How to Remove LVNV Funding from My Credit Report

LVNV Funding LLC is a debt buyer company that usually purchases overdue accounts from lenders, including financial institutions, credit card companies, and personal loan providers. They often sue people to collect the debt from the overdue accounts they have acquired. So, if they’ve contacted you, it likely means they’ve bought your old debt and are now trying to collect it.

But don’t get panicky if you have received a call from LVNV Funding LLC or third-party collectors on their behalf. In this blog, we’ll discuss what your next steps should be to remove LVNV Funding from your credit report.

| What Is LVNV Funding? Founded in 2005 in Greenville, SC, LVNV Funding LLC is a debt purchasing company that acquires overdue accounts from lenders, particularly credit card companies, banks, and loan providers, for a small fee. They take over the debt accounts and usually outsource the collections to a third-party collection agency. So, even if they are the ones who bought your debt, you may not directly receive a call from them but from another agency on their behalf, such as Resurgent Capital Services. |

How Does LVNV Funding on Your Credit Report Impact Your Credit Rating?

LVNV Funding LLC buys the overdue accounts for a fraction of the cost of what you owe. However, they will try to collect the full amount from you, and anything they recover would be their profit. For debt recovery, they will send you collection notices through Resurgence Capital Services.

Additionally, you may receive calls from multiple numbers and different debt collectors. In some cases, they use more aggressive collection tactics. For instance, many people have been sued by LVNV Funding for debt collection. These tactics can negatively affect your credit score, dropping your credit rating by 100 points or more. Moreover, the collection account can stay on your credit report for up to seven years, even if it has been paid off.

1. Request for Debt Validation

First, as soon as you get a call from LVNV Funding, you should raise a written debt validation request. This requires LVNV to provide proof that the debt you owe is truly valid and belongs to you. Sometimes they may be calling you to collect for an account that was paid off, closed, or belongs to someone else. This step ensures that the debt owed is genuine and saves you from the financial hassle if the debt isn’t valid.

2. Negotiate Pay-For-Delete

LVNV Funding LLC will most likely be up to negotiate a pay-for-delete agreement with you. For this, you can offer to make a partial or lump-sum payment in exchange for them reporting to the credit bureau regarding the “erroneous collection account”. However, this is not considered an ethical practice and is questionable/frowned upon. Hence, you should get the agreement in writing to ensure they follow through if it comes down to it. Remember, the credit bureau may decline the request by LVNV Funding LLC, so it is not guaranteed that the derogatory mark will get deleted.

While it may be a tempting option, it is best to deal with things the right way and seek all the other options before making a decision.

3. Dispute Wrongful Charges

If the debt is not valid, i.e., they are charging for a closed account, paid-off debt, cancelled autopayments, or incorrect personal details on the debt account, then you need to raise a dispute.

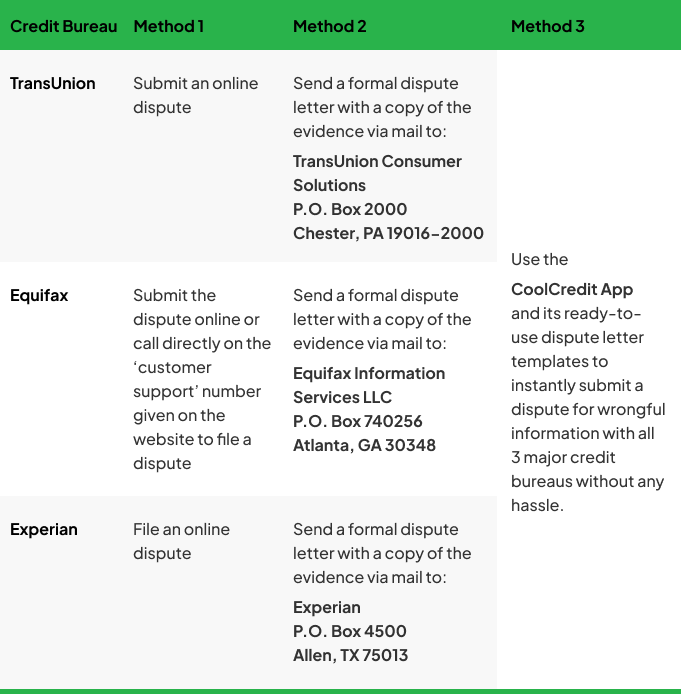

You can file a dispute with the different credit bureaus in the following three ways:

Here’s What You Should Include in the Dispute Letter:

- Personal Details: Your Full Name, D.O.B, SSN, and Residential Address (including all addresses where you’ve lived within the past two years).

