How Many Credit Cards Should You Have? A Complete Guide To Building Credit

Short Answer:

▪ 1 to 3 credit cards are ideal, especially for credit building. You can start with 1 credit card, and as you build a positive payment history, you can apply for 2 to 3 credit cards as your credit limit extends.

▪ More than 3 credit cards are ideal for those with excellent credit who want to achieve targeted reward points or credit limits. However, if your credit utilization on credit cards is exceeding 30%, you should avoid getting another credit card.

How many credit cards should you have? This is one of the most important questions for those who want a better credit standing. While the answer may not be the same for everyone, it keeps your spending habits in check, helps you manage your financial goals, and improves your debt management capabilities.

In this blog, we’ll discuss exactly “how many credit cards should you have to build credit.” We’ll also go over the advantages and risks of owning multiple credit cards, how you can determine the ideal number of credit cards for yourself, and ways to monitor and improve your credit profile. Let’s get into it!

Your path to a better score starts here—AI is ready to help fix your credit.

Try NowHow Many Credit Cards Should I Have?

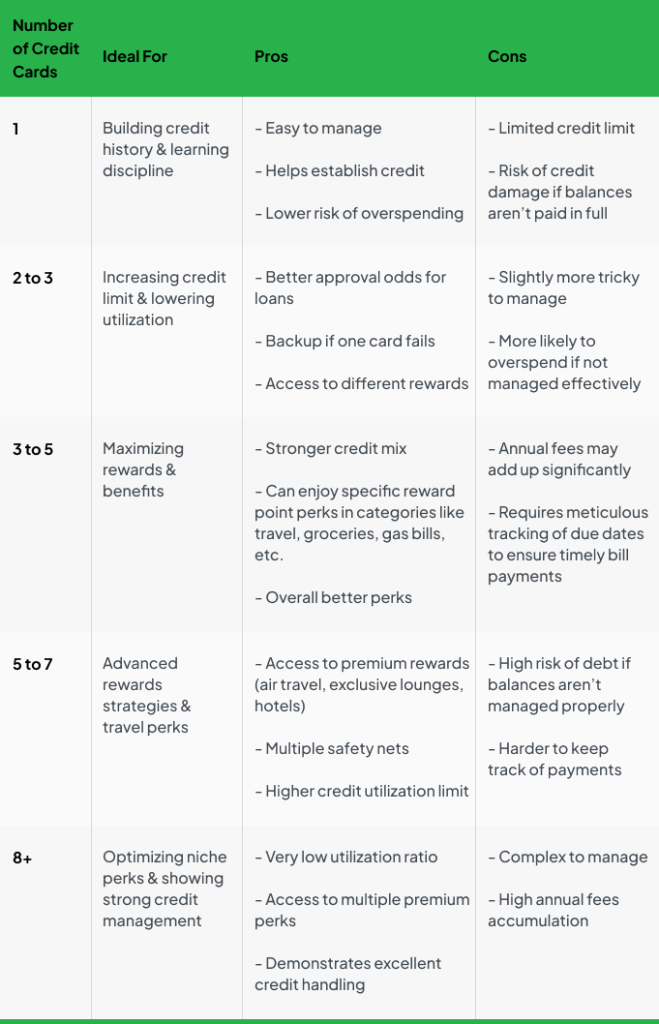

Let’s break it down with a simple table:

Why Does the Number of Credit Cards Matter?

You might think of the number of credit cards you hold as a small detail of your finances, but it can have a major impact on your overall credit health.

Reasons to Have Multiple Credit Cards

- Lower credit utilization ratio, as you can spread payments over multiple credit cards.

- Easier to keep credit balances low if used strategically

- Each card may offer different reward programs. So, using different cards to pay for specific categories, such as travel, gas, etc., can help maximize reward points.

- Each new credit card adds to your total available credit limit.

- With multiple cards, if one gets lost, stolen, or declined, you can rely on the others for backup.

- Responsibly using multiple credit cards shows excellent credit management and makes it easier to get approved for loans.

Potential Drawbacks:

- Using multiple credit cards can lower your credit utilization ratio but also increase the risk of overspending.

- There is a greater risk of missing payments, as it can be complex to manage multiple cards.

- Multiple credit cards may also cause a score dip (temporarily) due to hard inquiries.

To avoid the potential negative consequences, it's crucial to determine how many credit cards you can manage with ease. Hence, the right number of credit cards to have can vary for each individual.

Here’s a Smarter Way to Decide ‘How Many Credit Cards Should You Have?’

It's important to find the sweet spot that aligns with your financial goals and spending habits. According to Oprah Daily, most financial experts recommend owning two to three credit cards, depending on your situation.

This credit setup allows you sufficient credit access to keep your utilization low, diversifies your payment history, and provides access to different card features or reward programs.

Here are a few things to help you evaluate your readiness:

- Assess Your Payment Habits: Do you consistently pay your bills on time? Do you pay off balances in full? Or do you carry them over to the next month? If you are managing your expenses well, it may be good to get another credit card. But if you barely manage to pay bills on time, you should avoid adding another card.

- Assess Your Money Management Skills: Do you keep an accurate track of your monthly spending according to budget? Are you good at tracking due dates and avoiding late fees? This is crucial for maintaining a healthy credit score.

- Prioritize Responsible Use: Can you avoid unnecessary temptations to make impulsive purchases and use credit responsibly? If your answer is “yes,” you may benefit from having multiple cards. If not, start with having just one.

- Credit History: Are you just starting out on your credit-building journey, or do you have a long-established credit profile? If you are only starting out, stick to one card, and once your credit profile is stronger, you can add another one.

- Income Level: Can you comfortably handle multiple monthly payments? Financial discipline is crucial to responsibly manage multiple credit cards.

