What Is SYNCB/PPC and Why Is It on Your Credit Report?

Short Answer with Key Points:

What is SYNCB/PPC: It refers to Synchrony Bank/PayPal credit, which is a line of credit/credit card offered through PayPal, issued via Synchrony Bank.

Why it's on your credit report: It may appear on your credit report if you have an active or closed PayPal Credit account and you owe an outstanding balance on it.

What to do if you didn’t apply for SYNCB/PPC: It may indicate that you are the victim of identity theft or fraud. You should immediately contact Synchrony Bank and take the necessary steps for prevention.

▪ Dispute the inquiry

▪ Report identity theft or fraud (if applicable)

▪ Provide the necessary documentation proof

▪ Freeze your credit

▪ Take action to repair your credit

What Is SYNCB/PPC on My Credit Report?

The acronym stands for Synchrony Bank/PayPal Credit. It's a line of credit that PayPal users can apply for, and it's issued by Synchrony Bank.

SYNCB/PPC appears as a hard inquiry on your credit report if you applied for the SYNCB/PPC credit card. You may also see SYNCB/PPC on your credit report when you may have an outstanding balance on PayPal Credit or ‘Bill Me Later’ previously. However, if you don’t recognize the account, it may indicate identity theft or fraud risk.

| An Overview of PayPal and Synchrony Bank Synchrony Bank has had a long-standing partnership with PayPal since 2004. They issue various PayPal consumer credit products. This includes the PayPal Credit digital line and physical credit cards. Synchrony Bank purchased PayPal's U.S. consumer credit receivables in 2018, including outstanding PayPal Credit debts. Hence, Synchrony Bank holds and manages the accounts for this credit product. |

4 Reasons Why SYNCB/PPC Might Be On Your Credit Report

1. You opened a PayPal Credit card: As you’ve learned, PayPal Credit products are issued by SYNCB (Synchrony Bank), which is why a hard inquiry may appear on your credit report.

2. You have an active or inactive PayPal account with an overdue balance: As Synchrony Bank purchased the consumer credit receivables from PayPal and manages the accounts receivable for PayPal credit, they may have reported your overdue payments to the credit bureaus. Hence, SYNCB PPC collections entry may show up on your credit report.

3. You may be a victim of identity theft: If you didn’t apply for a PayPal credit card, but someone else may have used your personal information and fraudulently applied for it.

4. It may be a credit report error: Sometimes errors can occur on credit reports, and SYNCB/PPC may be listed in error. In that case, raising a dispute can resolve the issue and help remove the entry from your credit report.

Let AI Repair Your Credit Score Fast

Sign Up NowHow Does SYNCB/PPC Affect Your Credit Score?

There are a few areas where you may spot a SYNCB entry affecting your credit, such as:

- SYNCB/PPC Hard Inquiry

When you apply for a PayPal Credit or applied for “Bill Me Later” sometime in the past two years, you may see the hard inquiry on your credit report. A legit hard credit check inquiry stays on your report for up to two years and automatically falls off after that. It may temporarily cause a dip in your scores, but there’s no need to be concerned when you legitimately applied for it yourself. However, if a hard inquiry recently appeared on your credit report but you never applied for any PayPal Credit or SYNCB credit card, it may raise concerns. In this scenario, you should immediately reach out to Synchrony Bank and verify the details.

- Active or Closed Account in Collections

If you previously used PayPal Credit (or Bill Me Later), whether the account is still active or already closed, any past-due balances may now show up under SYNCB/PPC on your credit report. While PayPal may not have been reporting the payments, since Synchrony Bank took over these accounts, they report them to the credit bureaus. This can negatively impact your credit score.

Hence, any late payments, charge-offs, or collections tied to SYNCB/PPC appear as derogatory marks and can remain on your credit report for up to 7 years.

What If You Didn’t Apply for the SYNCB/PPC Credit Card?

If you’ve never applied for it, you need to take quick action to get it removed. So, let’s go over the steps you can take to remove SYNCB/PPC from your credit report and safeguard your credit.

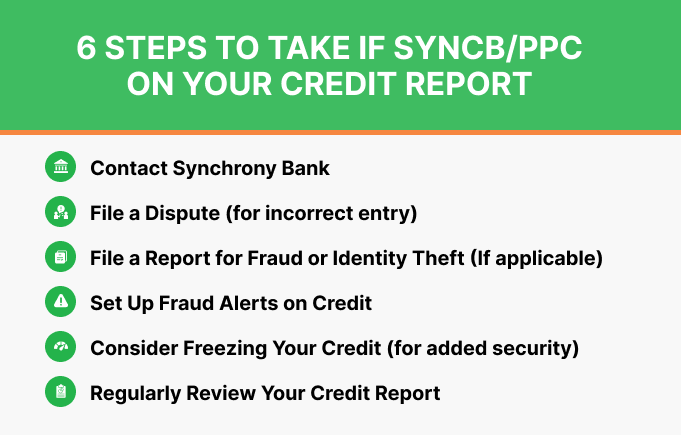

Here’s How to Remove SYNCB/PPC on Your Credit Report:

1. Contact Synchrony Bank

If SYNCB/PPC shows up on your credit report, you should reach out to the issuer of the PayPal Credit account to verify the account details and report your situation. Make sure to document everything and keep a record of your conversation, preferably in written communication.

