How To Boost Your Credit Score Overnight? Is That Really Possible?

Building an excellent credit score usually takes years. However, raising your score by 10, 20, or even 100 points can sometimes happen faster than you think. But how quickly your score improves really depends on why it’s low in the first place.

Some quick fixes that can give your score a boost include:

- Correcting errors on your credit report

- Paying off medical collections

- Consolidating high credit card debt

- Becoming an authorized user on a trusted friend’s or family member’s account

Of course, knowing what to do is only half the story. The other half is knowing how long it takes to see results. Obviously, you can’t boost your credit score overnight. So, here’s a closer look at the timelines for credit score improvement.

Check Your Score Instantly with CoolCredit

Sign Up NowHow Quickly Can You Boost Your Credit Score?

The speed of improvement in your credit depends on your actions and current credit situation. While the thought of boosting your credit score overnight is usually impossible. You can take some major steps to make a noticeable difference.

▪ Immediate impact (1–2 months):

By taking smart and focused steps, you can see a quick boost in your score. For instance, paying down high credit card balances can make a big difference. Since credit bureaus update your information every 30–45 days, your score could increase by 20–50 points in as little as one month.

▪ Short-term improvements (3–6 months):

When you consistently follow good credit habits, the results become more noticeable. Paying all your bills on time, keeping your credit card balances low, and avoiding too many new credit applications will not boost your credit score overnight, but can slowly raise your score.

▪ Long-term improvements (6–12 months and beyond):

Sustained, responsible credit behavior leads to lasting improvement. While short-term actions give a quick lift, long-term habits ensure your score stays higher, which helps when applying for bigger loans or better interest rates.

Why Your Credit Score Won’t Jump Overnight

Many people hope for a quick fix to improve their credit score, but in reality, raising it overnight is nearly impossible. Here’s why:

FIRST OF ALL, your credit score is built on years of financial behavior, not just one action. Most probably, 35% of your score comes from payment history, and another 30% comes from credit card balances (credit utilization). These factors reflect long-term payment patterns, not short-term changes.

SECONDLY, lenders and credit card companies usually report to credit bureaus every 30–45 days. Therefore, if you pay off a large debt today, it won’t show up on your score until the next reporting cycle.

THIRDLY, some issues, such as late payments, collections, or bankruptcies, can’t be erased overnight. For instance, a late payment can stay on your credit report for up to 7 years. Even though its impact lessens over time.

All-in-all, quick jumps overnight are rare. Paying down a big credit card balance might boost your credit score overnight by 20–50 points. But significant improvements usually take 3–6 months of consistent effort.

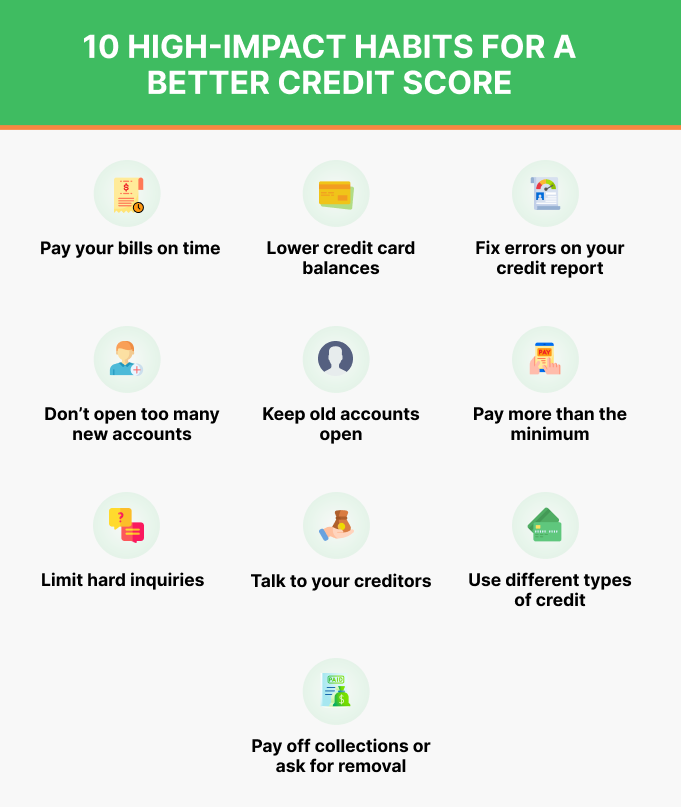

10 High-Impact Habits for a Better Credit Score

No matter what, the best way to improve your credit score is by building consistent habits. Here are some quick tips to guide you. Scroll down to see how each one can make a difference.