- Identification Proof: Also, include a copy of your State ID card, driver's license, or other government-issued ID proof.

- List Down the Incorrect Information: List the incorrect collection charges and any other errors on your credit report. Add the account number and other specific details, along with the reason for the inaccurate information.

- Supporting Evidence: You need to attach documented proof to back up your claim and dispute the error on your credit report.

- A copy of a utility bill, bank statement, or insurance statement: These documents are also needed so the credit bureau can verify your information and conduct their investigation.

After submitting the dispute, it can take up to 30 days for the results to reflect on your credit report. If you submit the dispute using CoolCredit, you can monitor the status of your dispute with real-time insights. Additionally, if your previously submitted dispute claim has been declined, you can opt for expert assistance from a legitimate credit expert through the CoolCredit app. Professional assistance is the most efficient way to deal with the issue.

4. Goodwill Letter For Removal of a Paid Account

If you are getting collection calls for an old account that was already paid off, you can try sending a goodwill letter to the credit bureau. Although this type of derogatory mark automatically falls off your credit report after seven years, so you may choose to wait it out. However, sending a goodwill letter—while it may not guarantee the removal of the collection account—is still worth a try.

Make sure to clearly explain the reason for the overdue payment and attach the records of repayment, along with proof of maintaining timely payments afterwards. The credit bureau may sometimes consider such requests.

| How Long Does LVNV Funding Stay on Your Credit Report? On average, a collection account can stay on your credit report for up to seven years. Hence, if the collection account has been reported by LVNV Funding LLC, it can stay on your credit report for at least 7 years, even if you have paid it off. |

5. Legal Options

If you’ve received a notice of a lawsuit or been served court papers from LVNV Funding LLC, it’s important not to ignore it. While being sued for debt collection can feel overwhelming, there are steps you can take to protect your rights.

Here’s what you should do if you have been sued by LVNV Funding LLC:

- Lawyer up as soon as you receive the notice, as you need to respond within the stipulated timeframe. Ignoring the summons can lead to a default judgment against you, which means LVNV Funding could legally garnish your wages or freeze your bank account.

- Debt collection lawsuits can often be challenged, especially if your rights under the Fair Debt Collection Practices Act (FDCPA) or state laws have been violated.

- Request debt validation even if you’ve been sued to demand proof that the debt is valid. If they can’t provide proper documentation, the lawsuit may be dismissed.

- Make sure to verify the statute of limitations in your state for the overdue debt collection. If the statute of limitations has lapsed, the lawsuit can be dismissed as the claim is time-barred.

If you have been sued or have received a notification of a lawsuit by LVNV Funding LLC, you should seek legal options without delay.

| Is LVNV Funding LLC Legit? LVNV Funding LLC is a legit third-party debt collection agency. They operate in different locations across the US with headquarters in Greenville, SC, as per the BBB accreditation. |

How to Improve Your Credit Score After Collections?

If your credit has been damaged after LVNV Funding’s negative reporting, here’s what you can do to counteract it:

▪ Regular Credit Monitoring

Start by requesting your credit reports from all three major bureaus (Equifax, Experian, and TransUnion). Look closely for inaccuracies, such as incorrect balances, duplicated accounts, or outdated debt statuses. If you spot errors related to the LVNV account, file a dispute promptly. Removing incorrect negative items can give your score a quick boost.

| Pro tip: Use the CoolCredit app for instant credit monitoring and get AI analysis of your credit report along with notifications about the negative items and step-by-step guidance for improving your credit score. |

▪ Make Timely Payments

Any further late payments can harm your credit even more. It’s crucial to make timely payments to build a positive payment history. So, set up automatic payments or calendar alerts to ensure all your bills and debt obligations are paid on time, without even a single late payment. This helps strengthen your credit over time, though you may not see an immediate boost in your scores.

