850 Credit Score: What It Really Means and What You Can Get

An 850 credit score is more than just a number—it’s the highest possible rating in the FICO credit scoring model. Landing in this elite range means you’re considered one of the most trustworthy borrowers in the eyes of lenders, placing you in the top 1% of credit holders nationwide. But beyond the prestige, what does an 850 score truly offer? And is it something worth striving for?

Let’s dive into the real benefits, myths, and smart habits that come with or lead to this perfect credit score.

Is 850 a Perfect Credit Score?

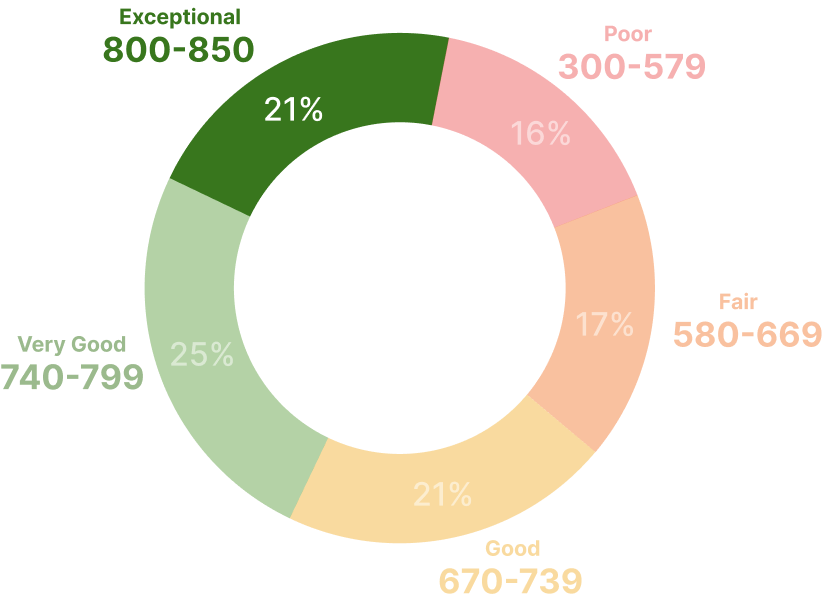

Yes—850 is the pinnacle of the FICO score range, which spans from 300 to 850. It's a flawless credit score that signals near-perfect financial behavior. Achieving it means you’ve likely paid every bill on time, kept your credit utilization low, avoided major derogatory marks, and maintained a lengthy credit history. While many aim to reach it, only about 1.6% of Americans actually do. It’s rare—but not impossible.

Let Our AI Credit Repair Analyze Your Report & Fix Issues For A Better Score.

Start todayWhat Are the Benefits of an 850 Credit Score?

Holding an 850 credit score gives you access to the most favorable financial terms across nearly every category—from home loans to car financing, and even insurance and rental approvals.

1. Better Mortgage Rates and Long-Term Savings

One of the most immediate advantages is access to the lowest mortgage interest rates. Lenders reward top-tier borrowers with reduced annual percentage rates (APR), translating into significant long-term savings. For example, individuals with scores between 760 and 850 often enjoy lower APRs compared to those with scores in the 600s—sometimes saving tens of thousands of dollars over a 30-year mortgage.

2. Auto Loan Perks That Save You Thousands

Looking to finance a car? With an 850 credit score, you’ll likely be offered the lowest interest rates, the flexibility to choose longer repayment periods, and potentially even zero down payment deals. Lenders see you as a low-risk borrower, which gives you stronger negotiation power and a faster approval process.

3. Access to Premium Credit Cards

When it comes to credit cards, your 850 score opens the door to nearly any card available—especially those with premium rewards, exclusive travel perks, and higher credit limits. You’ll also enjoy reduced interest rates, lower fees, and enhanced customer service options from many card issuers.

4. Lower Insurance Premiums and Easier Rental Applications

Many insurance companies use credit scores to assess financial responsibility, and those with higher scores often receive lower premiums. Similarly, landlords frequently check credit scores during rental applications. With an 850, you’re more likely to get approved quickly and may even benefit from reduced or waived security deposits.

| Pro Tip: Use CoolCredit to monitor and improve your score automatically with AI tools. Is It Worth Chasing a Perfect Score? |

How to Maintain or Reach an 850 Credit Score

Reaching a perfect score doesn’t happen overnight. It requires a mix of discipline, consistency, and smart financial habits. If you’re already in the high 700s or low 800s, you’re not far off.

Start by making sure every bill—credit cards, loans, utilities—is paid on time. Next, aim to keep your credit utilization below 30%, ideally under 10%, which shows lenders that you’re not overly reliant on borrowed money. Avoid applying for too many new credit lines in a short period, as each application results in a hard inquiry that can slightly reduce your score.

Maintaining older accounts helps extend your average credit age, which is a favorable factor in your score. And finally, monitor your credit reports regularly for errors, fraudulent activity, or opportunities to improve.

| Pro Tip: Tools like CoolCredit can help you stay on top of your credit. With AI-powered insights, real-time monitoring, and custom dispute solutions, CoolCredit makes it easier to maintain or improve your score. |

Is It Worth Chasing a Perfect Score?

While 850 is impressive, the truth is, you don’t need a perfect credit score to unlock the best financial products. In most cases, anything above 800 is considered exceptional. Lenders usually treat scores in the 800–850 range similarly, offering the same interest rates, loan terms, and card options.

So instead of obsessing over hitting 850, focus on maintaining strong habits that keep your score consistently high. Stability over time is far more valuable than perfection.

Common Myths About the 850 Score

There are several misconceptions surrounding perfect credit scores. One common belief is that you need an 850 to qualify for the best credit cards. In reality, many top-tier cards are available to individuals with scores above 740.

Another myth is that one mistake—like a missed payment—will instantly tank your score to 600. While late payments can impact your score, a well-established history of positive credit activity often softens the blow.

Take control of your credit Score Start with CoolCredit today stay exceptional.

Get StartedConclusion

An 850 credit score is a financial milestone. It opens doors to the best financial products, lowest interest rates, and exceptional opportunities—but it's not essential for success. Scores over 800 offer nearly identical benefits, and the key to credit excellence lies in consistency. With tools like CoolCredit, you can monitor your credit health, fix potential issues before they escalate, and safeguard the hard work you’ve put into your financial journey.

FAQs

Q: Is 850 a good credit score?

A: It’s not just good—it’s the best possible. An 850 score shows exceptional financial responsibility.

Q: What can I get with an 850 score?

A: You can access the lowest loan rates, highest credit card limits, and faster approvals for housing or financing.

Q: How can I maintain it?

A: Stay consistent: pay bills on time, keep your utilization low, and review your credit reports regularly.

Q: Do I need CoolCredit if I already have 850?

A: Absolutely. CoolCredit helps monitor, protect, and maintain your score while alerting you of any threats or changes.

Q: How rare is an 800+ score?

A: Only about 22% of Americans have a score over 800. An 850 score is even more exclusive.