600 Credit Score: What It Means and How to Improve It

A 600 credit score falls into the fair range. Even with a 600 credit score, you can get credit cards, personal loans, car loans, and home loans. But lenders may charge you higher interest rates or set stricter conditions. With steady, responsible habits, you can raise your score and unlock better financial opportunities.

Boost Your Credit with AI!Get real-time insights & personalized steps to improve your score.

Try NowUnderstanding a 600 Credit Score

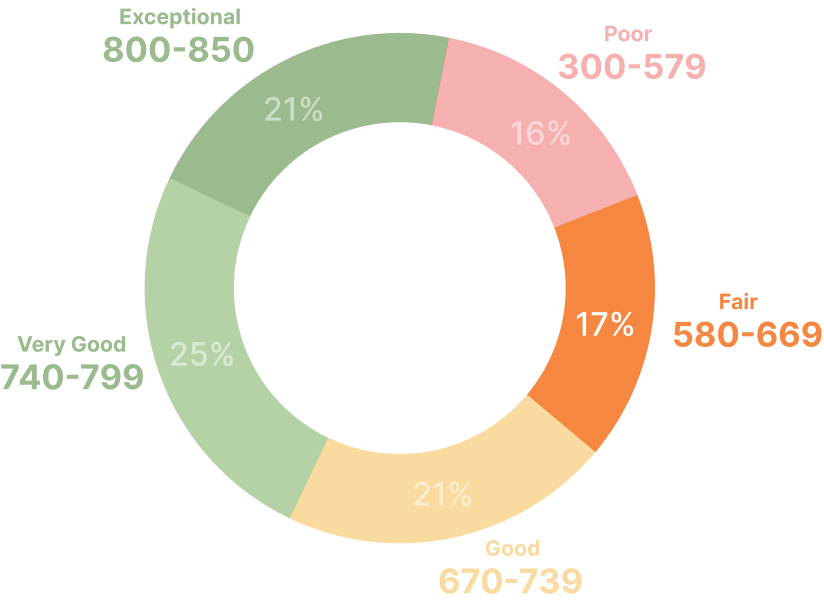

A credit score between 580 and 669 is considered fair by most scoring models (FICO and VantageScore). A 600 credit score puts you in this category. Lenders view borrowers with fair credit as moderate risk, which can affect loan approvals, interest rates, and credit limits.

The good news? A 600 score is highly recoverable. With focus and effort, you can move into the good (670–739) or even excellent range over time.

What Factors Contribute to a 600 Credit Score?

Credit scores are calculated using five key factors:

- Payment History (35%): Paying on time is critical

- Credit Utilization (30%): How much of your available credit you’re using

- Length of Credit History (15%): Older accounts help your score

- New Credit (10%): Too many new applications can lower your score

- Credit Mix (10%): A variety of credit types (cards, loans, etc.) improves your score

Knowing these factors helps you understand why your score may be at 600—and what to fix first.

What Can You Qualify for With a 600 Credit Score?

A 600 credit score limits some of your borrowing power, but many financial products are still available.

▪ Credit Cards for 600 Credit Score Borrowers

Secured credit cards offer the most reliable option. They require a refundable deposit and are designed to help rebuild credit. A few lenders also offer unsecured cards for fair credit, but expect smaller limits and higher fees. Store credit cards are easier to get but often come with high interest rates. Always use these cards responsibly to help improve your score over time.

▪ Car Loans With a 600 Credit Score

You can get a car loan with a 600 credit score, but you’ll probably pay a higher interest rate than borrowers with stronger credit. Rates may range between 8% to 18%. Increasing your down payment and adding a cosigner with strong credit can greatly improve your approval odds and terms. Many dealerships offer special 600 credit score auto loan programs.

▪ Personal Loans for a 600 Credit Score

Banks, credit unions, and online lenders offer loans for a 600 credit score. Avoid payday or high-fee lenders, as they can cost you much more. Interest rates are typically higher (15% to 36%) and loan amounts may be limited.

▪ Home Loans and Mortgages for a 600 Credit Score

Securing a 600 credit score home loan or 600 credit score mortgage can be difficult, but government-backed programs like FHA loans make it possible. FHA loans accept scores as low as 580 with a minimum 3.5% down payment. VA and USDA loans may also be an option if you meet eligibility requirements. Expect to pay Private Mortgage Insurance (PMI) if your down payment is less than 20%.

▪ Other Loan Options

Additional loans for 600 credit score borrowers include credit builder loans and secured loans. Credit unions are often more flexible and may offer lower rates. Peer-to-peer lending platforms can also provide access to funds, but always check lender credibility.

Can You Buy a House With a 600 Credit Score?

Yes, but with conditions.

An FHA mortgage is likely your best option. These loans are designed to help lower-credit borrowers access home ownership. Be prepared for a slightly higher interest rate and additional costs like PMI. Improving your score even slightly before applying can help you qualify for better terms.

How Long Does It Take to Improve a 600 Credit Score?

You can fix smaller problems, like high credit card balances, fairly quickly. Bigger issues, like defaults or collections, will take more time to improve. Depending on your starting point and financial behavior, improving your score can take as little as 6 months to a year.

Common Mistakes That Keep You Stuck at 600

Many borrowers stay at 600 credit score because of these common missteps:

- Maxing out credit cards

- Missing payment due dates

- Applying for too many new credit accounts

- Ignoring old debts that go to collections

- Failing to regularly check and correct credit report errors

Avoiding these pitfalls is crucial to rebuilding your credit.

How to Improve a 600 Credit Score

Here’s a detailed, step-by-step guide to improving your credit:

1. Pay All Bills on Time

Late payments are the fastest way to damage your credit. Use autopay or calendar reminders to make sure every bill is paid before the due date.

2. Lower Your Credit Utilization Ratio

Try to keep your credit usage below 30% of your total available credit. Pay down balances aggressively and consider requesting a credit limit increase (without increasing spending).

3. Limit New Credit Applications

Hard inquiries lower your score slightly. Only apply for new credit when absolutely necessary and space out applications over time.

4. Check Your Credit Reports Regularly

Request free reports from Experian, Equifax, and TransUnion. Dispute any errors or incorrect account information to reclaim lost points.

5. Become an Authorized User

If someone with good credit adds you to their credit card as an authorized user, it can help raise your score. You don’t even have to use the card.

6. Keep Older Accounts Open

The age of your credit history matters. Don’t close your oldest accounts unless there’s a strong reason to do so, even if you don’t actively use them.

Conclusion

A 600 credit score may feel limiting, but it’s far from permanent. You have access to credit cards for 600 credit score users, 600 credit score car loans, personal loans for 600 credit score, and even 600 credit score home loans. With steady effort and good habits, you can raise your credit score and enjoy more financial freedom.

FAQs

Q: Is 600 a good credit score?

A: No, a 600 score is considered fair. It’s not poor, but you won’t qualify for the best rates.

Q: Can I get a credit card with a 600 score?

A: Yes, secured credit cards and some unsecured cards for fair credit are available.

Q: How do I go from 600 to 700?

A: Pay bills on time, reduce credit balances, avoid new inquiries, and dispute any credit report errors.

Q: Does paying off collections improve my score?

A: Yes, paying off collections can stop further damage and may help your score gradually improve.