean, fixing any mistakes, and making payments on time—you’ll get there. Stay consistent, and you'll see that score climb. And if you ever need help boosting or repairing your score, CoolCredit’s a solid option to consider.

FAQs

Q: Is 740 a good credit score?

A: Yes, a 740 credit score is considered very good. It indicates strong creditworthiness and opens the door to favorable loan terms, higher credit limits, and lower interest rates.

Q: Can I get a mortgage with a 740 credit score?

A: Absolutely. With a 740 score, you can qualify for conventional mortgage loans and enjoy competitive interest rates, often without needing private mortgage insurance (PMI).

Q: What interest rate can I expect with a 740 credit score?

A: You’ll likely receive lower-than-average interest rates across credit cards, auto loans, and mortgages—typically within the lender’s best tier.

Q: How much can I borrow with a 740 credit score?

A: While your score plays a major role, the borrowing limit also depends on your income, existing debts, and the type of loan. However, a 740 score significantly improves your chances of getting approved for larger amounts.

Q: Can I increase my 740 credit score to 800?

A: Yes. By consistently paying bills on time, keeping your credit utilization low, and maintaining a mix of credit accounts, you can gradually boost your score into the excellent (800+) range.