Analyze each of these factors to decide whether it’s a good idea for you to apply for multiple credit cards.

How Does the Length of a Credit Card Impact Your Credit Score?

The term “length of credit card” means how long your cards have been active. The longer your credit history, the more data credit bureaus have to analyze your financial behavior. Applying for multiple new credit cards in a short period reduces the average age of your accounts. That’s why you need to consider spacing out your card applications at least 6 months to 1 year apart and keep older accounts open while planning on opening new ones.

How to Manage Multiple Credit Cards Wisely

- Payment Reminders

Use the Google Calendar to set up payment due date notifications, or simply take advantage of alerts/payment reminders sent by your card provider to stay on top of due dates.

- Automate Payments and Adjust Due Date

Set up auto-pay on your cards and keep the main account funded to streamline timely payments. Additionally, request to get your due date moved to a more convenient time, i.e., shortly after your payday. This reduces the risk of missing payments.

- Track Your Spending Across Cards

Create a budget and analyze expenditures on each credit card using an app or spreadsheet. This may help you control your spending, avoid overspending, and avoid accumulating debt.

- Regular Credit Monitoring

In addition to maintaining healthy financial habits, you need to watch out for unusual activities impacting your credit. Tools like the CoolCredit app can help with regular credit monitoring, provide alerts, and track any score changes in real time.

- Carry Only Essential Cards

Cards that you don't use very often, like airline booking cards, should be left at home in a safe place. By doing this, you reduce clutter in your wallet and limit your liability.

- Keep Credit Utilization Low

Avoid overextending the usage of a single card. Instead, spread out expenses in a way to keep credit utilization less than 30% of your available credit on every card. A lower ratio indicates stronger money management.

- Pay Balances in Full

At the end of every month, make sure to pay your entire balance rather than carrying forward balances at the end of each billing cycle.

| How CoolCredit Helps You Manage and Monitor Multiple Credit Cards CoolCredit offers a smarter, AI-driven solution to monitor your credit profile and stay ahead in your financial journey. If you are just starting out or already managing multiple cards, here’s what CoolCredit offers you as a credit monitoring tool. ▪ Real-Time Alerts: With real-time alerts, you’ll know immediately if anything unusual shows up on your credit report. ▪ Comprehensive Overview: With CoolCredit, you can track your credit score trends over time and gain a deeper understanding of your financial health. ▪ Score Improvement Insights: CoolCredit leverages AI to suggest actions that can improve your credit profile. |

Repair Your Credit with CoolCredit

If your credit score has already taken a hit, CoolCredit offers efficient solutions to help you get back on track. Here’s how:

- Positive Payment Reporting: You can set up a “Booster Payment Plan” and make on-time payments that get reported to the credit bureaus, helping you rebuild your credit score within 30 to 60 days.

- Targeted Dispute Letters: The AI analysis helps identify the negative items in your credit report that may be damaging your score. It generates professional, tailored, and result-driven dispute letters that you can send to the credit bureaus to file a dispute regarding any inaccurate info successfully.

- Multiple Boosts Over Time: You can boost your credit many times through no-interest plans that create lasting improvements in your credit score.

- Expert Support for Long-Term Success: CoolCredit also offers expert support so you can navigate the complexities of credit repair and achieve long-term financial success.

Boost your credit score effortlessly—get started with AI-powered repair

Get StartedConclusion

If your goal is to build credit strategically, start with one credit card and add 2 to 3 cards gradually as your credit profile strengthens and your credit limit extends. It’s crucial to ensure accurate tracking of your payments and credit mix and ensure timely repayments to build a stronger credit profile.

Credit building isn’t about chasing quantity; it’s about managing smartly with the right tools. So, if you’re recovering from a bumpy credit history or juggling multiple accounts, the CoolCredit app’s credit monitoring and repair capabilities can help boost your scores.

Level up from traditional credit repair, which is slow, expensive, and leaves you powerless. Switch to better privacy, more control, and smarter automation with CoolCredit.

FAQs

Q: How Many Credit Cards Are “Too Many”?

A: It depends on how many cards you can manage. There's no set number of credit cards that is "too many"; it depends on your income, financial discipline, and other factors. If you have multiple cards but the overall credit utilization stays low, i.e., <30%, you will be in a favorable position. However, if you are overextending each card, that may indicate you need to reduce the number of cards. Too many cards can lead to debt accumulation, missed payments, and a higher risk of damaging your credit score.

Q: Should I Close a Credit Card I Don’t Use?

A: No, it's better to keep older accounts open, as it helps maintain a longer credit length and total credit limit, which is favorable when you are planning to apply for credit in the future.

Q: What Is the 15/3 Rule for Credit Cards?

A: The 15/3 credit card rule suggests making two payments per two billing cycles, one 15 days before your due date and the other 3 days before. This technique helps lower your credit utilization ratio before your statement closes, thus improving your credit score.

Q: Are 5 Credit Cards Too Many?

A: Not necessarily. For many credit card users, having 5 credit cards is manageable, especially if you keep the balances low and make payments on time. However, if you’re missing due dates or carrying high balances, even 2 or 3 cards might be too many.

Q: How Often Should You Apply for a New Credit Card?

A: You should space out your credit card applications. The ideal gap is at least 6 months. Each new credit card application causes a hard inquiry, which can temporarily lower your score and reduce the average age of your credit accounts.

Q: Is It Bad To Have a Credit Card and Not Use It?

A: Not really. It may even help you maintain a healthy credit score. An unused credit card keeps your credit utilization low and contributes to your credit history length, positively impacting your score. It is a good idea to use it sometimes to avoid inactivity or closure by the issuer.