2. File a Dispute

Start by raising a dispute for any unauthorized inquiry, undue use of your credit information by someone else, or an inaccurate/false claim under the SYNCB/PPC inquiry. Follow these steps:

- Contact the Credit Bureau: Reach out to the relevant credit bureau (Experian, Equifax, and TransUnion) that lists the SYNCB/PPC inquiry on your report. You can do this by submitting a dispute online or via mail.

- Report the Inaccuracy: You need to draft a dispute letter that clearly states that you did not apply for the SYNCB/PPC credit card or Bill Me Later, and consider it an unauthorized inquiry. You can also use the ready-to-use templates in the CoolCredit app to craft a professional and personalized dispute letter and send it in an instant.

- Provide Evidence: Before sending the dispute letter, you need to gather any evidence you have to support your claim. This can include any documentation, relevant correspondence from the provider, or your previous credit reports showing no application activity, etc.

- Follow Up: After you file a dispute, the bureau is required to investigate and correct the inaccurate information. But you also need to follow up on the status of the dispute and review your credit report to see whether the changes are reflected in your updated credit report or not.

3. Report Identity Theft (If Applicable)

If you believe someone else applied for credit using your personal information with fraudulent intent, go to IdentityTheft.gov and file a report. You will receive a recovery plan and an identity theft report, which may be required if you need legal assistance later.

4. Enable Fraud Alerts

You can also request fraud alerts on your credit file with the credit bureau. Doing so will make it harder for someone to misuse your credit information, as it will send you a warning and require you to verify your identity before opening new credit lines in your name.

5. Freeze Your Credit

You can consider placing a credit freeze by visiting the official website of each credit bureau as an added security measure. Simply create a free online account with each bureau, and use it to freeze, unfreeze, and manage your credit freeze as needed.

6. Regularly Review Your Credit Report

Also, check your credit report for other inaccuracies. Look for any unfamiliar entries that could indicate broader identity theft, mistakes, or errors for early detection. You can use apps like CoolCredit for efficient credit monitoring. It also provides actionable suggestions to improve and strengthen your credit profile.

Conclusion

SYNCB/PPC on your credit report can impact your scores. Whether it’s there because you have an active or closed overdue account, due to fraudulent activity, or an error, either way, you must take timely action to prevent further damage to your credit. The CoolCredit app is a powerful tool to help you take the right steps to remedy the issues.

With its ready-to-use dispute letter templates, you can submit your dispute to major credit bureaus in an instant. Additionally, it can help analyze any additional negative items that may be impacting your scores while providing actionable insights to repair and boost your credit. And you can also opt for expert credit assistance to help you navigate complex credit scenarios, streamline your credit repair efforts, and strengthen your credit profile.

Sign up today to embark on your credit repair journey with the CoolCredit app!

Get StartedFAQs

Q: What Is SYNCB PPC on My Credit Report?

A: SYNCB stands for Synchrony Bank, and PPC refers to PayPal Credit. It is a line of credit available to PayPal users, which is issued through Synchrony Bank. SYNCB/PPC on your report signifies you owe an outstanding balance on your account, which has been reported to the credit bureau. A SYNCB/PPC derogatory mark can hurt your credit.

Q: How to Remove SYNCB/PPC from My Credit Report?

A: Contact Synchrony Bank directly to verify the debt. If the information is inaccurate, you can file a dispute with the relevant credit bureau, Equifax, Experian, or TransUnion. If it is due to identity theft, report it to the fraud department and consider freezing your credit to prevent unauthorized use in the future.

Q: Does SYNCB/PPC Credit Card Affect Your Score?

A: Yes, a negative mark by SYNCB/PPC can affect your score in several ways:

- Hard Inquiry: If you applied for PayPal Credit, a hard inquiry may appear on your report for up to two years.

- Payment History: Any late or missed payments on your PayPal Credit account are reported to credit bureaus, which can lower your scores significantly.

- Collections or Charge-Offs: If your account is sent to collections under SYNCB/PPC, it may stay on your report for 7 or more years.

Q: How to Freeze My Credit?

A: You can freeze your credit by visiting the website of each credit bureau, creating an account (if you don’t have one already), and requesting a security freeze/credit freeze. You can unfreeze it when you plan to acquire new credit in the future. This can block unauthorized access to your credit information by lenders and third parties.