▪ Keep Credit Utilization Low

If you have different credit cards, try to keep your balances below 30% of the total credit limit on each card. A lower credit utilization ratio demonstrates responsible credit use and has a substantial impact on your credit score.

▪ Use a Credit-Building App

Consider enrolling for tools like the CoolCredit app to add positive payment data to your credit file. This helps ensure that your timely payments are reported to credit bureaus, contributing to score improvement. Additionally, it is fully equipped with a range of features that help you analyze your credit report, raise instant disputes for derogatory marks, and a range of other resources that can help you boost your credit.

▪ Stay Consistent and Patient

Rebuilding your credit isn’t an overnight process that’ll give you instant results. The key is to consistently maintain financially responsible habits—steady on-time payments, low credit utilization, and avoiding unnecessary new credit applications. And over time, exhibiting this financially sound behavior will outweigh the past damage to your credit.

▪ Rebuild with a Secured Credit Card

Apply for a secured credit card where your credit limit is backed by a cash deposit that you’ll use for smaller purchases. Make sure the balance is paid in full every month like clockwork. Responsible usage helps build a positive payment history and improves your credit.

Check Your Credit Health Instantly

Tap to BeginConclusion

Dealing with LVNV Funding LLC can be stressful, especially if you’re facing a possible lawsuit. But knowing your options can make all the difference. Start by requesting debt validation, disputing any inaccuracies, sending a goodwill removal letter, or considering settlement if necessary.

At the same time, work on rebuilding your credit by instilling good financial habits like making on-time payments and using credit-building resources like CoolCredit. It can help you monitor your credit and identify actionable steps to improve it, so you can take control even when setbacks occur.

FAQs

Q: Who is LVNV Funding LLC?

A: LVNV Funding is a debt collection company that specializes in purchasing charged-off accounts, i.e., overdue debt accounts, from credit card companies and personal loan lenders. They operate in multiple locations throughout the US. If you receive a call from LVNV, it is most likely that your collections account has been bought by them.

Q: Who Does LVNV Funding LLC Collect For?

A: LVNV Funding is involved in buying debts, but they may not directly do the collections. They outsource the collections to Resurgent Capital Services. This means that Resurgent Capital Services often manages the collections on behalf of LVNV.

Q: How Do I Contact LVNV Funding for a Goodwill Removal?

A: You can call the LVNV Funding LLC phone number: (866) 453-0039, or you can reach out via mail to their registered address: 355 S Main St Ste 300-D

Greenville, SC 29601-2923. Additionally, they may sometimes use different numbers to contact you for collections. It's crucial to ensure they are genuinely from LVNV Funding. Also, get your debt validated before getting into any repayment agreement.

Q: Would a “Pay-for-Delete” Work with LVNV Funding LLC?

A: It’s possible that LVNV Funding may agree to a pay-for-delete arrangement. While not illegal, this approach is considered to be shady and unethical. Indeed, some debt collectors might be willing to remove a collection account from your credit report in exchange for a lump-sum payment. However, it may lead to inconsistencies in your credit report.

Q: Is LVNV Funding LLC a Scam?

A: LVNV Funding is a legitimate debt collection company accredited by the Better Business Bureau (BBB). However, they outsource their collections to third-party debt collectors who may use predatory or aggressive tactics. So, make sure to get your debt validated to ensure it's not a scam or fake debt.

Q: Why Is LVNV Funding Calling Me When I Don’t Have Them on My Credit Report?

A: LVNV Funding can contact you, even if they do not appear on your credit report, because they may have bought a debt you owe but outsourced the collections. For instance, the collection account may have been reported under another company, such as Resurgent Capital Services. They often handle their collections, even though LVNV Funding would be the one that bought the original account.

Q: Why Is LVNV Funding Calling Me for a Debt I Already Paid Off?

A: This may be due to an error in reporting the paid-off account that was sold to LVNV Funding. So, if the account is wrongly appearing in your credit report, you need to ‘raise a dispute’ and provide evidence of paying off the whole debt to the credit bureau.