- Pay Your Bills on Time

Your payment history makes up 35% of your score. Even one late payment can bring your score down. Use reminders or autopay so you never miss due dates.

- Lower Credit Card Balances

Credit card usage (how much you use compared to your limit) makes up about 30% of your score. Try to keep balances under 30% of your limit, and if possible, closer to 10%.

- Fix Errors on Your Credit Report

Sometimes reports show mistakes. If you dispute these errors and get them corrected, your score can improve quickly.

- Don’t Open Too Many New Accounts

Every new application adds a hard inquiry, which can lower your score a little. Too many new accounts also make you look risky. Only apply when you really need to.

- Keep Old Accounts Open

Closing old accounts shortens your credit history and may hurt your score. If there’s no annual fee, keep them open and use them once in a while.

- Pay More Than the Minimum

Paying just the minimum keeps your debt longer and costs more in interest. Paying extra lowers your balance faster and helps improve your score.

- Limit Hard Inquiries

Each hard inquiry can lower your score by 5–10 points. Too many at once makes lenders think you’re struggling financially. Space them out when applying for credit.

- Talk to Your Creditors

If you can’t pay on time, call your creditors. They may lower your interest, set up a payment plan, or sometimes remove a late mark if you show you’re trying to pay.

- Use Different Types of Credit

Having a mix of credit, like a credit card plus a loan, shows you can handle different debts. This makes up about 10% of your score.

- Pay Off Collections or Ask for Removal

Collections hurt your score badly. Paying them off doesn’t erase them, but it looks better than leaving them unpaid. Sometimes, collectors will agree to remove the account if you pay (“pay for delete”).

AI + Experts = Your Path to Better Credit

Get StartedThe Biggest Mistakes You Make To Boost Your Credit Score Overnight

Working on your credit score takes patience. But if you’re not careful, a few common mistakes can slow down your progress. Here are the pitfalls to watch out for:

1. Missing Payments

Even one late payment can hurt your score because payment history makes up 35% of it. Always try to pay on time, even if it’s just the minimum.

2. Using too much credit

Maxing out your credit cards can signal risk to lenders. It’s best to keep your usage below 30% of your limit, and ideally closer to 10%.

3. Closing Old Accounts

Closing older accounts can shorten your credit history and reduce your available credit. Unless the account has high fees, it’s better to keep it open.

4. Applying for Too Many New Accounts

Another mistake is applying for several new credit cards or loans at once. Each application adds a hard inquiry, which can drop your score slightly. Too many inquiries make you look desperate for credit.

5. Ignoring Credit Reports

Also, don’t forget to check your credit reports. Errors like late payments or duplicate accounts are common and can bring your score down if not corrected.

6. Believing in “Quick Fixes”

In order to boost your credit score overnight, be careful with companies that promise to erase negative marks overnight. Most negative items, like late payments or bankruptcies, can legally stay for 7–10 years. Good habits—not shortcuts—are the real solution.

Great Credit Starts with Consistent Efforts

By now, it’s clear—you can’t boost your credit score overnight. While quick improvements are possible, such as reducing debt or correcting errors, lasting progress takes time. Definitely, the real key is building consistent habits and sticking to them for months, not days.

In this blog, we shared some practical steps that can give your score a lift, like paying down high credit card balances and disputing mistakes on your report. But the biggest takeaway is this: meaningful credit growth comes from steady, responsible behavior over the long run.

FAQs

Q: Can I Boost My Credit Score Overnight?

A: No, you can’t truly boost your credit score overnight. While quick fixes like paying down high credit card balances or correcting errors may give a small lift, meaningful improvement takes consistent good habits over months.

Q: How Do I Raise My Credit Score by 100 Points in 30 Days?

A: Raising your credit score by 100 points in just 30 days is rare, but it can happen in certain cases. Paying down high credit card balances, disputing major errors on your credit report, or removing collections can lead to fast improvements. However, long-term habits are still the key to lasting results.

Q: How To Raise a Credit Score 100 Points Overnight?

A: A 100-point jump in one night is unlikely. However, by lowering debt, avoiding late payments, and maintaining healthy accounts, you can see steady progress in just a few months.

Q: How Long Does It Take To Raise Your Credit Score by 20 Points?

A: A 20-point increase may only take a few weeks to a couple of months, depending on your actions. Simple steps like lowering credit use or making all payments on time help.

Q: How To Increase Credit Score by 100 Points in 30 Days?

A: It’s very rare to raise your credit score by 100 points in just 30 days. However, paying down high balances, correcting errors, or becoming an authorized user could give a quick boost.